The Ho Chi Minh City Stock Exchange (HOSE) has announced the constituent stocks, free-float adjusted shares, free-float ratio, growth weight cap, and capitalization weight limit for the VN50 GROWTH Index, effective November 3, 2025.

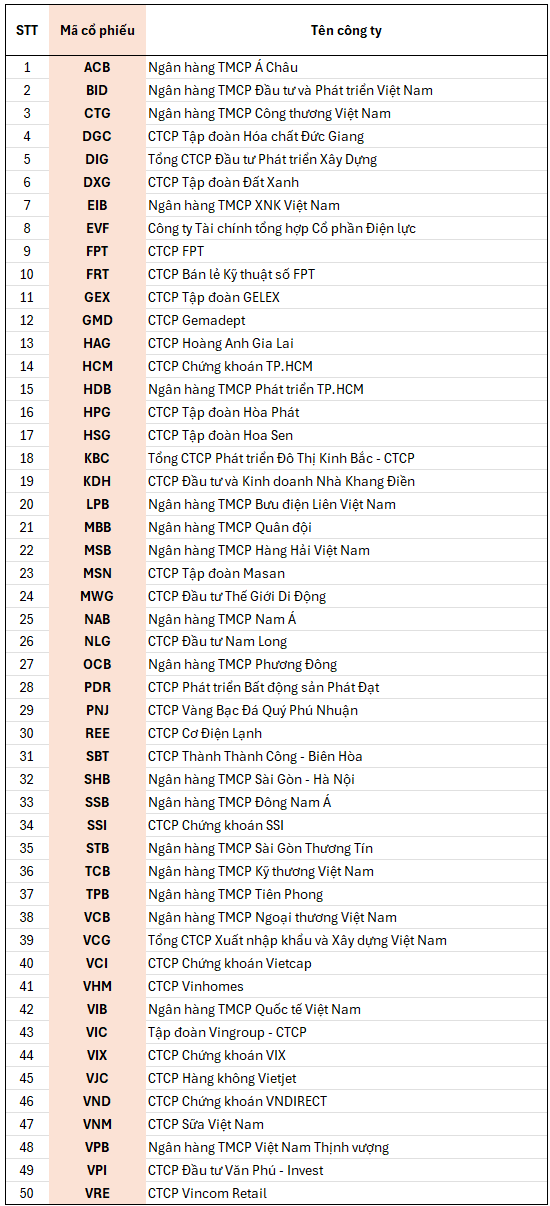

The index includes the following stocks: ACB, BID, CTG, DGC, DIG, DXG, EIB, EVF, FPT, FRT, GEX, GMD, HAG, HCM, HDB, HPG, HSG, KBC, KDH, LPB, MBB, MSB, MSN, MWG, NAB, NLG, OCB, PDR, PNJ, REE, SBT, SHB, SSB, SSI, STB, TCB, TPB, VCB, VCG, VCI, VHM, VIB, VIC, VIX, VJC, VND, VNM, VPB, VPI, VRE.

According to HOSE, the VN50 Growth Index is designed to track the performance of the 50 largest market capitalization stocks on HOSE, reflecting the business growth potential of listed companies.

The VN50 Growth Index is calculated using the free-float adjusted market capitalization method, with a maximum weight cap of 10% for individual stocks and 40% for stocks within the same sector.

A key feature of the VN50 Growth Index is the growth factor adjustment, which considers the historical EPS growth of companies. This factor prioritizes higher weights for companies with superior and sustainable growth, enabling investors to pursue a focused and effective growth strategy.

The index will officially launch on November 3, 2025.

AgriS Announces Adjusted Shareholder Meeting Schedule to Optimize 2025-2030 Strategy Implementation

On October 20, 2025, AgriS (HOSE: SBT) announced a change in the date of its Annual General Meeting of Shareholders for the fiscal year 2024-2025 (AGM), moving it from October 24, 2025, to December 2025.

Unveiling HOSE’s VNDIVIDEND Index: Tracking Vietnam’s Dividend-Paying Stocks

On October 6th, the Ho Chi Minh City Stock Exchange (HOSE) introduced the Vietnam Dividend Growth Index (VNDIVIDEND), a benchmark designed to track the performance of growth stocks with a consistent record of dividend payouts. The index prioritizes companies demonstrating a strong commitment to shareholder value through regular profit distribution.