From the opening session, shares of Masan Group (ticker: MSN), chaired by Mr. Nguyen Dang Quang, surged dramatically, hitting the upper limit and even showing “no sellers” available. As of 10 AM on October 16th, the stock price climbed to 88,200 VND per share, with trading volume spiking to over 13 million units.

According to UBS Investment Bank, SK Invest VINA II Pte. Ltd is offloading approximately 42.6 million MSN shares (valued at around $127 million) via a block trade agreement.

The transaction was executed at a price range of 78,000–79,300 VND per share, reflecting a 3.9–5.5% discount compared to MSN’s closing price of 82,500 VND on October 15th. The total deal value is estimated at $127 million.

Registration, pricing, and allocation will take place from October 15th to 16th, 2025, with settlement scheduled for October 20th, 2025. Post-transaction, SK will retain only 1,000 shares, effectively exiting its position in Masan.

SK Group, South Korea’s second-largest conglomerate with over 200 subsidiaries, has invested more than $3.5 billion in Vietnam to date.

SK Group became a major shareholder of Masan in 2018 after investing 530 billion won (approximately $460 million) for a 9.5% stake and securing a put option exercisable in 2024.

In early September 2024, both SK and Masan agreed to extend SK’s put option on MSN shares by up to five years. Concurrently, Ms. Chae Rhan Chun, representing SK Investment Vina I, resigned from Masan’s Board of Directors.

SK’s divestment from Masan was anticipated, as indicated in its 2024 consolidated financial report, where the investment was reclassified as “assets held for sale.”

While SK held Masan shares at the end of 2024, the investment was earmarked for potential divestment rather than long-term retention as an affiliate.

Masan Group reported after-tax profits of 1,619 billion VND in Q2 2025 and 2,602 billion VND in the first half, surpassing 50% of its annual target.

Growth was driven by contributions from WinCommerce (WCM) and Masan MEATLife (MML), along with gains from the divestment of H.C. Starck (HCS). Conversely, Masan Consumer (MCH) faced declines due to disruptions in traditional sales channels (GT) following new tax regulations for individual businesses.

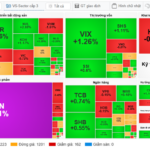

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.

Masan Surges Past 91,000 VND/Share, Hits Near 3-Year High

Shares of Masan Group Corporation (HOSE: MSN), chaired by billionaire Nguyen Dang Quang, surged again in the morning session on October 17th, reaching 91,100 VND per share—the highest level since February 2023. This follows an unexpected ceiling-hit on October 16th, driven by a remarkable 44 million share block trade, creating a significant ripple effect across the market.

Unleashing a New Wave: Domestic Consumption and Market Upgrades Drive Momentum

The consumer and retail stock sector is entering its most anticipated phase in years, fueled by a convergence of robust corporate growth and positive international capital flows. A resurgence in domestic purchasing power, coupled with the expansion of modern retail channels, is driving significant profit improvements for leading companies in the third quarter of 2025.

Masan Forecasts 90% Profit Plan Completion for the Year

Consumer stimulus policies, particularly the VAT reduction to 8% for essential goods, have provided a significant boost to the consumer and retail sectors. In this landscape, Masan (HOSE: MSN) stands out, having projected the achievement of 90% of its 2025 profit plan within just nine months, reinforcing confidence in the industry’s growth prospects.