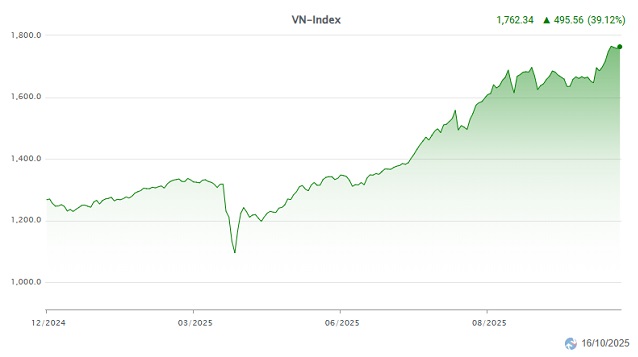

By 2025, Vietnam’s stock market is brimming with anticipation, bolstered by a robust macroeconomic foundation and the prospect of an upgrade. Indeed, aside from a sharp decline triggered by U.S. tariff news in April, the VN-Index has surged by nearly 379 points as of early October, marking a remarkable 30% increase. Following the official upgrade announcement on October 8th (Vietnam time), the VN-Index even breached the 1,700-point milestone. Compared to the April low of 1,094 points, this represents a staggering 60% upswing.

While these VN-Index records evoke memories of 2021, when investors seemed to profit effortlessly, the reality behind the impressive growth figures is more complex. Investors are grappling with significant psychological challenges, akin to the recent storms battering the country. Many portfolios have endured fiery tempest, mirroring the intensifying emotional turmoil.

From High Hopes

The VN-Index began 2025 on an optimistic note. Building on the previous year’s momentum, the market swiftly approached and successfully breached the 1,300-point resistance level for the seventh time since 2024. This achievement was driven by large-cap stocks, unlike previous instances dominated by mid- and small-cap stocks. Liquidity also improved significantly, solidifying this milestone.

However, the landscape shifted abruptly with the emergence of tariff news from the Trump administration. The VN-Index plummeted in early April, hitting a low of 1,094 points. Yet, a remarkable recovery ensued. In the subsequent months, the VN-Index not only recouped its losses but also surpassed the 1,500 and 1,600-point thresholds, with ambitions set on reaching 1,700, 1,800, and even exceeding 2,100 points by year-end. Vietnam’s stock market is poised to be one of the top performers in the ASEAN region.

This market surge is underpinned by favorable macroeconomic conditions. In Q3, GDP growth is estimated at 8.22% year-on-year, the highest since 2011, excluding the post-COVID-19 recovery year of 2022. For the first nine months, GDP growth is projected at 7.84% year-on-year, closely aligning with the full-year growth target of 8%.

Moreover, controlled inflation and low-interest rates have fostered an environment conducive to capital inflows. Additional catalysts include the launch of the KRX system in June and FTSE Russell’s upgrade of Vietnam from Frontier to Emerging Market status, announced on October 8th, which is expected to attract foreign investment. The economic recovery has also rendered many previously underperforming stocks attractively valued, further stimulating capital inflows.

Unfulfilled Joy

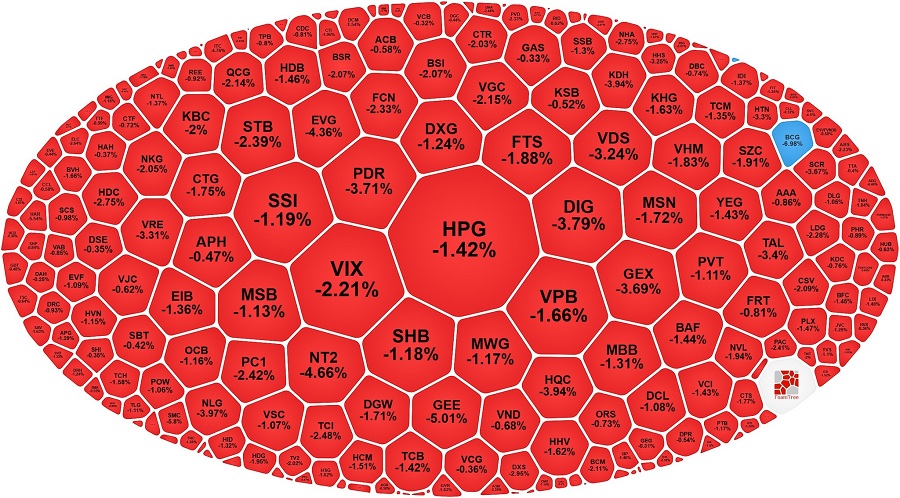

In June 2025, the market witnessed peculiar trading sessions where the VN-Index rose significantly or remained flat, yet the number of declining stocks overwhelmingly outnumbered the advancing ones, reaching nearly 60% of the total listings on HOSE. Even during the July-September rally, which saw a 300-point gain, there were sessions where the VN-Index was engulfed in fiery sell-offs. Notably, the session on July 29th saw one of the year’s sharpest declines (-64 points), and late August to early September experienced adjustments of 70-80 points over 2-3 sessions.

Market gains do not guarantee profits. The volatile sessions have inflicted substantial psychological stress on investors, particularly amidst a surge in new retail investors (F0s) at securities firms.

