Technical Signals of VN-Index

During the morning trading session on October 17, 2025, the VN-Index experienced a significant correction, with a Bearish Engulfing Line candlestick pattern emerging, signaling an increased short-term risk.

The Stochastic Oscillator continued its downward trend after issuing a sell signal. The author anticipates the 1,700-1,711 point support zone to hold firm in the coming period.

Technical Signals of HNX-Index

In the morning session on October 17, 2025, the HNX-Index formed its third consecutive bullish candlestick, contrasting with the pessimistic trend of the VN-Index.

Trading volume consistently remained above the 20-day average, and the MACD indicator has issued a strong buy signal, improving the short-term outlook.

BMP – Binh Minh Plastics Joint Stock Company

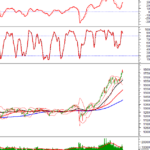

In the morning session on October 17, 2025, BMP shares continued their strong upward momentum, accompanied by a Rising Window candlestick pattern and increased trading volume, surpassing the 20-session average, indicating active investor participation.

The MACD indicator has issued a buy signal, crossing above the zero line, as the stock price surpassed the September 2025 high (equivalent to the 152,000-155,000 range). If positive technical signals persist and BMP prices remain above this range, the medium-term uptrend will be further reinforced.

VJC – Vietjet Aviation Joint Stock Company

In the morning session on October 17, 2025, VJC shares extended their rally for the sixth consecutive session, with volume expected to exceed the 20-day average by the session’s close, reflecting continued investor optimism.

Additionally, the stock price closely followed the Upper Band of the Bollinger Bands, while the MACD indicator continued its upward trajectory after issuing a buy signal. This suggests that the positive outlook remains intact.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change when the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:09 October 17, 2025

Technical Analysis Afternoon Session 16/10: Intense Tug-of-War

The VN-Index experienced a tug-of-war session, while the Stochastic Oscillator continued its downward trajectory, reaffirming a sell signal. Meanwhile, the HNX-Index formed a pattern resembling a Long Upper Shadow, indicating persistent selling pressure.

October 2025 Cryptocurrency Report (Part 2): Will the Recovery Trend Continue?

Uncover the latest insights and trends shaping the world of leading cryptocurrencies. Our expert analyses provide valuable perspectives for both short-term and long-term investors, helping you navigate the dynamic crypto landscape with confidence.