What is Hedging?

In finance, hedging is an investment strategy designed to reduce or eliminate the risk associated with another investment. It involves taking an offsetting position in a related security to minimize potential losses while potentially preserving gains. |

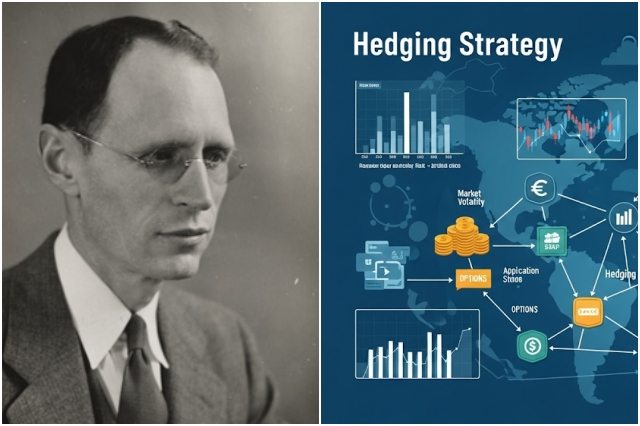

Who Pioneered Hedging Theory?

Holbrook Working is credited as the pioneer of hedging theory. He referred to this strategy as “speculating on the basis.” The basis represents the difference between the theoretical and actual prices of a security (or between the spot and futures prices). |

Basic Hedging Strategy

Typically, a hedger invests in a security believed to be undervalued in the market relative to its intrinsic value. Simultaneously, they engage in short selling of another security or securities. This dual approach allows the hedger to balance potential risks from price fluctuations, focusing solely on the performance of the purchased security rather than overall market movements. |

– 20:00 17/10/2025

Daily Investment in Vietnam’s Largest Bank: What’s the 16-Year Profit?

With a calculated investment of approximately 208 million VND over 16 years, the current value of the investment stands at an impressive 680 million VND.

What Sectors Will Be the Focus for Investors as the VN-Index is Predicted to Surpass 1,800 Points by Year-End?

“VCBS foresees a bullish trajectory for the VN-Index, targeting the lofty heights of 1,838 points in the final stretch of 2025. This optimistic outlook is underpinned by the latest market-wide EPS update, which stands at an impressive 18%.”