Techno Commercial Joint Stock Securities Company (TCBS) has announced a Board of Directors Resolution seeking shareholder approval via written consent for the 2024 Dividend Payment Plan. This move underscores TCBS’s robust financial foundation and unwavering commitment to delivering consistent, long-term value to its shareholders.

According to the resolution, the final registration date for shareholders to participate in the vote is October 30, 2025. The proposed 2024 dividend plan includes two payment options: First, a cash dividend with a 5% payout ratio, equivalent to VND 500 per share; Second, a stock dividend with a 5:1 ratio, representing a 20% bonus share issuance, meaning shareholders holding 5 shares will receive 1 additional share. For example, a shareholder with 100,000 TCX shares will receive both VND 50 million in cash and 20,000 new shares.

The dividend payment will be sourced from undistributed after-tax profits reported in the audited 2024 financial statements. In 2024, TCBS recorded an after-tax profit of VND 3,850 billion, with approximately VND 1,150 billion allocated for cash dividends and over 462 million new shares issued for stock dividends.

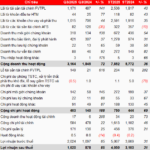

In the first nine months of 2025, the company’s pre-tax profit reached VND 5,067 billion, a 31% year-on-year increase and nearly 90% of the full-year target. TCBS maintained the industry’s lowest cost-to-income ratio (CIR) at approximately 14%, alongside leading profitability metrics: a return on equity (ROE) of 15.8% and a return on assets (ROA) of 7.8%.

As of the latest data, TCBS boasts a shareholders’ equity of over VND 42,000 billion, leading Vietnam’s securities industry. Its digital investment platform, TCInvest, attracts nearly 17 million monthly visits, while its comprehensive WealthTech ecosystem solidifies TCBS’s leadership in core business segments, including corporate bond underwriting and margin lending.

TCX shares will list on the Ho Chi Minh City Stock Exchange (HOSE) on October 21, 2025, with a reference price of VND 46,800 per share. TCBS’s market capitalization is expected to exceed VND 108,000 billion (approximately USD 4.2 billion) on its debut trading day.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

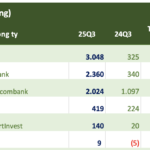

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

Foreign Block Net Sells Trillions in Week of October 6-10, Contrasting with 700 Billion Dong “Buy” of a Bluechip Stock

Foreign investors maintained their selling pressure, though the intensity eased compared to previous weeks.