On October 16th, Vietnam’s domestic gold market continued its volatile trend. From early morning, major gold shops in Ho Chi Minh City, Hanoi, and various provinces were crowded with traders.

Record-Breaking Surge

Both gold bars and gold rings set new records on October 16th. In smaller gold shops and the black market, SJC gold bars soared to nearly 170 million VND per tael—approximately 20 million VND higher than the listed price at major companies, and a staggering 35 million VND above global gold prices, an unprecedented gap.

The unpredictable and continuous rise in gold prices left the market both exhilarated and anxious. Investors rejoiced as gold prices peaked, while those with practical needs, especially those planning weddings, found themselves in a dilemma.

Crowds gather at gold shops to trade as prices soar. Photo: MINH CHIẾN

Ms. Nguyễn Thị Thanh Hương from Khánh Hòa had to change her plan to gift gold to her fiancé, opting for cash instead due to the rapid price increase. “Earlier this year, SJC gold bars were around 85 million VND per tael. When they reached 90 million, I thought that was the peak. Little did I know, the price would keep climbing. Now, at nearly 150 million VND, I can’t afford it and have switched to cash,” she explained.

For young couples preparing for marriage, gold has become more of a burden than a traditional gift. Mr. Nguyễn Hoàng Thanh, an office worker in Ho Chi Minh City, noted that wedding gifts in gold could cost over 200 million VND. “Wages are rising slowly, but gold prices have nearly doubled, making everything astronomically expensive,” he lamented.

Meanwhile, Ms. Nguyễn Thu Sương from Lâm Đồng faces a debt of 3 taels of gold borrowed at less than 65 million VND per tael for her business. “Now, with each tael nearing 150 million VND, my debt has ballooned to nearly 450 million VND. I hope the government stabilizes the market soon to reduce the gap between domestic and global gold prices,” she expressed.

In an interview, Dr. Đinh Thế Hiển, an economist, emphasized the need for regulatory authorities to cool down the domestic gold market. A price difference of just 10 million VND compared to global rates can lead to gold smuggling, foreign exchange depletion, and disadvantages for consumers buying gold through legal channels.

“Vietnam is pursuing deep integration, planning to establish an International Financial Center in Ho Chi Minh City, and aims to join the region’s top economies. The instability in the gold market contradicts this financial integration goal. Domestic gold prices should align with global trends rather than remain disconnected,” Dr. Hiển observed.

Smoother Transactions Ahead

To stabilize the gold market, the State Bank of Vietnam (SBV) proposed establishing a national gold trading platform.

Deputy Governor Phạm Tiến Dũng explained that this platform aims to improve regulations, unlock private resources, and enhance state management. “The platform will provide transparent data for analysis, forecasting, and policy-making. Timely connected and processed data will support more effective market control by authorities,” he stated.

Mr. Lê Minh, owner of a gold shop in Ho Chi Minh City’s Cầu Market area, believes phased implementation of the platform will facilitate transactions for banks, importers, and small retailers. “This will clarify supply and demand, helping the government assess actual needs and import gold more reasonably, preventing artificial shortages and stabilizing the market,” he commented.

Mr. Trần Hữu Đang, CEO of ASEAN Jewelry Corporation (AJC), anticipates that the platform will enable nationwide online trading, similar to stock transactions. “It will allow authorities to monitor unusual activities, detect money laundering or speculation early, and enable the SBV to trace funds and stabilize the market promptly,” he stressed.

Long-term, Mr. Đang suggests the SBV could use the platform to mobilize idle gold from the public, converting it into capital for production and business. The SBV could issue long-term gold deposit certificates and resell them to those wanting to hold gold. Collaboration with importers and manufacturers would ensure payout plans when citizens withdraw gold.

“The SBV must be the ultimate guarantor for mobilizing and returning gold, building trust so people feel secure in depositing their gold,” Mr. Đang added.

According to Mr. Nguyễn Thế Hùng, Vice Chairman of the Vietnam Gold Traders Association (VGTA), a national gold platform with robust legal frameworks will activate this dormant asset. Many view gold as a savings tool. A secure, transparent platform would encourage depositing gold like cash in banks. This would help the government control gold circulation and reduce its use as an alternative currency.

Absolute Security Required

Mr. Hùng emphasized that for the platform to succeed, the SBV must ensure absolute security and legal frameworks. “Public trust in the platform’s strict, transparent, and manipulation-free management is crucial. Once lost, trust will be hard to regain,” he warned.

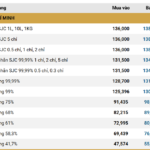

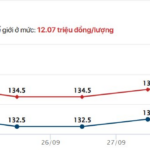

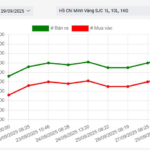

Gold Ring and Bullion Prices Hit New Peak on September 30th Morning

Domestic gold prices continue to set new highs, with gold bars reaching a staggering 136.5 million VND per tael, while gold rings also hit a record 133.6 million VND per tael.