VPBank Securities JSC (VPBankS) has officially announced its IPO plan, offering 375 million shares at a price of VND 33,900 per share, with an expected total fundraising of nearly VND 12,713 billion.

This scale positions VPBankS as one of the largest IPOs in the history of Vietnam’s securities industry, providing a solid foundation for the company to expand its margin lending capacity and drive business growth.

At the offering price, VPBankS is valued at approximately VND 63,562 billion, equivalent to over USD 2.4 billion. Following the IPO, VPBankS shares are expected to be listed on HOSE by December 2025.

VPBankS’ Unique Advantages

Speaking at the roadshow introducing investment opportunities in VPBankS shares on October 16 in Hanoi, Mr. Nguyen Duc Vinh – CEO of VPBank, stated that this IPO is not the destination but a strategic turning point in the journey to restructure and comprehensively upgrade VPBank’s financial ecosystem.

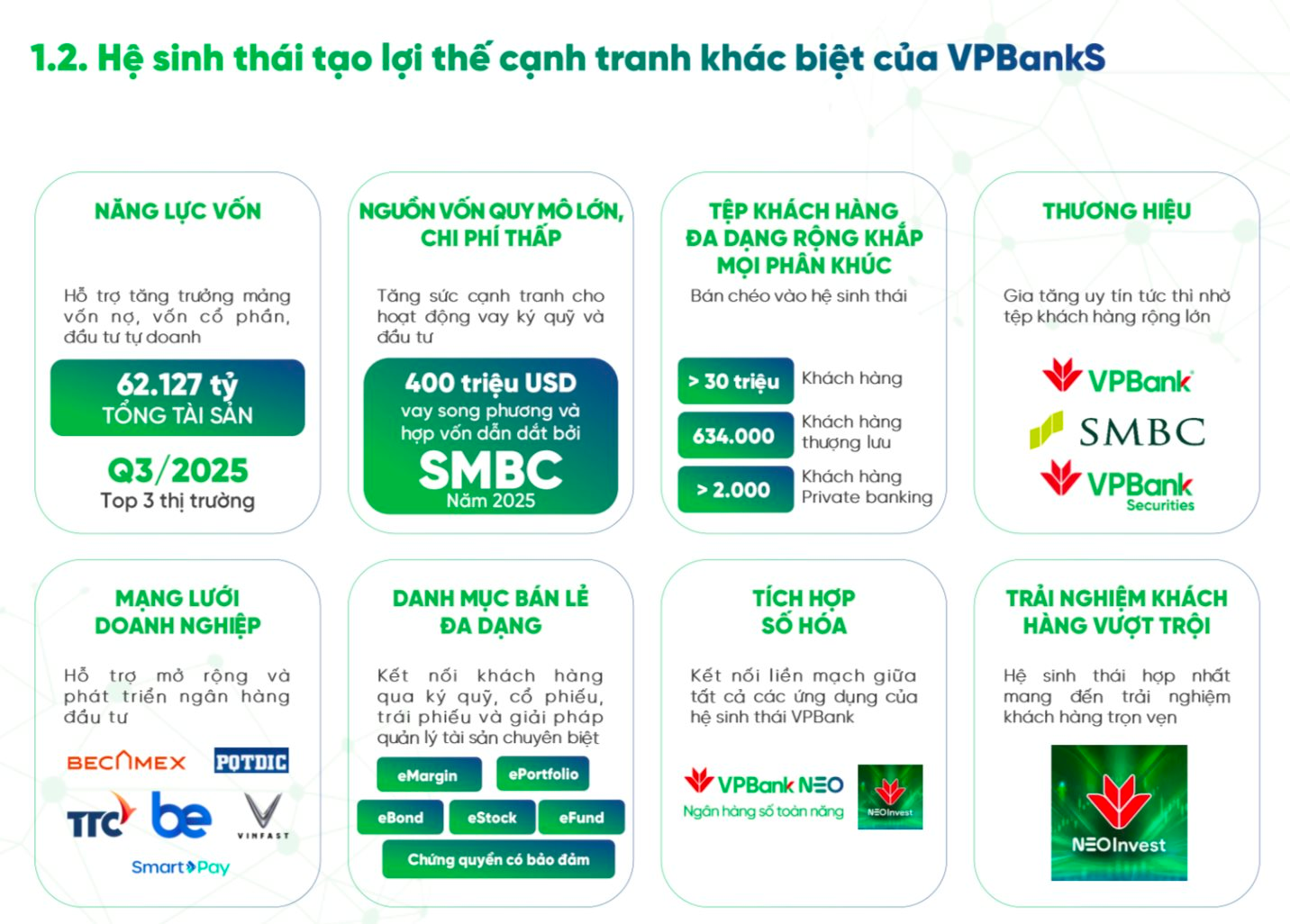

According to Mr. Vinh, VPBankS’ distinct advantage lies in its ability to leverage the strong foundation of its parent bank, unlike many other securities companies that operate independently. This rare advantage allows VPBankS to tap into resources, customer bases, and management capabilities, enabling rapid growth in scale within just over three years of establishment.

