Conference on the Amendments and Supplements to the Securities Law and Detailed Implementing Regulations Held on October 16, 2025

|

According to Mr. Hoàng Văn Thu, Vice Chairman of the State Securities Commission (SSC), the policy development approach is closely tied to market upgrading, with a clear focus not only on achieving the upgrade but also on maintaining the ranking and enhancing the legal framework in line with international standards.

One of the key objectives in the Government’s Market Upgrade Plan is to sustain the ranking post-upgrade. Maintaining this ranking is essential to build investor confidence in Vietnam’s market, thereby sustaining and attracting indirect capital for economic development.

Achieving this goal requires more than just efforts from the securities sector; it demands collaboration from all market participants, particularly businesses. Companies must prioritize transparency, fairness, and openness in their market operations.

SSC leadership emphasizes that the securities industry’s efforts involve refining business processes and legal tools to align with international practices. Key solutions include: Further enhancing legal instruments and revising operational procedures, especially payment processes.

A critical step is the implementation of the Central Counterparty Clearing (CCP) mechanism, which is vital for introducing new trading activities. The SSC is advancing its management framework and plans to soon launch the CCP model for the primary market. This model is expected to be operational by early 2027, adhering to international standards and meeting foreign investor requirements.

According to Ms. Phạm Thị Thùy Linh, Representative of the Market Development Department at SSC, the CCP model aims to ensure that transactions are not canceled during the settlement process. This new mechanism opens opportunities for innovative transactions, such as T0 (same-day trading).

Additionally, the SSC is collaborating with the Stock Exchange to explore extending trading hours, including during the lunch break.

Regarding trading bandwidth and settlement cycles (T+), regulators have not proposed changes. The current bandwidth is functioning smoothly and safely, with no issues requiring adjustments.

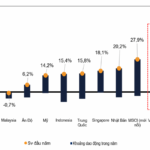

Upon market upgrade, FTSE Russell estimates that foreign capital inflows into Vietnam will range from 5 to 6 billion USD.

Of this, passive capital from index funds is expected to be between 1 and 1.5 billion USD, starting to flow in once the market’s upgrade is officially announced (anticipated in August 2026).

Active capital, estimated at 4 to 5 billion USD, will be gradually disbursed following FTSE Russell’s October 8 announcement of the market upgrade.

– 16:36 16/10/2025

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.

Maybank Securities: VN-Index to Stabilize Between 1,600 – 1,700 Points in October, Targeting 1,800 Post-Accumulation Phase

According to Maybank Securities’ October strategy report, the VN-Index is likely to continue fluctuating within the 1,600-1,700 range in October 2025, before targeting the 1,800 mark. This optimism is driven by expectations of an expansionary monetary and fiscal policy, accelerating corporate earnings, and the potential return of foreign capital inflows.

Prime Minister Directs Key Solutions to Sustain Vietnam’s Stock Market Growth

On October 8, 2025, Prime Minister Phạm Minh Chính signed Directive No. 192/CĐ-TTg regarding the upgrading of Vietnam’s stock market. The directive acknowledges the securities industry’s concerted efforts to implement reforms aimed at fostering a transparent, modern, and efficient market aligned with international standards.