I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 15, 2025

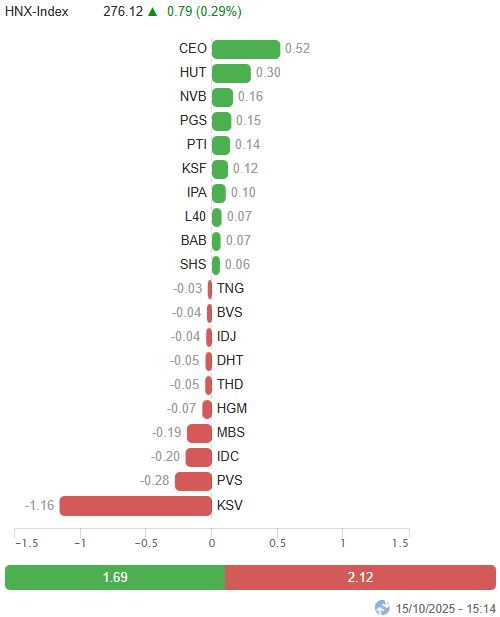

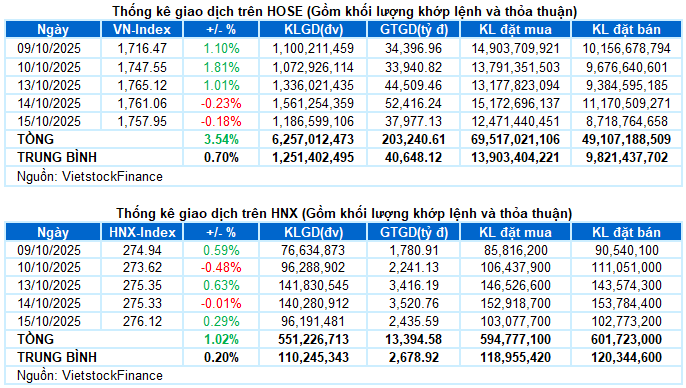

– Key indices showed mixed movements during the October 15 trading session. Specifically, the VN-Index dipped slightly by 0.18%, closing at 1,757.95 points, while the HNX-Index rose by 0.29%, reaching 276.12 points.

– Liquidity significantly decreased compared to the previous session. Order-matching volume on the HOSE fell by 25.7%, totaling 1.1 billion units. Similarly, the HNX recorded nearly 89 million matched units, a 36.3% decline.

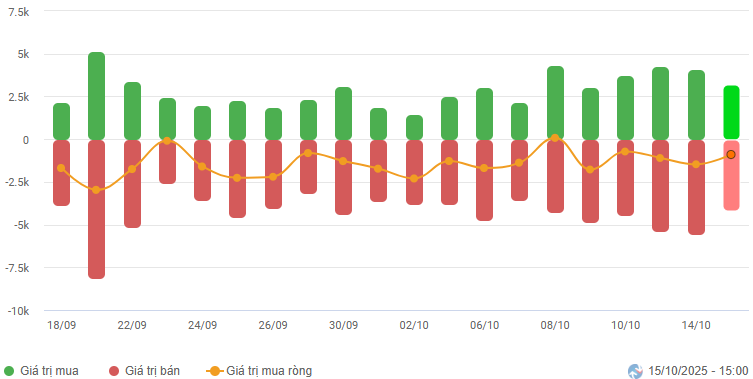

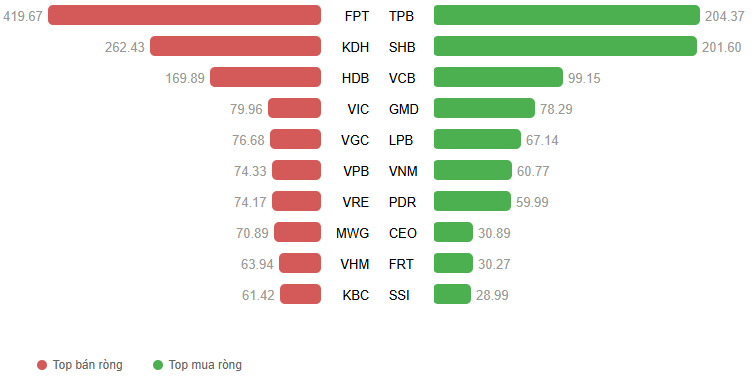

– Foreign investors continued net selling on both the HOSE, with over VND 844 billion, and the HNX, with over VND 68 billion.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

