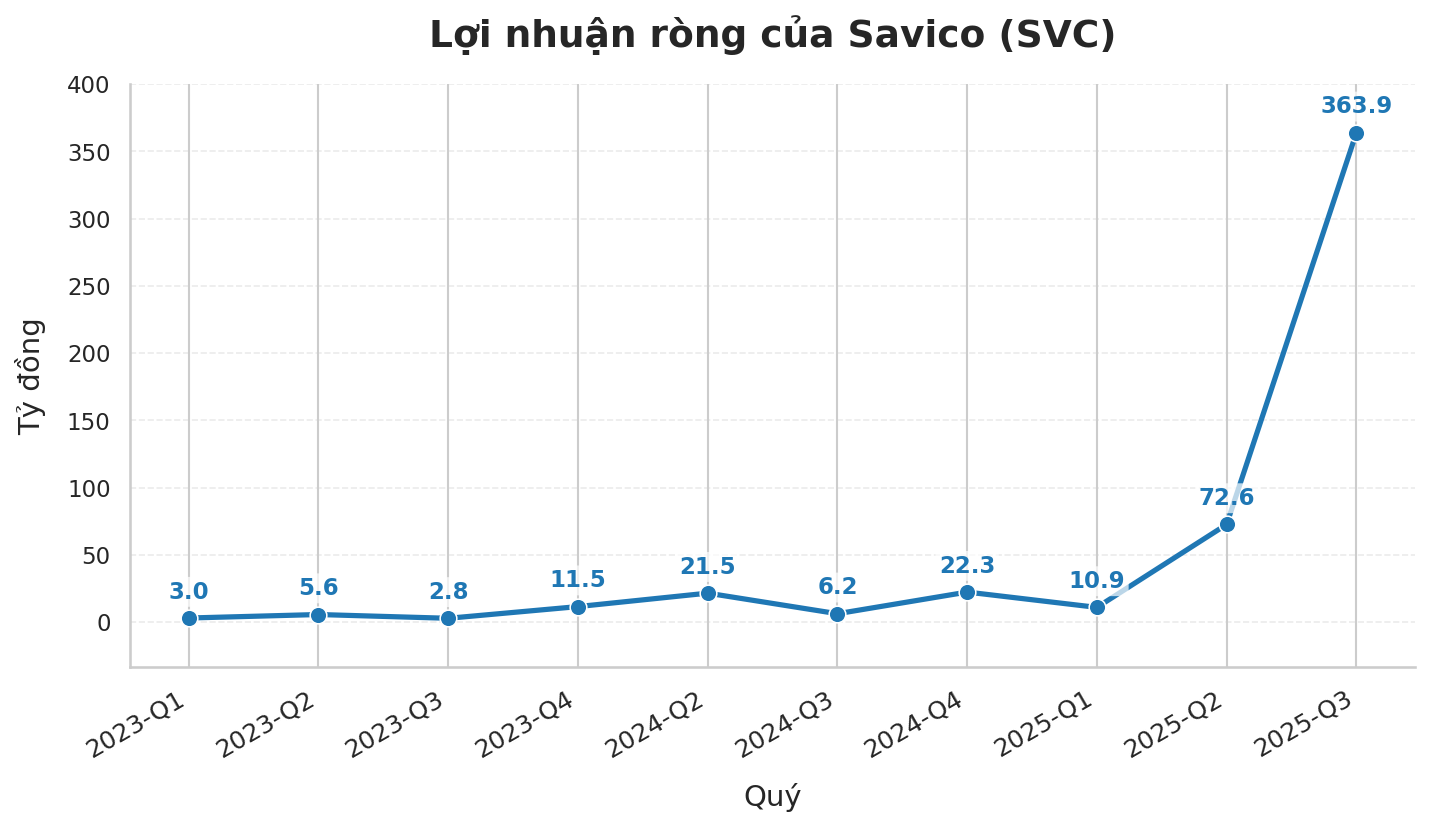

Saigon General Service Corporation (Savico, HoSE: SVC) has released its Q3/2025 consolidated financial report, showcasing a remarkable surge in profits.

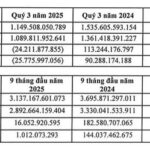

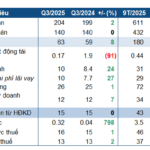

In Q3 2025, Savico recorded net revenue of VND 8,217 billion, a 21% increase compared to the same period in 2024. Gross profit rose by 6% to VND 480 billion.

The company attributed the revenue growth to an improved automotive market and the expansion of its subsidiary network, which significantly boosted sales.

However, the standout achievement was in financial activities. Financial revenue for the quarter reached VND 669 billion, a staggering 33-fold increase from the VND 20 billion recorded in Q3/2024. Over VND 537 billion of this came from profits on investment sales.

