Recently, at the PTSC Supply Base port, PTSC Operation and Installation Company (POS) celebrated the safe arrival of the PTSC GUARDIAN barge after successfully completing two critical offshore campaigns: LDV Pipelines and DUA 3P SCM replacement.

Following its Drydock period from May to July 2025, the PTSC GUARDIAN was deployed for these two campaigns. The LDV Pipelines project, funded by Murphy Cuu Long Bac Oil Co. Ltd (MCB), was executed at the LDV field in Block 15-1/05 (Cuu Long Basin). Initially scheduled from August 16 to October 6, 2025, the campaign was completed ahead of time despite challenging weather conditions due to prolonged storms. POS’s efficient management and skilled workforce ensured the project’s early completion, wrapping up on October 1, 2025, with over 200 personnel involved.

Operations aboard the PTSC GUARDIAN.

Following the success of the LDV Pipelines project, the PTSC GUARDIAN was assigned to the DUA 3P SCM replacement project for EnQuest at the Dua field in Block 12W (Nam Con Son Basin). Executed from October 1 to 6, 2025, this fast-track project involved over 170 personnel.

The project’s tight schedule demanded high efficiency, and through seamless collaboration between EnQuest and POS, all tasks were completed safely and ahead of schedule.

Both projects were highly valued by clients and delivered significant benefits to both POS and its partners, showcasing POS’s commitment to excellence.

POS welcomes the PTSC GUARDIAN to port.

PTSC Operation and Installation Company (POS) is a subsidiary of PTSC Group, established from the restructuring of PTSC Production Services. Its core services include hook-up, commissioning, operation, and maintenance for oil and gas and industrial projects.

In the first half of 2025, POS reported revenue of 905 billion VND, a 9% decrease year-over-year, with after-tax profit at 37 billion VND, down 30%. This decline was attributed to reduced revenue and lower warranty provision reversals compared to the previous year. The company achieved approximately 36% of its annual revenue and profit targets.

On September 29, POS set the record date for a 20:3 stock dividend, equivalent to a 15% bonus. The company plans to issue 6 million new shares, increasing its charter capital from 400 billion VND to 460 billion VND. This marks POS’s first capital increase since 2012, funded by the development investment fund as of December 31, 2024, per audited financial reports.

This stock dividend replaces the cash dividends distributed in previous years. Historically, POS maintained cash dividends ranging from 7% to 25%, with the most recent payout in 2023 at 10%.

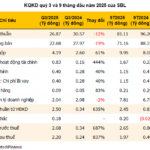

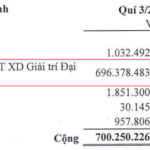

Record-Breaking Q3 for HDC: Nearly 550 Billion VND Profit After Selling Dai Duong Vung Tau Company

Despite a sharp decline in real estate revenue and shrinking profit margins, Hodeco achieved record-high profits, driven by a nearly 700 billion VND gain from the sale of its stake in Dai Duong Vung Tau Company.

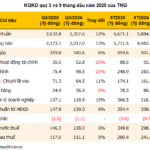

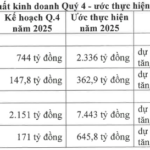

Phú Tài Aims to Surpass 2025 Profit Target by Over 35%

The Board of Directors of Phu Tai Corporation (HOSE: PTB) has approved the estimated consolidated business results for the first nine months of 2025, reporting a revenue of VND 5,292 billion and pre-tax profit of nearly VND 475 billion. This represents a 15% increase in revenue and a 36% surge in pre-tax profit compared to the same period last year.

VPD Boosts 2025 Profit Target by 59%

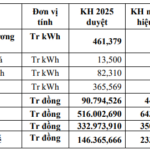

On October 9th, the Board of Directors of Vietnam Power Development Joint Stock Company (HOSE: VPD) approved adjustments to its 2025 business plan, increasing its commercial electricity output target from 461 million kWh to nearly 579 million kWh, representing a growth of over 25% compared to the previous target.