On October 15th, under the supervision of the Ho Chi Minh City People’s Procuracy and witnessed by singer Lương Bằng Quang, authorities opened a safe belonging to Võ Thị Ngọc Ngân (alias Ngân 98), a suspect in an ongoing case.

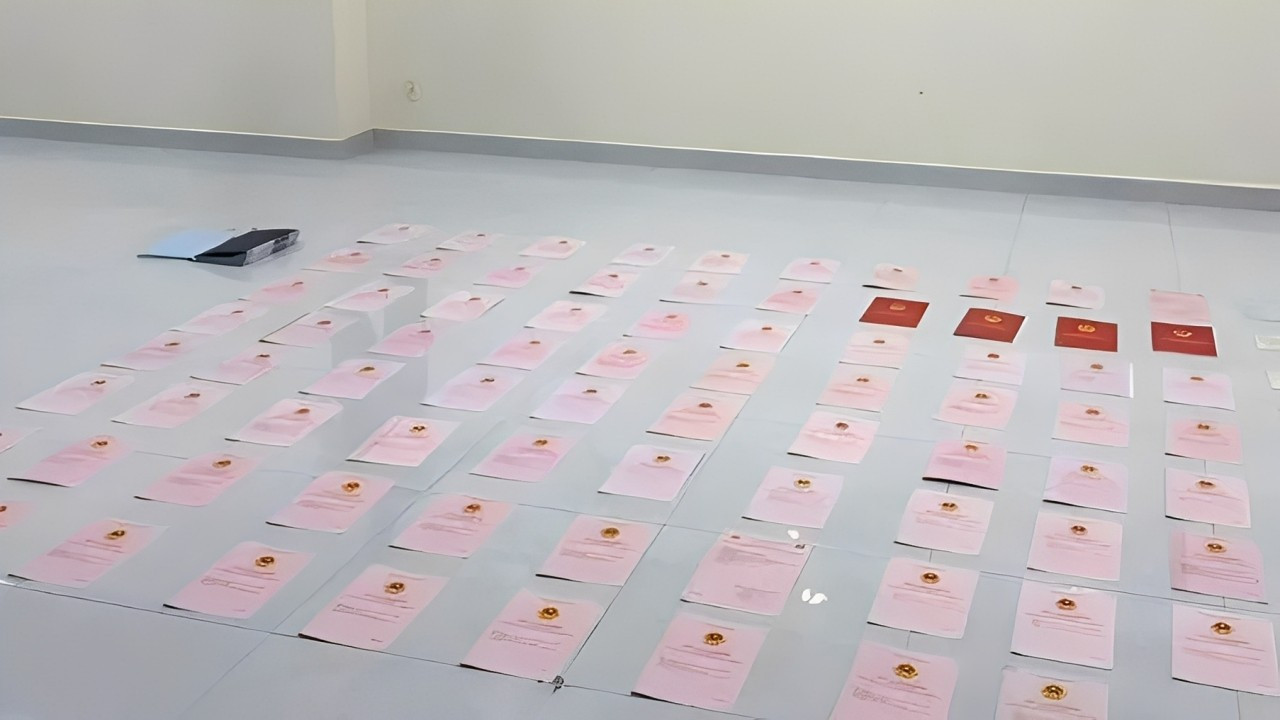

Inside the safe, police discovered 80 land use right certificates, $8,000 in cash, and four savings books totaling approximately VND 3.2 billion. Investigators also seized two luxury cars for further verification.

The revelation that Ngân 98 possesses 80 land certificates, substantial cash, and savings worth VND 3.2 billion has sparked public interest. Many are questioning how authorities will handle these assets following her arrest on charges of producing and trading counterfeit food products.

Can Ngân 98 Legally Own 80 Land Certificates?

In an interview with Tiền Phong, attorney Nguyễn Quốc Cường (Ho Chi Minh City Bar Association, founder of Inlaw Vietnam) addressed legal concerns surrounding the case. He clarified that Vietnamese law does not limit the number of land certificates an individual can own. A person may legally hold multiple land certificates, provided the ownership and use of the land comply with regulations.

The key requirement is that the owner must prove the lawful origin of the assets. If all transactions are conducted according to regulations, with clear documentation and no violations of land use limits or tax obligations, owning multiple properties is not illegal.

However, given the suspect’s ongoing criminal investigation, all assets must be thoroughly reviewed to determine if they were acquired through unlawful means.

80 land use certificates found in Ngân 98’s safe.

Attorney Cường emphasized that tax authorities and investigators can demand proof of the funds used to purchase real estate, especially for high-value assets.

Under the Tax Administration Law, tax authorities have the right to audit income declarations and tax payments. If discrepancies are found, they may request explanations and supporting documents.

Additionally, the Anti-Money Laundering Law mandates scrutiny of large real estate transactions. If suspicions arise, investigators can demand proof of funds to rule out money laundering, tax evasion, or the legitimization of illicit assets.

