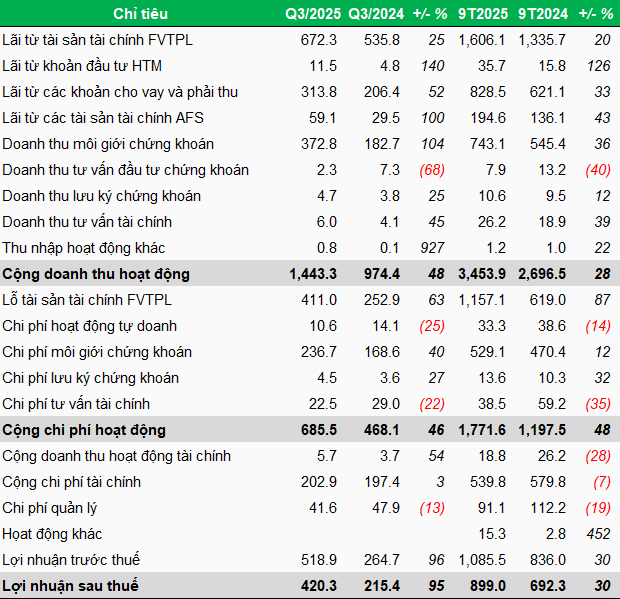

For brokerage activities, Vietcap generated nearly VND 373 billion in revenue, doubling the figure from the same period last year, thereby boosting profits by 9.7 times to VND 136 billion.

According to Vietcap, in Q3/2025, the stock market showed positive developments, with liquidity surging and the VN-Index reaching new highs, closing at 1,661.7 points on September 30, 2025. With favorable market conditions, Vietcap’s brokerage market share grew to 6.43%, ranking fourth on the HOSE. In institutional trading, the company maintained its lead with over 30% market share, contributing to increased brokerage revenue.

Another positive activity was lending, with a 52% growth in revenue, reaching nearly VND 314 billion.

Regarding proprietary trading, Vietcap reported realizing profits from certain investments, leading to a 25% increase in revenue from the sale of financial assets at fair value through profit or loss (FVTPL). However, the company’s financial statements also showed a 63% rise in FVTPL financial asset losses, causing a 7% decline in proprietary trading profits to nearly VND 251 billion.

Overall, the company’s net profit exceeded VND 420 billion, up 95% year-on-year, bringing the nine-month total to nearly VND 900 billion, a 30% increase.

In 2025, Vietcap aims for VND 1.42 trillion in pre-tax profit. With nearly VND 1.1 trillion achieved in the first nine months, the company has completed 76% of its annual target.

|

Vietcap’s Q3 and 9-month 2025 business results

Unit: Billion VND

Source: VietstockFinance

|

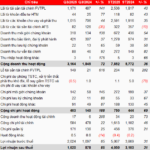

By the end of Q3/2025, Vietcap’s total assets reached over VND 29.7 trillion, a 12% increase from the beginning of the year. The two largest asset categories both grew: loans increased from VND 11.2 trillion to VND 13.9 trillion, primarily margin loans; and available-for-sale financial assets (AFS) rose from VND 8.4 trillion to VND 11.5 trillion, mainly comprising listed securities (KDH, IDP, MBB, FPT, TDM, STB…), other listed and unlisted AFS securities, and listed bonds.

Compared to the end of Q2, the cost basis of investments in KDH increased from VND 536 billion to VND 635 billion; FPT rose from VND 255 billion to VND 570 billion, a 2.2-fold increase; while MBB decreased from VND 180 billion to VND 165 billion.

In contrast to loan and AFS growth, another significant asset category, cash and cash equivalents, declined from VND 4.7 trillion to VND 2.6 trillion.

Additionally, the FVTPL financial asset portfolio decreased from over VND 846 billion to over VND 599 billion, primarily unlisted bonds and listed equities. The company also held VND 300 billion in held-to-maturity investments (HTM), all term deposits, down from VND 598 billion at the beginning of the year.

On the funding side, short-term borrowing surged from nearly VND 12.6 trillion to nearly VND 15.9 trillion, accounting for 54% of total funding. The company primarily borrowed from domestic banks. These short-term loans, with interest rates ranging from 3.5% to 7% per annum, were used to supplement working capital.

– 22:16 16/10/2025

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.

Fertilizer Company Reports Staggering 1,000% Profit Surge in Q3 2025

The company attributes its revenue growth primarily to increased sales volume and a higher average selling price compared to the same period last year. Specifically, the average selling price for this period stood at 17.74 million VND per ton, marking a significant increase of 4.56 million VND per ton over the previous year.

VPBank Surpasses Annual Total Asset Plan in Just 9 Months, Driven by Ecosystem Synergy

Harnessing the unique power of its diverse and expansive ecosystem, Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) has built a robust foundation, setting the stage for significant growth and breakthrough advancements in the upcoming period.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.