“Investors choosing VPBankS are not only placing trust in its leadership or business results but also in the potential and vision of the entire VPBank ecosystem,” Mr. Vinh emphasized.

The public offering is not only aimed at raising capital for VPBankS but also serves as a crucial step in strengthening the consolidated financial capabilities of the group, spanning from the parent bank to consumer finance, insurance, investment, and capital markets.

Post-IPO, VPBankS’ chartered capital is expected to reach VND 20,000 billion, placing the company among the leaders in terms of capital scale in Vietnam’s securities market. VPBank positions VPBankS as a “strategic arm” in investment and capital markets, playing a pivotal role in perfecting the financial ecosystem structure, aiming for sustainable development and regional expansion.

Accelerating Toward Market Leadership

At the event, Mr. Vu Huu Dien – CEO of VPBankS, shared that VPBank boasts over 30 million customers, including 634,000 Diamond customers and more than 2,000 ultra-high-net-worth individuals (UHNWI) – a vast potential customer base for VPBankS in investment and asset management.

This synergy has enabled VPBankS to rapidly expand its scale, entering the top 3 largest securities companies in Vietnam within just 4 years, with total assets exceeding VND 62,000 billion, equity of over VND 20,000 billion, and margin lending reaching VND 27,000 billion.

Additionally, strategic partner SMBC (Japan) brings international strength to VPBankS, from M&A advisory to foreign capital mobilization. In 2025, VPBankS successfully raised USD 150 million in the first half and is finalizing an additional USD 250 million deal. For a securities company to raise USD 400 million in international capital within three years of operation is a rarity in Vietnam’s market.

Currently, VPBankS leads in investment banking and margin lending. Its corporate bond market share is nearly 15%, and its brokerage segment has doubled to approximately 3% – the fastest growth rate in the market. Revenue structure is also becoming more balanced, with 28% from margin lending, 22% from investment banking, and 16% from proprietary trading.

The CEO of VPBankS stated that the company aims to become Vietnam’s leading securities and investment bank, pioneering personalized financial solutions for all customer segments. “We are confident in maintaining our leadership position in the current phase and over the next 5–10 years,” said Mr. Dien.

Building on the foundation of the parent bank and supported by strategic partner SMBC, VPBankS aims to become a leading securities company with the highest growth rate over the next 5 years. By 2030, it expects to lead in total assets and pre-tax profit, targeting a 15% market share in margin lending, 20% in investment banking, and maintaining an ROE of around 20%, among the highest in the industry.

After three years of foundation-building, VPBankS is entering an acceleration phase. In the first 9 months of 2025, the company recorded pre-tax profit of VND 3,260 billion, achieving 76% of its annual plan.

With a strong financial foundation, modern technology, and backing from VPBank and SMBC, VPBankS is solidifying its position as one of the most dynamic and capable investment institutions, ready for the new development phase of Vietnam’s securities industry.

Upcoming IPOs Set to Ignite the Market

In the first nine months of this year, only four companies listed or transferred to the HoSE. However, the final quarter has seen a surge in IPO and listing activity, with numerous businesses filing applications or announcing plans to move to the HoSE.

VPBank CEO Nguyễn Đức Vinh: VPBankS IPO Strengthens Entire Ecosystem Foundation

According to VPBank CEO Nguyen Duc Vinh, the IPO of VPBankS is part of a strategic initiative to strengthen the capital foundation across the entire ecosystem, benefiting not only the securities company but also the entire group. This move will enable the conglomerate to continue pursuing its critical objectives.

From Employee to IPO Leader: The Journey of a Business Visionary

After 25 years of working in various roles across multiple companies, Mrs. Trần Thị Thu Phương decided to take a bold leap into entrepreneurship, embarking on a high-risk journey to revive paper mills teetering on the brink of bankruptcy. Reflecting on her path as a business owner, she candidly admits there were moments of overwhelming challenges that seemed insurmountable.

October’s Blockbuster IPO: Attracting Investors with a 2 Billion VND Mercedes, 300 Million VND Diamond, iPhone 17, and More

On October 10th, VPBankS officially commenced its highly anticipated IPO, opening the doors for investors to subscribe to what is poised to be the largest public offering in Vietnam’s securities market.