Haxaco (HCM City Services Automobile Joint Stock Company, stock code: HAX) has released its Q3/2025 financial report, revealing a decline in business performance.

Mercedes Distributor Reports Nearly VND 26 Billion Loss

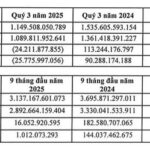

Specifically, the company’s net revenue for the quarter reached nearly VND 1.15 trillion, a 25% decrease compared to the same period last year. After deducting expenses, Haxaco recorded a post-tax loss of nearly VND 26 billion, in contrast to a profit of over VND 90 billion in the same quarter of the previous year. Notably, this marks the first quarter Haxaco has reported a loss since Q4/2021.

For the first nine months of 2025, Haxaco’s cumulative post-tax profit amounted to just over VND 1 billion, a staggering 99% decline.

Explaining the downturn, Haxaco cited significant market fluctuations in the automotive sector during Q3. The market saw widespread aggressive discount programs, not only in the luxury segment but also extending to the mainstream segment.

Haxaco’s performance declines in the first nine months of 2025

Additionally, competitors continuously launched new models with deep incentives to enhance competitiveness and attract customers. Operational costs also increased year-over-year due to the company’s expansion efforts.

“These factors have exerted significant pressure, narrowing profit margins and impacting the company’s earnings,” Haxaco explained.

Haxaco is Vietnam’s largest distributor of Mercedes-Benz vehicles. In addition to Mercedes-Benz, the company also distributes MG vehicles.

On the stock market, HAX shares closed the session on October 15 with a sharp decline of over 5%, falling to VND 11,050 per share. This represents a nearly 16% drop over the past month and a more than 30% decline since the beginning of 2025.

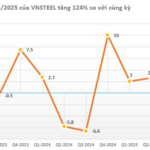

Steel Company Reports 120% Surge in Q3/2025 Post-Tax Profits

Driven by improved business performance and a rebounding market, consumption volumes surged significantly, resulting in higher profit margins in Q3 2025 compared to Q3 2024.

Shocking Revelations at the Company of the Mysterious Female Tycoon Who Once Held Over $175 Million in ACB Stocks

In the first nine months of 2025, despite a revenue decline of 18% year-over-year to VND 957 billion, the company’s after-tax profit reached VND 191 billion, marking a robust 22% growth compared to the same period last year.