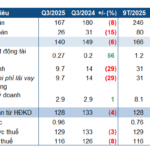

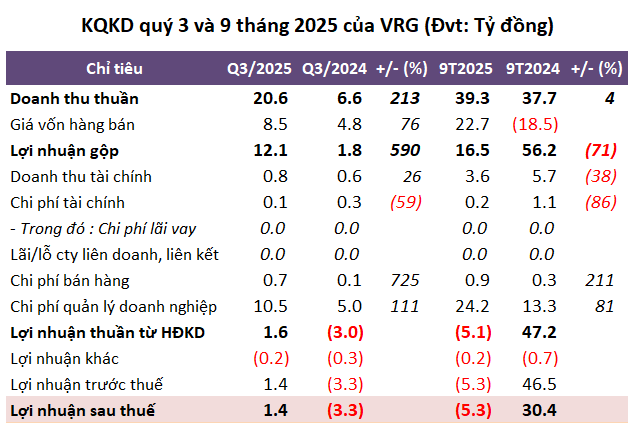

Vietnam Rubber Industry and Urban Development Corporation (UPCoM: VRG) has released its Q3 2025 business performance report, revealing a net revenue of nearly VND 21 billion, a threefold increase compared to the same period last year.

After deducting the cost of goods sold, the company’s gross profit surged to over VND 12 billion, a 6.9-fold increase, pushing the gross profit margin from 27% to 59%, the highest in the past year.

This remarkable growth is primarily driven by the signing of a new lease agreement for industrial zone land (IZ) with associated infrastructure, covering an area of approximately 5,348 m². VRG has recognized 90% of the contract value using the one-time revenue recognition method.

However, a sharp rise in financial, selling, and administrative expenses to VND 11 billion, more than double the previous year, resulted in a net profit of just over VND 1 billion. Despite this, the company has turned a profit for the first time in 2025, a significant improvement from the VND 3 billion loss recorded in the same quarter last year.

For the first nine months, VRG generated a net revenue of over VND 39 billion, a 4% increase; however, it still reported a loss of more than VND 5 billion, compared to a profit of over VND 30 billion in the same period last year. These results fall significantly short of the company’s 2025 targets of VND 358.5 billion in revenue and VND 133.5 billion in pre-tax profit.

Source: VietstockFinance

|

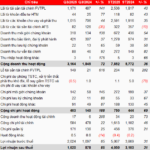

This year, VRG aims to attract investors to lease infrastructure at the Cong Hoa Industrial Zone, spanning nearly 13 hectares.

The Cong Hoa Industrial Zone, covering over 200 hectares in Chi Linh, formerly Hai Duong Province (now Hai Phong Province), is a VRG-led project with a total investment of over VND 834 billion. As of the end of 2024, the company has attracted 11 domestic and international investors, leasing a total area of 113 hectares.

Phase 2 of the Cong Hoa Industrial Zone, covering 190 hectares, was approved by the Prime Minister in 2023 and is currently under study. Chi Linh City is finalizing the functional zoning plan.

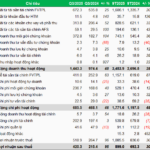

As of the end of Q3, VRG’s total assets stood at over VND 895 billion, a 13% decrease from the beginning of the year. Cash and cash equivalents amounted to more than VND 110 billion, down 13%. Work-in-progress construction costs totaled over VND 158 billion, a 52% decrease. Total liabilities were over VND 586 billion, a 6% decrease, with nearly half comprising long-term unearned revenue of approximately VND 262 billion, down 2% from the start of the year.

– 09:34 16/10/2025

Vietcap Securities Doubles Q3 Net Profit on Strong Brokerage and Lending Performance

Vietcap Securities Corporation (HOSE: VCI) has released its Q3/2025 financial report, revealing a remarkable net profit of over 420 billion VND, doubling the figure from the same period last year. This impressive growth is primarily driven by robust brokerage and lending activities. Consequently, the company’s cumulative profit for the first nine months of the year has surged to nearly 900 billion VND, marking a 30% increase year-on-year.

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.

Fertilizer Company Reports Staggering 1,000% Profit Surge in Q3 2025

The company attributes its revenue growth primarily to increased sales volume and a higher average selling price compared to the same period last year. Specifically, the average selling price for this period stood at 17.74 million VND per ton, marking a significant increase of 4.56 million VND per ton over the previous year.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.