Recently, Construction Investment and Development Joint Stock Corporation (DIC Corp, Stock Code: DIG, HoSE) submitted a report detailing the utilization of capital raised from its 2021 private placement of shares.

On October 7, 2021, DIC Corp successfully issued 75 million shares to existing shareholders at a price of VND 20,000 per share. The total proceeds from this offering amounted to VND 1,500 billion. After deducting expenses of VND 143 million, the company netted approximately VND 1,499.9 billion.

According to the issuance plan, DIC Corp will allocate the funds to invest in the New Urban Area Project in Bắc Vũng Tàu, Ward 12, Bà Rịa – Vũng Tàu Province (now Phước Thắng Ward, Ho Chi Minh City). Additionally, the funds will be used to settle payments to Tan Long Investment and Development Joint Stock Company.

Illustrative image

As of October 7, 2025, the company has disbursed nearly VND 1,422.8 billion, leaving approximately VND 77.1 billion undisbursed.

In a separate development, the Ho Chi Minh City Stock Exchange (HoSE) recently announced that October 10, 2025, will be the final registration date for shareholders to exercise their rights to purchase newly issued shares from DIC Corp.

DIC Corp is offering 150 million shares to existing shareholders. The rights issue ratio is 1,000:232, meaning shareholders holding 1,000 shares can purchase an additional 232 new shares. The newly issued shares will be freely tradable.

The registration period for purchases will run from October 20, 2025, to November 14, 2025. The transfer of purchase rights will be allowed from October 20, 2025, to October 31, 2025.

The issuance price is set at VND 12,000 per share, with an expected maximum capital raise of VND 1,800 billion. Of this amount, VND 600 billion will be allocated to supplement investment in the Cap Saint Jacques Complex Project (CSJ) – Phase 3 (Block C4).

Another VND 600 billion will be used to supplement investment in the Vị Thanh Commercial Residential Area Project, and the remaining VND 600 billion will be used to repay the DIG12301 bond. Disbursement is scheduled from Q4/2025 to 2026.

This offering replaces DIC Corp’s previous plan to issue 200 million shares to the public, as per the Certificate of Registration for Public Offering of Shares No. 231/GCN-UBCK dated December 12, 2024, issued by the State Securities Commission.

“Shark” with a $600 Million Appetite: Potential Buying Spree for This Stock in October’s Index Rebalancing

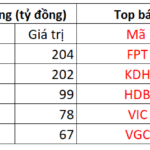

In contrast, a bank code witnessed the highest sell-off, with over 295 billion VND, equivalent to nearly 7.6 million shares, being offloaded.

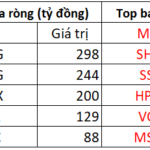

October 16th Session: Foreign Investors Net Buy Over VND 500 Billion on HOSE – Which Stocks Were the Most Accumulated?

Foreign investors’ net buying surge of over 404 billion VND across the market has become a significant highlight in today’s trading session.