Kicking off the Q3 2025 financial reporting season, Vietnam Prosperity Bank (VPBank) unveiled impressive business results, with pre-tax profits reaching VND 9.2 trillion, a 77% surge compared to the same period last year. This marks the highest growth rate in the past 15 quarters, signaling a robust recovery for the bank after a slowdown in credit growth during the first half of the year.

Exceptional Q3 Bank Profits

For the first nine months of the year, VPBank’s consolidated pre-tax profit exceeded VND 20.396 trillion, a 47.1% increase from the same period in 2024.

With this performance, the bank has surpassed its full-year 2024 profit after just three quarters, positioning VPBank as one of the fastest-growing private banks in terms of profit within the system.

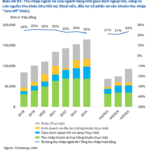

The financial report indicates that VPBank’s consolidated total assets reached VND 1.18 quadrillion, a 27.5% increase from the beginning of the year, surpassing the set target. Consolidated credit outstanding hit nearly VND 912 trillion, up 28.4%, double the industry’s average growth rate.

VPBank’s credit growth focused on small and medium-sized enterprises, along with home loans and personal consumption loans, which grew by 29.1% and 27.7%, respectively. Various preferential loan packages have been launched, making it easier for individuals to access capital for housing and for private businesses to expand their operations.

Numerous banks and securities companies reported significant profits in Q3.

Effective Bad Debt Management

Meanwhile, Nam A Bank continues to stand out with its breakthrough growth. Q3 pre-tax profit reached over VND 3.8 trillion, a 16% increase year-on-year. Total assets as of September 30 exceeded VND 377 trillion, growing by over VND 132 trillion in just nine months, a rare surge among mid-sized banks. Both deposits and credit outstanding rose by 20% and 17.8%, respectively.

Nam A Bank reports that over 98% of its transactions are conducted digitally. Cross-border QR payment services with Thailand, Laos, and Cambodia have been seamlessly implemented, contributing to the expansion of the Southeast Asian payment ecosystem.

Not only private banks but also state-owned commercial banks have recorded positive results. The Bank for Agriculture and Rural Development of Vietnam (Agribank) announced that as of September 30, total capital reached over VND 2.2 quadrillion, a 10.7% increase from the beginning of the year, achieving nearly 96% of the growth plan. Agribank leads the system in retail deposits, with a scale of over VND 1.7 quadrillion from nearly 18 million customers.

A notable highlight is that Agribank’s on-balance-sheet bad debt ratio has dropped to 1.19%, the lowest since the bank’s first restructuring phase in 2013. This is also the lowest ratio among the four state-owned commercial banks, reflecting effective risk management and credit portfolio restructuring efforts.

Nam A Bank has deployed cross-border QR payment services in Thailand, Laos, and Cambodia.

Beyond the banking sector, the securities industry is also experiencing a remarkable quarter. Several securities companies like VPBankS, VIX, and SHS have reported substantial profit increases. Most recently, Saigon-Hanoi Securities (SHS) announced a Q3 pre-tax profit of VND 590 billion, a 7.9-fold increase compared to the same period last year. Total assets as of September 30 exceeded VND 20 trillion, up 57%, driven by expanded financial investment portfolios, margin lending activities, and increased equity capital.

For the first nine months, SHS achieved a pre-tax profit of VND 1.379 trillion, a 45% increase, surpassing the full-year 2025 profit target set by the shareholders’ meeting. As of August, SHS’s market capitalization surpassed the USD 1 billion mark for the first time, ranking it among the top six securities companies by market capitalization.

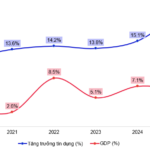

Skyrocketing Credit Growth Forecast Sparks Inflation Concerns: 15-Year High Predicted

As of the end of September, the economy’s credit growth has reached 13.37% compared to the beginning of the year. It is estimated that credit growth for this year could hit 19-20%, the highest level in 15 years. The State Bank of Vietnam emphasizes ongoing monitoring to ensure both economic growth and inflation control.