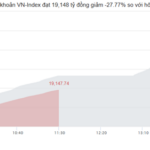

Following a session under selling pressure near the 1,800-point mark, which halted a four-session rally, the market opened the October 15 session with a rebound. However, the benchmark index faced continued adjustment pressures. By the close, the VN-Index dipped by 3.11 points (-0.18%), settling at 1,757.95 points. Foreign trading activity remained a drag, with net selling reaching 883 billion VND across the market.

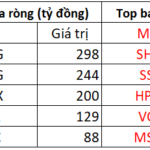

Securities firms’ proprietary trading desks recorded a net buy of 369 billion VND on HOSE.

Specifically, KDH shares saw a net buy of 67 billion VND. HPG ranked second with 53 billion VND, followed by VIX (40 billion), FPT (35 billion), TCB (31 billion), ACB (23 billion), VCB (22 billion), MSN (22 billion), MWG (19 billion), and DGC (15 billion VND).

Conversely, securities firms heavily sold VHM, with a net value of -23 billion VND, followed by VRE (-12 billion), SHB (-10 billion), VDP (-9 billion), and HDG (-7 billion VND). Other notable net sells included SSI (-6 billion), FUEVFVND (-5 billion), VPB (-5 billion), CTR (-4 billion), and FRT (-3 billion VND).

October 16th Stock Market: Bank and Real Estate Stocks Leading the Investment Flow?

The stock market on October 16th may continue to see a divergence in stock groups, with the banking and real estate sectors taking center stage.

KBSV Raises VN-Index Forecast Above 1,800 Points, Backed by Strong Supportive Factors

As we enter the fourth quarter, KBSV anticipates that the growth drivers established in recent quarters will not only persist but also expand further.

Market Pulse 15/10: VN-Index Closes in the Red, Financial and Tech Sectors Buck the Trend

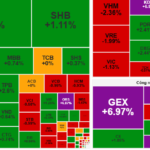

At the close of trading, the VN-Index dipped 3.11 points (-0.18%), settling at 1,757.95 points, while the HNX-Index climbed 0.79 points (+0.29%), reaching 276.12 points. Market breadth favored decliners, with 446 stocks closing lower compared to 257 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.