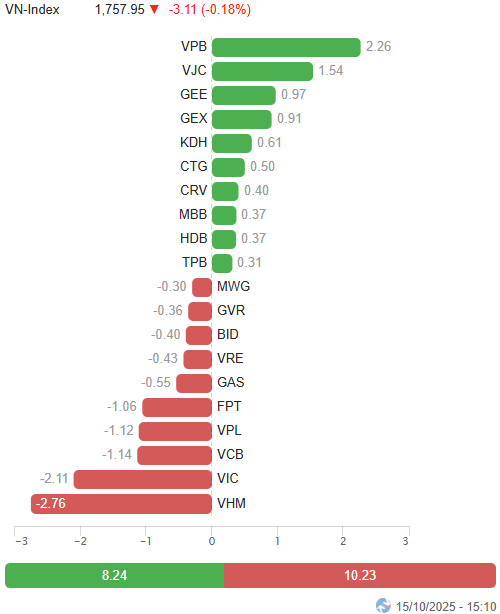

– The market experienced volatility during the October 15 session. Despite a positive start with widespread green, the VN-Index gradually weakened as major VinGroup stocks reversed, exerting significant pressure on the index. Declining liquidity reflected investor caution following yesterday’s reversal. Prolonged divergence persisted until the close, with the VN-Index ending at 1,757.95 points, down over 3 points from the previous session.

– Among the top influencers on the VN-Index, VinGroup stocks (VHM, VIC, VPL, and VRE) were the primary drag, collectively subtracting 6.4 points from the index. Additionally, VCB and FPT contributed to the downward pressure, each costing the VN-Index over 1 point. Conversely, VPB, VJC, GEE, and GEX stood out as bright spots, collectively adding 5.7 points to mitigate deeper losses.

Top Influencing Stocks on the Index. Unit: Points

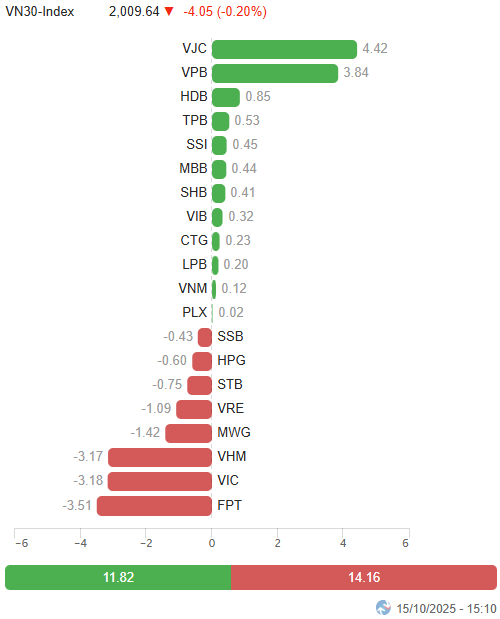

– The VN30-Index closed slightly lower by 4.05 points (-0.2%), at 2,009.64 points. The basket’s breadth was balanced, with 15 decliners, 12 advancers, and 3 unchanged stocks. On the downside, FPT extended its losing streak with a 3% drop, while VHM, SSB, and VRE also adjusted by around 2%. Conversely, VJC continued its stellar performance with a third consecutive ceiling session, alongside VPB and TPB, which gained 3.7% and 2.6%, respectively.

Divergence persisted across sectors. Information technology and communication services were the market’s laggards, both adjusting over 2%. Red dominated leading stocks such as FPT (-3.03%), CMG (-1.55%), DLG (-2.97%); VGI (-2.38%), FOX (-2.23%), VNZ (-1.34%), CTR (-1.7%), YEG (-2.99%), and VNB (-3.65%).

The real estate sector also weighed on the index, with notable adjustments in VIC, VHM, VRE, KBC, SIP, IDC, SNZ, and VCR. However, the sector still featured standout performers, including KDH hitting the ceiling, CEO (+4.28%), PDR (+2.41%), DIG (+1.77%), DXG (+2.44%), and HDC (+2.49%).

Meanwhile, industrial and financial sectors emerged as bright spots, with strong demand for stocks like GEX, VJC, GEE hitting ceilings, VSC (+1.62%), GMD (+1.32%), HAH (+1.45%), CII (+1.85%); VPB (+3.69%), SHB (+1.11%), VIX (+1.28%), TPB (+2.6%), SSI (+1.1%), HDB (+1.38%), and ORS reaching their upper limits. Nonetheless, several stocks recorded notable declines, including ACV (-1.67%), VGC (-2.99%), FCN (-1.72%), PC1 (-3.25%); VCB (-0.95%), BID (-0.63%), STB (-0.99%), BVH (-1.92%), MBS (-1.45%), and SSB (-2.06%).

The VN-Index continued to oscillate with declining liquidity, reflecting investor caution. Currently, the Stochastic Oscillator has issued a sell signal in the overbought zone, indicating heightened short-term correction risks.

