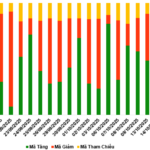

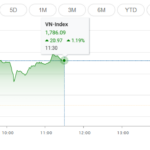

The stock market opened the final session of the week on October 17th in the green, but selling pressure from large-cap stocks dragged the VN Index down to the 1,730 mark. By the close, the VN-Index had fallen by 35.66 points, or 2.02%, ending at 1,731.19 points. Foreign investors turned net sellers, with a total value of 2,107 billion VND.

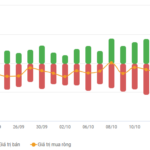

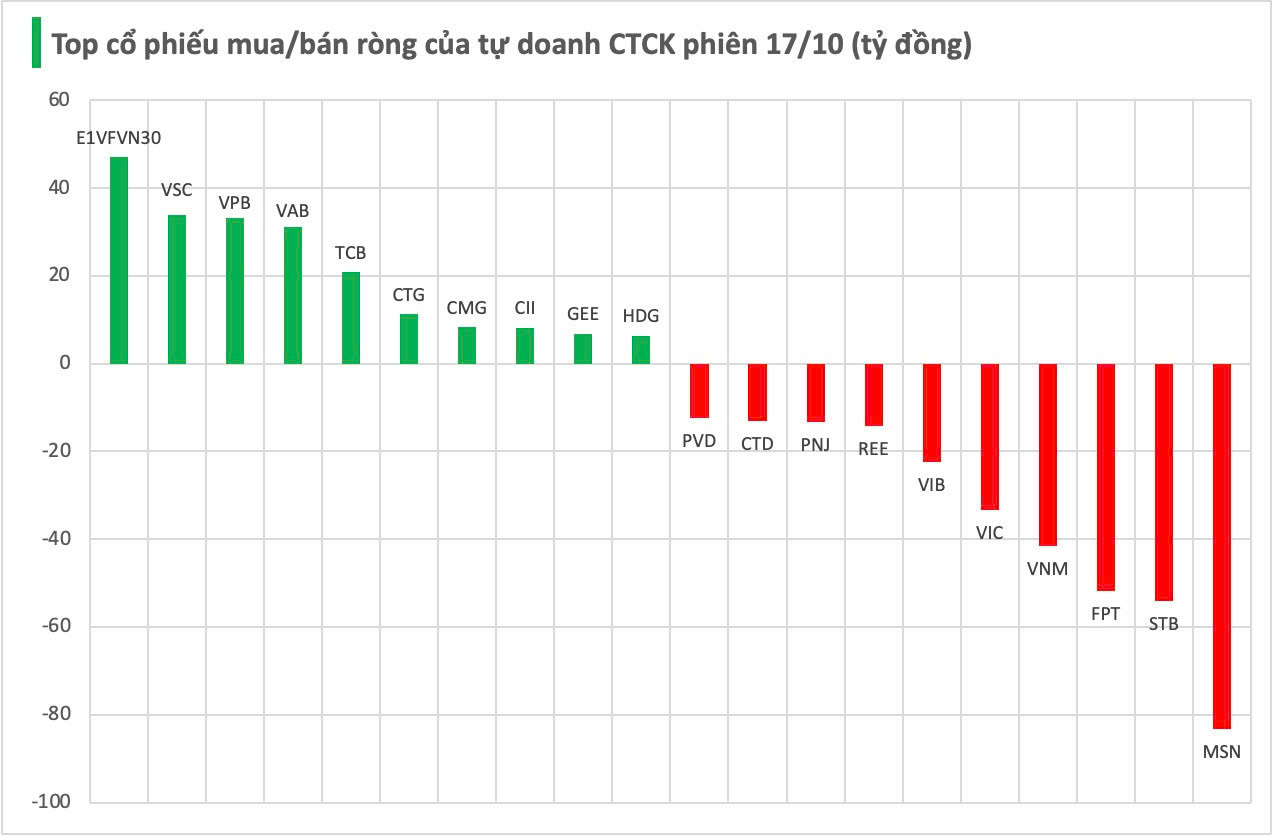

Securities firms’ proprietary trading desks net sold 243 billion VND on HOSE.

Specifically, securities firms were the heaviest net sellers of MSN, with a value of -83 billion VND, followed by STB (-54 billion), FPT (-52 billion), VNM (-41 billion), and VIC (-33 billion VND). Other stocks also saw significant net selling, including VIB (-22 billion), REE (-14 billion), PNJ (-13 billion), CTD (-13 billion), and PVD (-12 billion VND).

On the flip side, E1VFVN30 was the most heavily bought stock, with a net purchase value of 47 billion VND. This was followed by VSC (34 billion), VPB (33 billion), VAB (31 billion), TCB (21 billion), CTG (11 billion), CMG (8 billion), CII (8 billion), GEE (7 billion), and HDG (6 billion VND).

October 16, 2025: Foreign Investors Continue Net Selling in Warrant Market

At the close of trading on October 15, 2025, the market saw 105 stocks rise, 126 fall, and 33 remain unchanged. Foreign investors continued their net selling streak, offloading a total of 2.6 million CW.

Market Pulse 14/10: Blue-Chip Stocks Bolster Against Intense Selling Pressure

In stark contrast to the morning’s optimism, the VN-Index closed in the red as selling pressure dominated towards the end of the session. The HOSE index settled at 1,761.06 points, marking a 4-point decline. Similarly, the HNX-Index dipped slightly below the reference level, shedding 0.02 points to close at 275.33.

Vietstock Daily October 15, 2025: Momentum Slows

The VN-Index reversed its course, closing lower and snapping a four-session winning streak. With the Stochastic Oscillator potentially signaling a sell-off from overbought territory, the previously breached September 2025 peak (around 1,700–1,711 points) is poised to act as critical support should the correction extend in upcoming sessions.

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

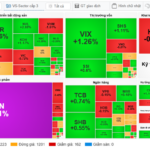

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.