Vietcap Securities Joint Stock Company (Stock Code: VCI, HoSE) has released materials in preparation for the 2025 Extraordinary General Meeting of Shareholders, scheduled for November 7, 2025.

Notably, Vietcap Securities plans to present a private share offering proposal for shareholder consideration and approval.

According to the Board of Directors of Vietcap Securities, in a market expected to continue its positive growth trajectory, the company recognizes the need to promptly increase its charter capital. This move aims to strengthen financial resources for existing business operations, enhance competitiveness, and solidify a sustainable, long-term development foundation.

Based on this, the Board proposes a private share offering to raise capital for margin lending and proprietary trading activities. This strategy seeks to expand operational scale, optimize capital utilization, and create value for shareholders.

Specifically, the company plans to offer up to 127.5 million shares to reputable domestic and international professional securities investors with strong financial capabilities.

The offering price will not be lower than the company’s book value as of December 31, 2024, which stands at VND 18,026 per share (based on the 2024 audited financial report).

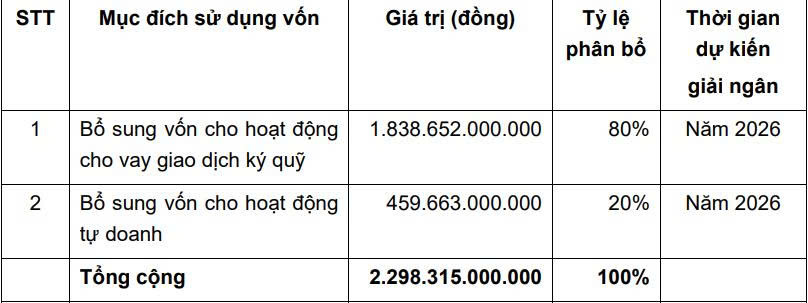

Vietcap Securities estimates raising a minimum of VND 2,298.3 billion from this offering, allocated as follows:

Source: Vietcap Securities

The offering is expected to take place in 2025 and Q1/2026, following the State Securities Commission’s (SSC) receipt of the private share offering registration dossier.

If approved, Vietcap Securities’ charter capital is projected to increase from VND 7,226 billion to VND 8,501 billion.

In addition to the capital increase plan, the Board also proposes establishing a subsidiary in Singapore.

The proposed subsidiary, Vietcap Singapore Pte.Ltd, will have an investment capital of USD 29 million (approximately VND 725 billion). Its primary focus will be on indirect overseas investment through proprietary trading.

The subsidiary will also provide securities business services in accordance with the company’s licensed activities and applicable laws at any given time.

At this Extraordinary General Meeting, Vietcap Securities will also seek shareholder approval for amendments to the company’s charter.

Securities Firms Forecast MWG’s 2026 Profit at VND 8.5 Trillion, Anticipating Bach Hoa Xanh to Accelerate Opening of 6,000 Stores

Vietcap forecasts a remarkable 77% surge in post-tax profit for 2025, reaching an estimated VND 6,559 billion, significantly outpacing the previous year’s performance.

Đạt Phương Group Proposes Private Placement of Shares to Shareholders

At the upcoming extraordinary shareholders’ meeting, Dat Phuong Corporation will present a plan to issue nearly 17.8 million shares to its shareholders. This strategic move aims to increase the company’s chartered capital and strengthen its financial capacity, enabling greater investment in future projects.