Despite the VN-Index reaching new heights, many individual investors have had less-than-positive experiences due to the uneven distribution of gains. The VN-Index is calculated based on the market capitalization of all stocks listed on HOSE. Larger-cap stocks exert a more significant influence on the index. Consequently, a handful of large-cap stocks within the VN-30 can propel the index higher, even if hundreds of other stocks are underperforming.

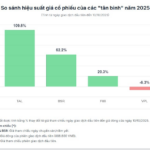

In 2025, the VinGroup family of stocks has been the primary driver of the market. According to VietstockFinance, as of October 15th, this group contributed over 267 points to the market. Specifically, VIC and VHM were the top contributors, adding 165 points and over 87 points, respectively, far outpacing the banking sector represented by VPB, TCB, CTG, and MBB. Conversely, the 2024 superstar FPT, despite its poor performance, has only subtracted nearly 15 points from the index year-to-date.

| Top 10 Stocks with the Greatest Impact on the VN-Index Year-to-Date |

Examining year-to-date performance as of October 10th, VIC leads with a staggering 373% gain, reaching 192,000 VND per share. VHM follows in fourth place with a 207% increase. Another VinGroup stock, VRE, ranks seventh with a 135% gain. Additionally, two “Gelex” stocks, VIX and GEX, have performed exceptionally well, rising 302% and 218%, respectively.

In contrast, the top 10 decliners, excluding BCG and TCD due to legal issues, include prominent stocks with strong fundamentals such as FPT (-27%), DGC (-19%), and SZC (-18%).

Only includes stocks with average daily trading volume exceeding 1 million units

Broadly, nearly 150 stocks on the HOSE have declined year-to-date. Thus, despite the market’s strong performance in 2025, investor returns may lag the market if their portfolios lack high-performing stocks like VIC, VHM, GEX, or VIX. For instance, on October 3rd, the VN-Index dipped only 0.42%, but many portfolios were “on fire” as the number of declining stocks outnumbered advancing ones by 2.7 times, with 229 decliners, including 160 stocks falling over 1%. VIC and VHM continued to provide support, contributing 4.8 points.

|

Calming the Emotional Storm

The phenomenon of “green on the outside, red on the inside” has fueled a simmering emotional storm among investors. Sessions with sharp declines have seen many portfolios lose 15%, even 20% or more for those with high margin ratios. For example, Minh Anh, an office worker holding many banking stocks, experienced a 21% drop due to adjustments around the 1,700-point level in late September.

Adding to the pressure is foreign selling. In the first nine months, foreign investors net sold approximately 107 trillion VND (around 3.9 billion USD), with numerous consecutive net-selling sessions, surpassing the entire net-selling value of 2024. In October, the 21-session net-selling streak was only interrupted on October 8th, with selling resuming in the subsequent two record-breaking sessions.

| Foreign Investors’ Heavy Net Selling in 2025 |

Foreign investors have been net sellers despite positive market expectations and the upgrade narrative. According to Yuanta Securities, this trend is primarily driven by the USD-VND interest rate differential and the tech investment wave in the U.S. Regardless of the reason, the relentless selling pressure has significantly impacted investor sentiment, with new investors fearing losses and existing holders reluctant to sell at lows, creating a stalemate throughout September. Average liquidity in the month fell to just over 34 trillion VND per day, a 31% decline in value from the previous month.

However, with FTSE Russell’s announcement of Vietnam’s upgrade, optimism is gradually returning, evidenced by two record-breaking sessions and a surge in VN-Index liquidity. Expectations are also high for foreign capital inflows, with VNDIRECT estimating that Vietnam could attract 1-1.5 billion USD from open-end funds and ETFs tracking FTSE indices, or even more.

Nevertheless, risks remain, particularly regarding U.S. policies. For instance, on October 10th, President Donald Trump announced a new 100% tariff on Chinese imports, effective November 1st. This immediately sent U.S. markets tumbling and triggered a crypto market liquidation of over 7.5 billion USD—the worst since the April tariff announcement.

While the VN-Index rebounded strongly afterward, the emotional storm among investors persists as VinGroup leads the charge amidst market volatility. However, given the existing and emerging prospects, perhaps what investors need most is calm. After all, every storm eventually passes.

– 13:04 16/10/2025

Accelerating Energy Projects: General Secretary To Lam Urges Murphy Oil to Expedite Vietnam’s Oil and Gas Initiatives

Vietnam’s General Secretary has affirmed the nation’s commitment to fostering a conducive environment for foreign investment and business operations, particularly in the energy sector. This includes extending support to U.S. companies seeking to establish or expand their presence in Vietnam’s thriving energy market.

“Foreign ‘Sharks’ Dragon Capital, VinaCapital, J.P. Morgan, Pyn Elite Fund Forecast Vietnam’s Stock Market Trends”

Leading international organizations such as Dragon Capital, VinaCapital, J.P. Morgan, and Pyn Elite Fund have issued overwhelmingly positive assessments of Vietnam’s stock market following the recent upgrade, with some forecasts proving truly surprising.

Gelex Group Stocks Witness Massive Trading Volume Surge

The VN-Index retreated from its peak near the 1,800-point mark today (October 14), as heavy profit-taking pressure in the afternoon session triggered a market correction. The Gelex Group (GEX) stood out with a surge in trading activity, as its shares hit the ceiling price and saw massive volume, equivalent to over 5.5% of its free-floating shares changing hands.