I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

Futures contracts surged during the trading session on October 10, 2025. Specifically, 41I1FA000 (I1FA000) rose by 2.03%, closing at 1,975.9 points; 41I1FB000 (I1FB000) increased by 1.96%, reaching 1,968 points; the VN30F2512 (F2512) contract climbed 1.82%, ending at 1,965 points; and 41I1G3000 (I1G3000) gained 1.57%, closing at 1,936.2 points. The underlying index, VN30-Index, concluded the session at 1,980.57 points.

Additionally, VN100 futures contracts also experienced widespread gains on October 10, 2025. Notably, 41I2FA000 (I2FA000) advanced by 1.54%, closing at 1,909 points; 41I2FB000 (I2FB000) rose by 1.38%, reaching 1,908.5 points; 41I2FC000 (I2FC000) increased by 0.56%, ending at 1,895 points; and 41I2G3000 (I2G3000) gained 1.55%, closing at 1,920.2 points. The underlying VN100-Index finished the session at 1,911.55 points.

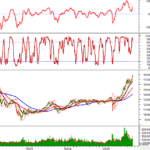

During the trading week from October 6 to 10, 2025, the 41I1FA000 contract, with early advantages favoring the Long position, saw a strong rally in the initial session. As the week progressed, the contract entered a narrow range, tempering the earlier gains, though buyers maintained a slight edge. However, buyers regained dominance in the final session, propelling I1FA000 to a significant weekly gain of 119 points, closing at its peak of 1,975.9 points.

Intraday Chart of 41I1FA000 from October 6 to 10, 2025

Source: https://stockchart.vietstock.vn/

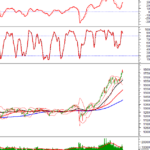

At the close, the basis of the 41I1FA000 contract widened compared to the previous session, reaching -4.67 points, indicating increased investor pessimism.

Fluctuations of 41I1FA000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

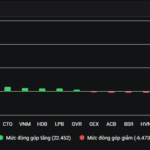

Trading volume and value in the derivatives market decreased by 10.18% and 9.13%, respectively, compared to the session on October 9, 2025. For the week, trading volume and value rose by 8.86% and 12.56%, respectively, compared to the previous week.

Foreign investors resumed net selling, with a total net sell volume of 738 contracts on October 10, 2025. For the week, foreign investors net sold a total of 247 contracts.

Weekly Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of October 13, 2025, the fair price range for actively traded futures contracts is as follows:

|

Summary Table of Derivatives Pricing for VN30-Index and VN100-Index

Source: VietstockFinance

|

Note: Opportunity costs in the pricing model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

I.3. Technical Analysis of VN30-Index

On October 10, 2025, the VN30-Index surged, accompanied by a White Marubozu candlestick pattern and trading volume exceeding the 20-session average, indicating robust investor activity.

The MACD indicator continued its upward trend after generating a buy signal, while the index remained near the upper band of the Bollinger Bands, suggesting sustained medium-term optimism.

However, the Stochastic Oscillator entered overbought territory. If this indicator triggers a sell signal soon, short-term correction risks may reemerge.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of October 13, 2025, the fair price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Pricing

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

According to the above pricing, the GB05F2512, 41B5G3000, and 41B5G6000 contracts are currently attractively priced. Investors should focus on and consider buying these futures contracts, as they present excellent value in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 October 11, 2025

Derivatives Market on October 16, 2025: Lingering Uncertainty Ahead of Expiry Session

On October 15, 2025, most VN30 and VN100 futures contracts closed higher. Despite the VN30-Index’s slight decline, a small-bodied candlestick pattern emerged alongside trading volume surpassing the 20-session average, indicating lingering investor hesitation.