II. TREND AND PRICE VOLATILITY ANALYSIS

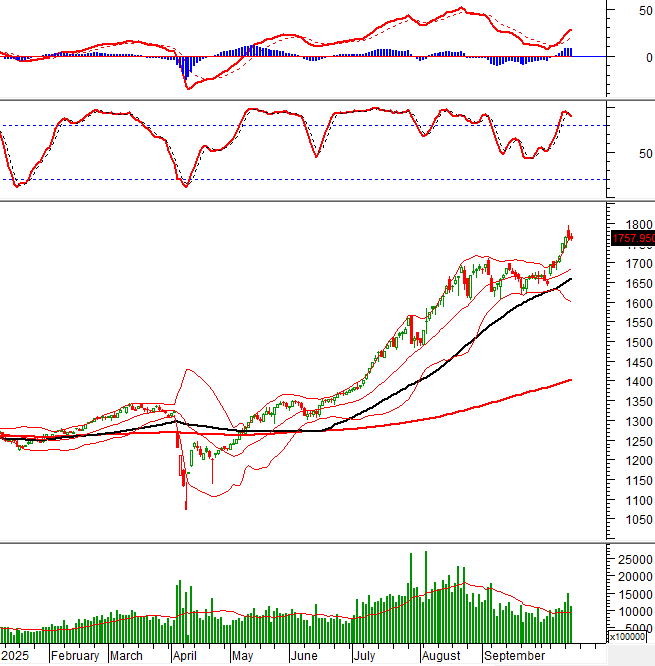

VN-Index – Stochastic Oscillator Signals Sell in Overbought Territory

The VN-Index continued to oscillate with declining liquidity, reflecting investor caution.

Currently, the Stochastic Oscillator has issued a sell signal in the overbought zone, indicating heightened short-term correction risks.

If selling pressure persists, the index is likely to retest the 1,700-1,711 point range, corresponding to the September 2025 peak.

HNX-Index – Maintains Above Bollinger Bands’ Middle Line

The HNX-Index edged up after a tug-of-war session, remaining above the Bollinger Bands’ Middle Line.

The MACD indicator continues its upward trajectory after issuing a buy signal and crossing above the zero line. If this trend persists in upcoming sessions, the index’s short-term outlook is likely to improve significantly.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued net selling on October 15, 2025. If this trend persists in upcoming sessions, the outlook will become increasingly pessimistic.

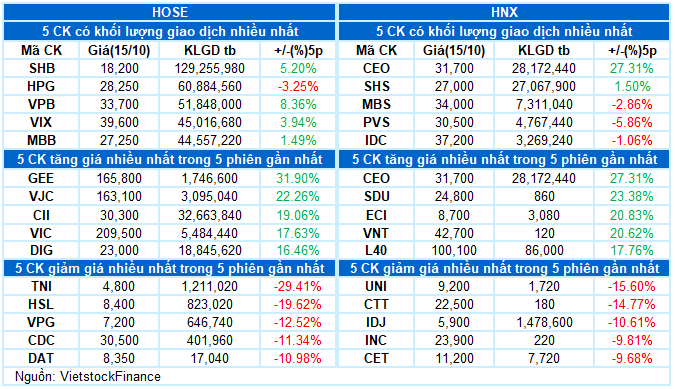

III. MARKET STATISTICS FOR OCTOBER 15, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:57 October 15, 2025

The Storm Within: A Martyr’s Heart

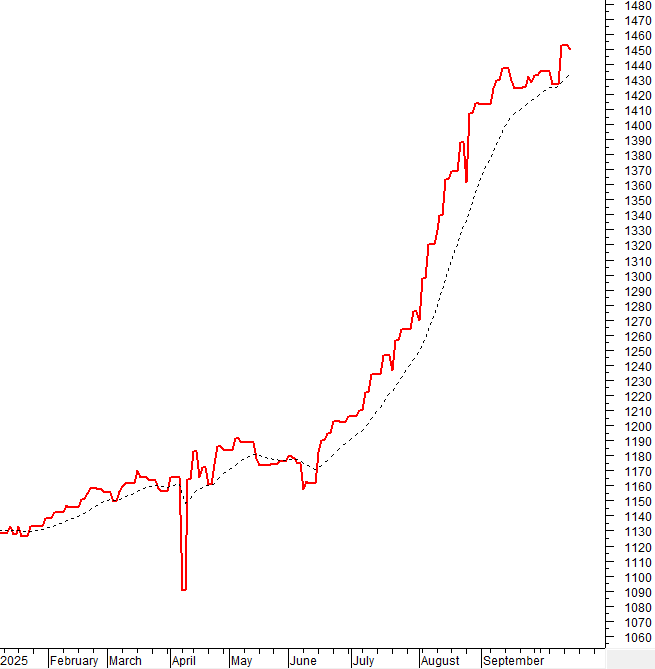

Investors anticipated a booming year as the VN-Index surged 60% from its tariff-driven lows, yet underlying anxieties continue to simmer among market participants.

Gelex Group Stocks Witness Massive Trading Volume Surge

The VN-Index retreated from its peak near the 1,800-point mark today (October 14), as heavy profit-taking pressure in the afternoon session triggered a market correction. The Gelex Group (GEX) stood out with a surge in trading activity, as its shares hit the ceiling price and saw massive volume, equivalent to over 5.5% of its free-floating shares changing hands.