According to VCI, as we step into 2025, Vietnam’s stock market has shown numerous positive signals, with trading liquidity maintaining a strong upward trend. The average trading value across the market (including HOSE, HNX, and UPCoM) in Q3/2025 reached VND 44,029 billion per session, an 81% increase compared to Q2/2025. Over the first nine months of 2025, the average trading value stood at VND 29,266 billion per session, a 30% rise year-on-year.

Notably, on October 8, 2025, FTSE Russell officially announced Vietnam’s upgrade from a frontier market to a secondary emerging market. This milestone is expected to significantly enhance the attractiveness of Vietnam’s stock market to foreign investment in the coming period.

Amidst this positive market outlook, the VCI Board of Directors recognizes the need to increase the company’s chartered capital to strengthen financial resources, bolster competitiveness, and ensure long-term sustainable growth. To achieve this, the Board proposes a private placement of shares to raise capital for margin lending and proprietary trading activities, thereby expanding operations, optimizing capital efficiency, and creating greater value for shareholders.

The company plans to issue up to 127.5 million shares, with the offering price not lower than the book value of VND 18,026 per share as of December 31, 2024, based on the audited 2024 financial report.

All privately placed shares will be subject to a one-year transfer restriction from the completion of the offering.

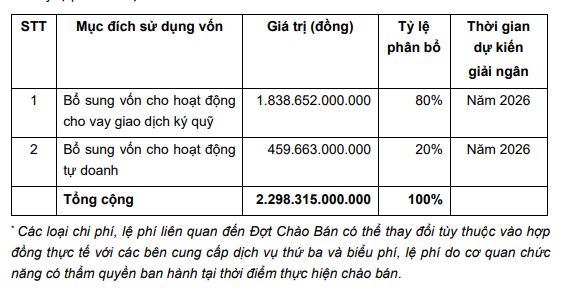

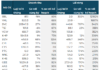

The total expected proceeds from this private placement are approximately VND 2.3 trillion. After deducting related fees and expenses, the funds will be allocated as follows: 80% (VND 1.8 trillion) for margin lending activities and 20% (approximately VND 460 billion) for proprietary trading.

|

Capital Allocation Plan by VCI

Source: VCI

|

Following the issuance, VCI’s chartered capital will increase to over VND 8.5 trillion.

In addition to the capital increase, the Board also proposes establishing a subsidiary in Singapore with an investment of USD 29 million (approximately VND 725 billion). The subsidiary will primarily engage in indirect overseas proprietary investment and provide securities-related services in compliance with local regulations.

During this Extraordinary General Meeting, VCI will also seek shareholder approval to amend certain provisions in the company’s charter.

– 5:13 PM, October 16, 2025

KBSV Raises VN-Index Forecast Above 1,800 Points, Backed by Strong Supportive Factors

As we enter the fourth quarter, KBSV anticipates that the growth drivers established in recent quarters will not only persist but also expand further.

The Storm Within: A Martyr’s Heart

Investors anticipated a booming year as the VN-Index surged 60% from its tariff-driven lows, yet underlying anxieties continue to simmer among market participants.