As a result, pre-tax consolidated profit reached VND 443.4 billion, a 1,058% increase year-on-year. Post-tax profit for the parent company soared to VND 364 billion, 59 times higher than the VND 6.2 billion recorded in the same period last year. This marks Savico’s highest quarterly profit ever.

According to the company’s explanation, this surge was driven by profits from capital transfers in real estate projects, alongside improvements in the automotive sector.

For the first nine months of 2025, Savico’s net revenue reached VND 20,547 billion, a 27% increase compared to the same period in 2024. Post-tax profit for the parent company hit VND 450 billion, 8.7 times higher than the previous year.

As of September 30, 2025, the company’s total assets stood at VND 12,067 billion, a 35% increase since the beginning of the year. Notably, short-term receivables rose sharply from VND 1,087 billion to VND 2,597 billion, with investment cooperation contract receivables increasing from VND 284 billion to VND 1,611 billion.

On the liabilities side, total debt at the end of Q3 was VND 9,055 billion, a 37% increase year-to-date. Of this, corporate debt amounted to VND 5,609 billion.

Savico primarily operates in automotive distribution, real estate, and financial services.

According to its website, Savico is Vietnam’s leading automotive distributor and service provider, with a network of 106 showrooms nationwide. In 2024, Savico held a 13.6% market share (as per VAMA member reports).

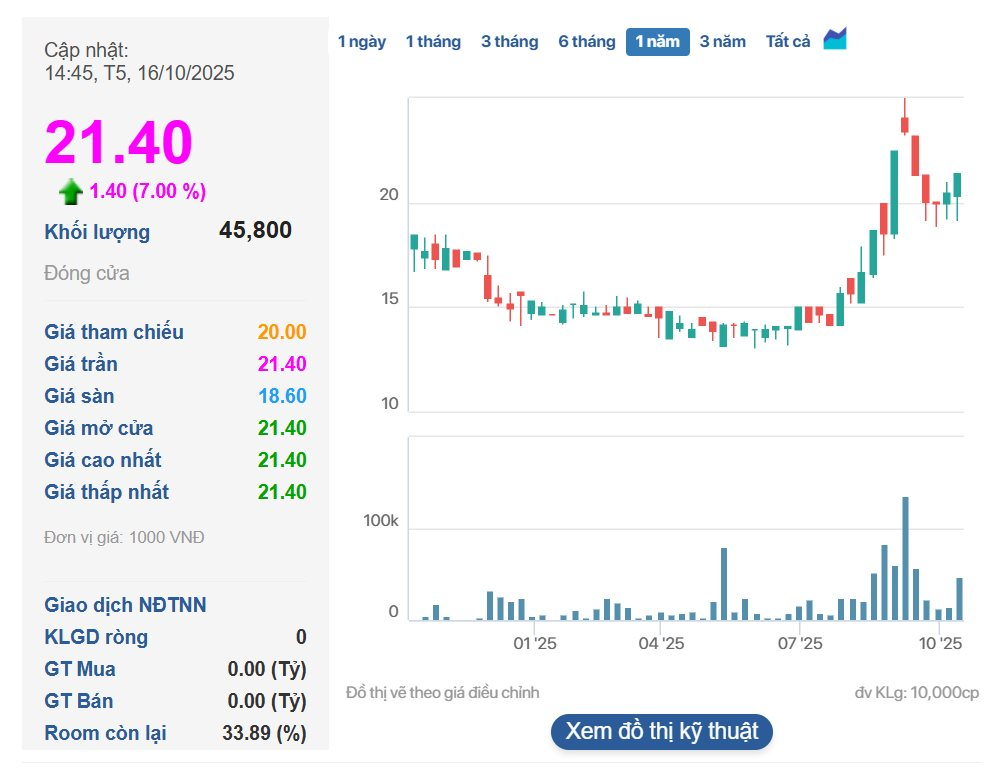

On October 16, SVC shares hit their upper limit, closing at VND 21,400 per share. Since the beginning of the year, SVC shares have risen by approximately 48%.

Upcoming IPOs Set to Ignite the Market

In the first nine months of this year, only four companies listed or transferred to the HoSE. However, the final quarter has seen a surge in IPO and listing activity, with numerous businesses filing applications or announcing plans to move to the HoSE.

Over 4 Million Trillion Dong in Real Estate Credit: What Could Happen Next?

As of the end of August 2025, real estate credit outstanding debt has surpassed 4 million trillion VND, accounting for nearly a quarter of the total debt in the economy. This substantial capital inflow is anticipated to stimulate market recovery, yet it also raises concerns regarding capital efficiency and the potential risk of an asset bubble.