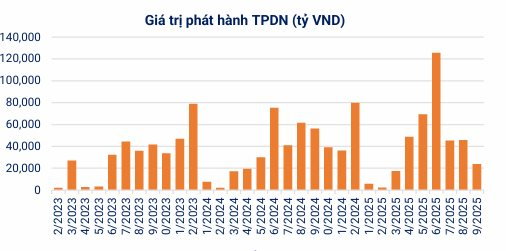

The corporate bond market experienced a relatively quiet September in the primary market. According to data from the Vietnam Bond Market Association (VBMA), total mobilization value reached only VND 23.703 trillion, a significant 61% drop compared to August and 58% lower than the same period in 2024.

Source: VBMA

September’s issuance structure included 26 private placements totaling VND 23.204 trillion and a single public offering of VND 499 billion by Thanh Thanh Cong – Bien Hoa JSC (SBT).

Source: VBMA

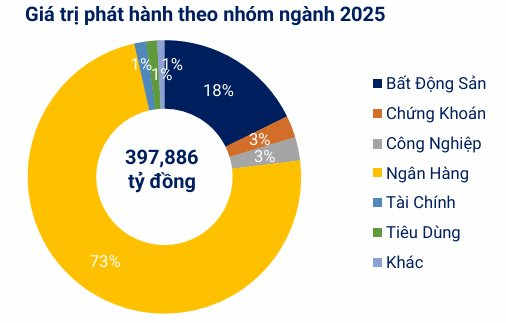

Despite September’s slowdown, the first nine months of 2025 showed overall growth. Cumulatively, companies raised nearly VND 398 trillion, a 27% increase year-over-year. Banks dominated with 73% of issuances, followed by real estate at 18%.

Source: VBMA

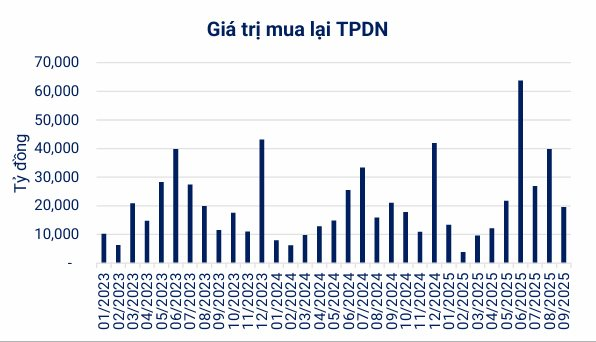

While new capital inflows were cautious, debt repayment obligations remained significant. In September, companies repurchased VND 19.509 trillion in bonds, an 8% decrease from last year.

Source: VBMA

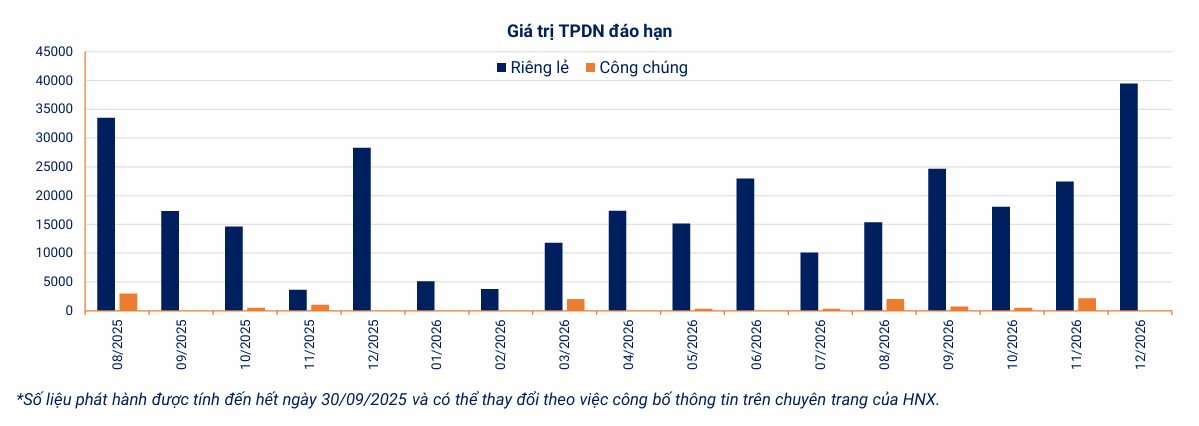

Repayment pressure is expected to rise in Q4. VBMA estimates VND 48.080 trillion in maturities for the remaining months, with real estate accounting for 38% (VND 18.331 trillion).

Liquidity pressures are evident as more companies delayed payments in September. Notable cases include Tracodi (TCD) with VND 27.4 billion in interest, R&H Group with VND 55.4 billion, and Dai Thinh Phat with VND 5.3 billion. Big Gain also missed VND 55 billion in principal and interest on BGICH2125004.

The secondary market showed resilience, with private corporate bond trading reaching VND 150.766 trillion in September. Average daily volume increased 45% to VND 7.538 trillion, indicating continued investor interest despite lower new issuances.

Looking ahead, major players like Vingroup (VIC) plan to issue upND 2.5 trillion in private bonds in Q3, while Vietjet (VJC) targets up to VND 3 trillion in H2.

Government Inspectorate Hands Novaland Case to Investigators, Unveiling the Mysterious Trail of 7,000 Billion VND, Affected Parties Speak Out

Furthermore, the conclusion highlights the mobilization of trillions of dong for real estate projects that lack the necessary legal conditions for sale or business partnerships.

Unveiling Anomalies: Lawyer Highlights Irregularities in $5 Billion Loan Debt Forgiveness Case

The recent ruling by the People’s Court of District 7 (Ho Chi Minh City), which declared the credit and mortgage contracts between VPBank and client Trần Hồng Sơn null and void, effectively freeing Mr. Sơn from a debt exceeding 5 billion VND, has sparked widespread debate. Legal experts highlight numerous irregularities, suggesting the verdict may violate procedural laws, lack legal basis, and compromise objectivity.

Banks Race to Issue Bonds: How to Manage Risks Effectively?

Bank deposit growth has lagged behind credit expansion due to persistently low interest rates. As a result, many banks are increasingly turning to bond issuance to meet capital adequacy and liquidity requirements.