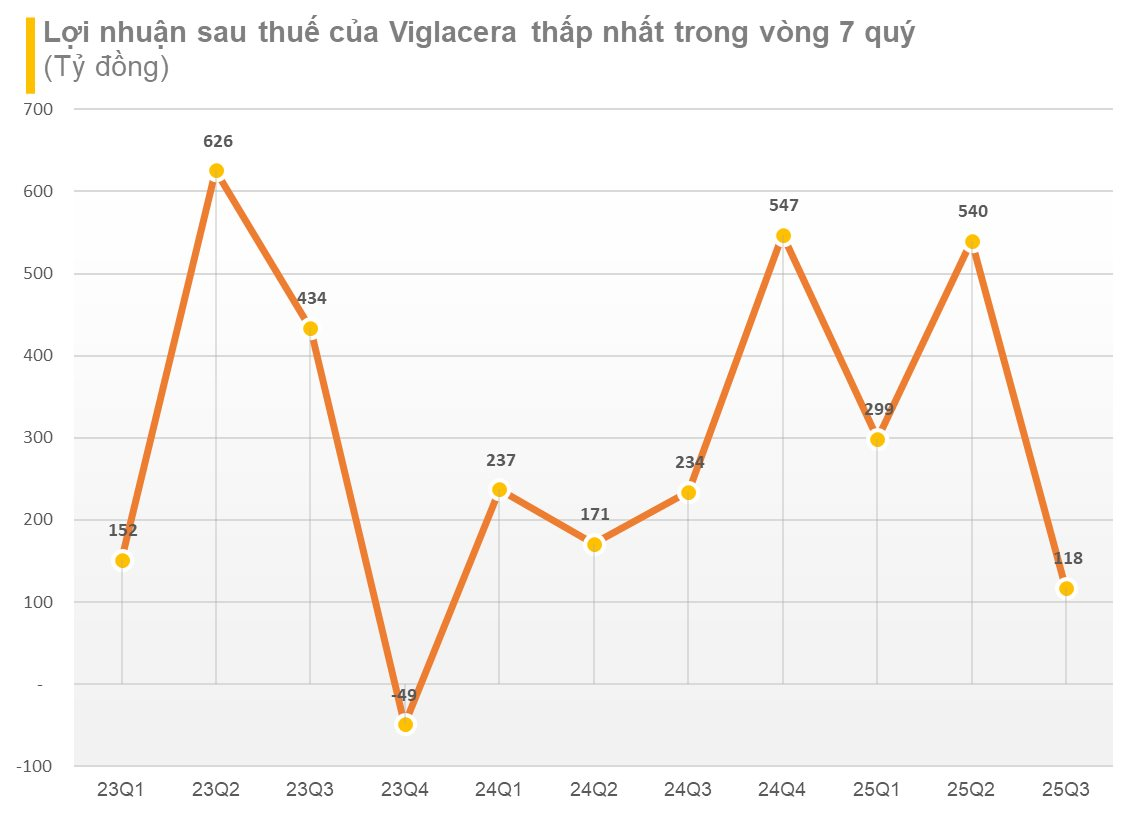

Viglacera Corporation (HoSE: VGC) has released its consolidated financial report for Q3/2025, revealing a 15% year-over-year increase in net revenue to VND 3,254 billion. However, a sharper rise in cost of goods sold led to a 21% decline in gross profit, which stood at VND 692 billion.

After deducting expenses, Viglacera’s consolidated net profit for Q3 reached VND 118 billion, a 50% drop compared to the VND 234 billion recorded in Q3/2024.

The company attributed this sudden decline to seasonal business fluctuations and adverse weather conditions, including major storms like Ragasa and Bualoi.

For the first nine months of the year, Viglacera’s net revenue reached VND 9,337 billion, a 14% increase year-over-year. Consolidated net profit for the period hit VND 956 billion, up 49% compared to the same period in 2024.

This growth was driven by improved profitability in industrial zone infrastructure leasing and building materials segments, both outperforming their previous year’s results.

Financial activities also contributed significantly, with financial revenue doubling from VND 52 billion to VND 104 billion. This included a VND 29 billion profit from the consolidation of business following an increased capital contribution in Vietnam Float Glass LLC.

As of September 2025, Viglacera’s total assets reached VND 25,624 billion, a modest 3% increase from the beginning of the year.

On the liabilities side, total payables stood at VND 14,751 billion, slightly down 1% from the start of the year. The company’s total financial debt was VND 4,921 billion.

Steel Company Surpasses 58% Profit Target in First Nine Months

Thuduc Steel JSC – VNSTEEL (UPCoM: TDS) has announced robust Q3 2025 financial results, driven by strengthened core operations and additional profit streams.