Regarding the possibility of Ngân 98 using proxies to hold land certificates, attorney Cường stated that Vietnamese law does not recognize proxy ownership of land rights. The individual named on the certificate is the sole legal owner and has full authority over the asset.

According to Article 124 of the Civil Code, proxy ownership arrangements are considered fictitious transactions and may be declared void in disputes. If investigators determine that the funds used to purchase the land originated from criminal activities, proxy ownership would be treated as an attempt to conceal illicit assets and could lead to criminal charges.

Legal experts assert that if assets are proven to be derived from illegal sources, investigators may apply measures such as freezing, seizing, or confiscating them.

Under the Criminal Procedure Code, freezing applies to bank account funds, while seizure applies to fixed assets like houses, land, vehicles, and stocks. Confiscation occurs only after a final criminal judgment confirms the assets were obtained through criminal means. These measures prevent asset dissipation and ensure enforcement of judgments.

Regarding whether assets purchased before the investigation retain ownership rights, attorney Cường clarified that the law focuses on the origin of the funds, not the timing of the purchase.

“If assets are proven to be derived from illegal sources, they may be seized, frozen, or confiscated, regardless of when they were acquired. Conversely, if the suspect can prove lawful ownership, their rights will be protected, though assets may be temporarily seized to secure penalties or compensation,” he explained.

Attorney Cường noted that individuals owning multiple properties are obligated to declare and pay taxes such as personal income tax, registration fees, and real estate transfer taxes. Failure to declare accurately or conceal income may result in tax evasion charges under Article 200 of the Penal Code.

He also pointed out that in cases of co-owned or jointly funded properties, only the portion belonging to the convicted individual may be seized. However, to maintain the status quo, authorities may seize the entire property and later determine each party’s share. Co-owners must provide contribution agreements, transfer records, or legal documents to protect their interests.

Penalties for Producing and Trading Counterfeit Food Products

In addition to asset-related issues, Võ Thị Ngọc Ngân faces charges of “Producing and Trading Counterfeit Food Products” under Article 193 of the Penal Code. This offense carries severe penalties, including 15 to 20 years’ imprisonment or life imprisonment if illegal profits exceed VND 1.5 billion or cause significant harm.

Attorney Cường explained that investigators examine all elements of the offense, including counterfeit production, brand impersonation, and harm to consumers’ health or finances.

“If the acts were organized, repeated, or yielded substantial illegal profits, these factors will aggravate the penalties, potentially leading to the maximum sentence,” he analyzed.

Ngân 98’s confession at the police station.

Beyond imprisonment, offenders may face fines, professional bans, and confiscation of counterfeit goods, tools, and profits. Attorney Cường stressed that the law strictly addresses counterfeit food production due to its direct impact on public health and safety.

He noted that investigations often trace financial flows to identify illicit profits. Authorities may scrutinize all financial transactions, bank accounts, contracts, and assets linked to the suspect, even those acquired before the case was initiated.

“The law does not limit the timeframe for tracing funds. The scope and duration depend on the case’s nature and scale to ensure recovery of illegal assets,” he stated.

Under Article 128 of the Criminal Procedure Code, lawfully acquired assets are not subject to confiscation. However, attorney Cường cautioned that even legal assets may be temporarily seized to secure civil obligations such as compensation or fines. Once obligations are fulfilled, the remaining legal assets are returned to the convicted individual.

Attorney Nguyễn Quốc Cường concluded that all of Ngân 98’s assets and funds will undergo rigorous scrutiny during the investigation. “If proven to be derived from illegal sources, freezing, seizure, and confiscation measures will apply. Conversely, legal assets will be protected under the law,” he stated.

He emphasized that Vietnamese law safeguards citizens’ lawful assets but does not tolerate attempts to conceal, transfer, or legitimize illicit assets. “Transparency in asset origins is crucial for protecting individuals’ legal rights,” attorney Cường affirmed.

Unexpected Twist in the Case of Ngân 98’s Arrest: Who is the Real Owner of the Involved Company?

Unveiling a hidden empire, investigations reveal that Ngân masterfully orchestrated the establishment and operations of ZuBu Company (registered under her mother’s name) and ZuBu Shop (registered under another individual’s name). Despite the nominal leadership, Ngân wielded absolute control over every facet—from strategic direction to financial management and profit distribution.

Hundreds of Ho Chi Minh City Apartments to Receive Land-Use Certificates After Additional Land Fees Paid

The Golden King project, featuring Sky 9 apartments, is finally set to receive property ownership certificates after nearly a decade of anticipation. The Ho Chi Minh City Task Force on Resolving Issues Related to Land Use Rights Certificates for Commercial Housing Projects has approved the issuance, marking a significant milestone for residents and investors alike.