For years, the Philippines and Indonesia have been the cornerstone markets for Vietnam’s rice exports, accounting for nearly half of the total export volume. However, recent policy shifts in both countries have sent shockwaves through Vietnam’s rice industry.

Since early September, the Philippines, Vietnam’s largest rice buyer, imposed a 60-day suspension on rice imports, with potential extensions until year-end. According to the General Department of Vietnam Customs, September saw a 93.3% drop in volume and a 92.6% decline in value of rice exports to the Philippines compared to August. Simultaneously, Indonesia, the second-largest market, tightened import quotas, leading to numerous contract delays or cancellations.

September’s total rice exports plummeted to 466,800 tons, valued at $232.38 million, a nearly 47% decrease from the previous month. Countless businesses faced cargo backlogs at ports, with an estimated 500,000 tons awaiting shipment.

Mr. Nguyễn Văn Đôn, Director of Việt Hưng Co., Ltd., noted that the Philippines’ import halt caused domestic rice prices to plummet. Purchased goods and signed contracts faced postponement requests, freezing capital and inflating storage and transportation costs.

The situation worsened due to prolonged VAT refund procedures, further immobilizing corporate cash flow.

In response to these major markets’ reduced imports, Vietnam’s rice export prices significantly dropped. The Vietnam Food Association (VFA) urged businesses to remain calm, avoid price wars, and proactively seek new avenues.

Many rice exporters are exploring alternative markets

Mr. Phan Văn Có, Marketing Director at Vrice, shared that amidst challenges in traditional markets, companies are venturing into Africa, despite higher shipping costs and complex payment processes, due to lower policy risks.

However, Mr. Có emphasized that not all businesses can easily “go the distance.” African markets require G2G contracts, substantial capital, legal expertise, and robust logistics networks. This arena favors companies with long-term vision and willingness to invest strategically rather than pursuing quick gains.

Alongside market diversification, many firms are focusing on premium segments—fragrant rice, specialty rice, and organic rice. Varieties like ST24, ST25, OM18, and Jasmine are being promoted in Japan, the EU, and South Korea—smaller but high-value and stable markets.

“We must shift from ‘more rice’ to ‘better rice.’ Premium rice demands technical investment and traceability, but once integrated into international supermarket systems, price pressures diminish,” Mr. Có added.

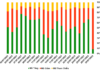

Statistics from the Vietnam Food Association (VFA) reveal that rice exports to African markets have grown by two or three digits. For instance, in the first eight months of this year, rice exports to Ghana reached 662,000 tons, valued at $373 million, up 95% in volume and 59% in value compared to the same period in 2024, making it Vietnam’s largest rice import market.

During the same period, rice exports to Ivory Coast totaled 754,000 tons, valued at $349 million, increasing 156% in volume and 96% in value. Markets like Nigeria and Senegal are also expanding.

Mr. Đỗ Hà Nam, Chairman of VFA, stated that no official documents extending the Philippines’ ban have been issued. However, this serves as a clear warning: Vietnamese businesses cannot remain dependent on a few major markets.

Mr. Nam also urged the Ministry of Finance to expedite tax refunds, extend credit for companies holding inventory, broaden trade promotions through diplomatic channels—especially in Africa and the Middle East—and collaborate with the Philippines to clear pre-ban orders.

“This crisis is a true test for Vietnam’s rice industry. We cannot rely on the policy fortunes of other nations. It’s time to build internal strength—from grain quality and production chains to national branding,” Mr. Nam stressed.

The World’s Largest Rice Importer to Halt Imports by April 2026: Where is Vietnamese Rice Pivoting Next?

While the Philippine market is expected to halt rice imports until early 2026, Vietnamese rice continues to receive positive news from other markets.

A Grainy Concern: The Ongoing Challenge of Rice Exports

The Vietnamese rice industry faces a challenging period with prices at a low ebb. The primary culprit is the temporary cessation of purchases by the Philippines for the next two months, which has significantly impacted the output and sales of Vietnamese rice.