VPBank Securities JSC (VPBankS) has announced its IPO plan, offering 375 million shares at a price of VND 33,900 per share, aiming to raise nearly VND 12,713 billion. At this price, VPBankS is valued at approximately VND 63,562 billion, equivalent to over USD 2.4 billion. The company’s shares are expected to be listed on the Ho Chi Minh Stock Exchange (HOSE) in December 2025.

During the Roadshow event held in Hanoi on October 16th, Mr. Vu Huu Dien – Board Member and CEO of VPBankS, explained that the offering price of VND 33,900 per share remains “below the company’s intrinsic value.” According to him, this price is set with a “win-win” approach, benefiting both the company and investors, while leaving room for post-listing price appreciation.

Mr. Dien stated that, based on current valuations, VPBankS’ projected P/E ratio for 2025 is 14.3 times, and P/B is 2.4 times. By 2026, these figures are expected to drop to around 12 times and below 1.7 times, respectively—lower than the industry average.

“As a long-time securities industry professional, I believe we cannot solely focus on current valuation metrics but must consider growth potential. VPBankS boasts rapid growth, and VPBank’s brand value is not yet fully reflected in the share price,” he added.

Additionally, the CEO revealed that on the first day of the offering, VPBankS recorded purchase registrations totaling VND 6,000 billion. Notably, Dragon Capital committed to buying USD 50 million, and VIX Securities registered approximately VND 2,000 billion.

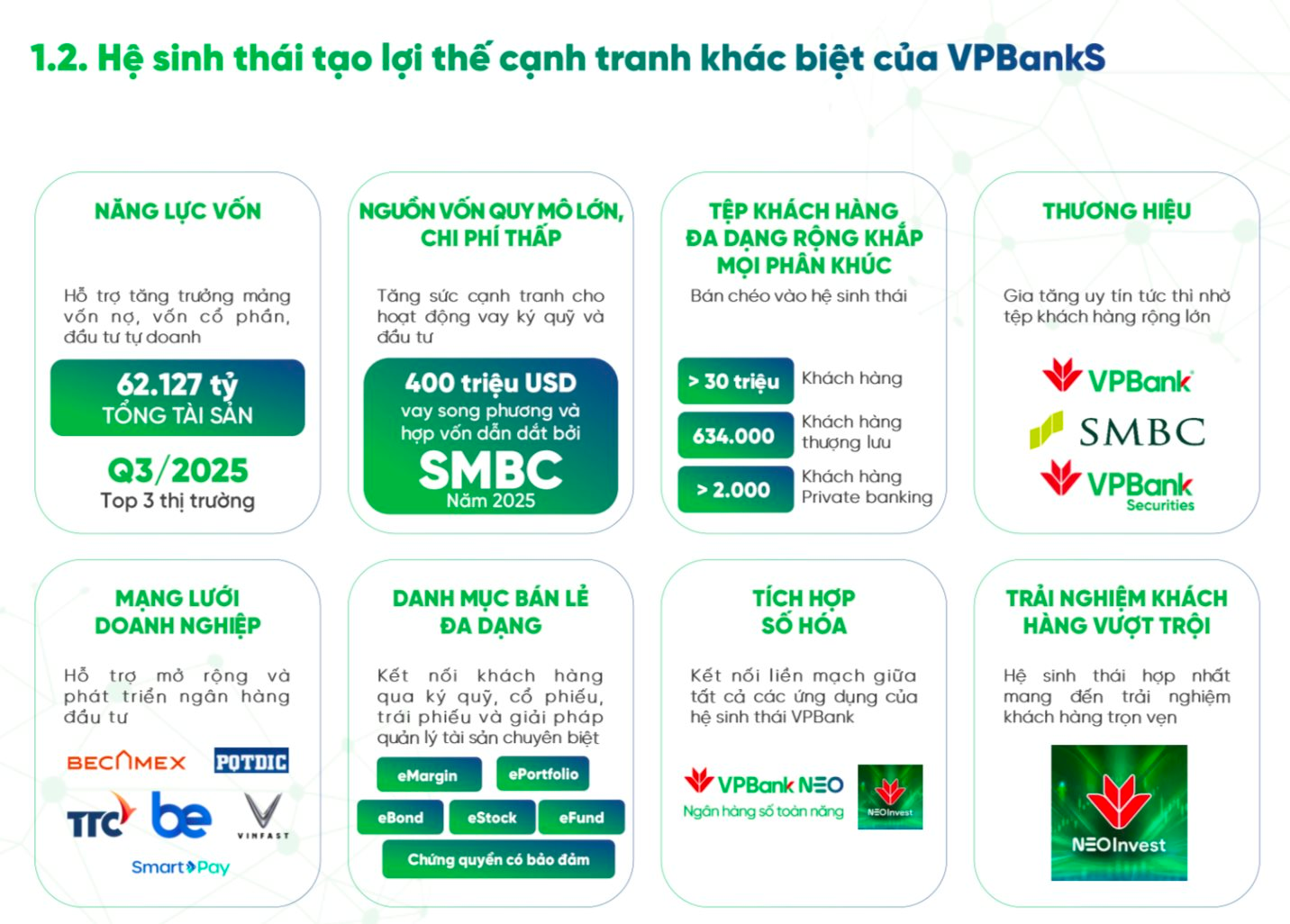

Currently, VPBankS ranks among the top three securities firms in terms of total assets and margin lending. With over 900,000 trading accounts, the company aims to reach 1 million accounts by the end of 2025, representing roughly 10% of the total securities accounts in the market.

According to the leadership, this growth stems from VPBankS’ strategic position within VPBank’s financial ecosystem and its partnership with SMBC (Japan). Building on this foundation, VPBankS targets becoming a leading securities firm, maintaining the highest growth rate over the next five years, and entering the top tier in terms of total assets and pre-tax profits by 2030.

In its development strategy, the investment banking segment is projected to capture around 20% market share by 2030, while margin lending aims for 15%—placing it among the market leaders. The brokerage segment has already doubled its market share to nearly 3% in the past nine months, with expectations to reach 10% by 2030 if current growth rates persist.

Leveraging its low-cost funding advantage and robust financial management, VPBankS aims for a ROE of approximately 20% during 2025–2030, positioning itself among the industry’s most efficient players.

The company’s revenue structure is well-balanced, with 28% from margin lending, 22% from investment banking, and 16% from proprietary trading. Moving forward, segment contributions will be adjusted, with a focus on increasing brokerage and investment banking revenues while maintaining leadership in margin lending—its current stronghold.

The Remarkable Story Behind VPBank’s Record-Breaking IPO

Our company stands apart from other securities firms by embracing a collaborative approach, ensuring we never walk the path alone. This unique strategy sets us apart in the industry, fostering a distinct advantage in the market.

VPBank CEO Nguyễn Đức Vinh: VPBankS IPO Strengthens Entire Ecosystem Foundation

According to VPBank CEO Nguyen Duc Vinh, the IPO of VPBankS is part of a strategic initiative to strengthen the capital foundation across the entire ecosystem, benefiting not only the securities company but also the entire group. This move will enable the conglomerate to continue pursuing its critical objectives.

From Employee to IPO Leader: The Journey of a Business Visionary

After 25 years of working in various roles across multiple companies, Mrs. Trần Thị Thu Phương decided to take a bold leap into entrepreneurship, embarking on a high-risk journey to revive paper mills teetering on the brink of bankruptcy. Reflecting on her path as a business owner, she candidly admits there were moments of overwhelming challenges that seemed insurmountable.