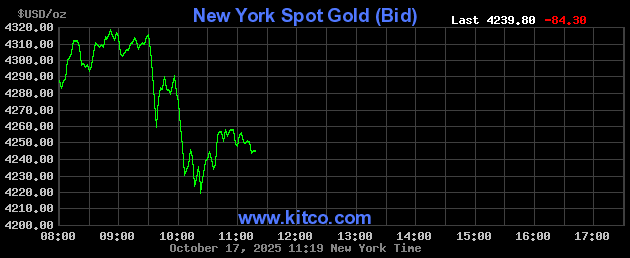

As of 10:20 PM, gold prices continued their sharp decline to $4,234 per ounce. Earlier, spot gold prices plummeted to $4,219 per ounce, marking a $160 drop from the peak reached earlier today.

———————

On the evening of October 17th (Vietnam time), spot gold prices stood at $4,309 per ounce, down approximately $76 from the record high of $4,378.69 set earlier in the day.

Despite the correction, gold remains at historically high levels, with December futures on COMEX edging up 0.4% to $4,320.70 per ounce.

Global gold price movements over the past 24 hours. (Source: Kitco News)

According to Reuters, this marks the first pullback after eight consecutive sessions of gains, during which the precious metal repeatedly set new records on expectations of a Federal Reserve rate cut and safe-haven demand. For the week, gold prices surged approximately 7.2%, marking the strongest weekly gain since the 2008 financial crisis.

Gold’s rally paused after U.S. President Donald Trump stated that the proposed 100% tariff on Chinese goods “cannot be sustained long-term.” This comment eased concerns over U.S.-China trade tensions, boosting Wall Street stocks and prompting investors to take profits in gold.

Fawad Razaqzada, an analyst at City Index and FOREX.com, commented: “Equity markets rallied following Trump’s remarks, exerting short-term pressure on gold prices. However, the long-term outlook for the precious metal remains positive.”

Analysts believe gold continues to benefit from a low-interest-rate environment and investor risk aversion. Federal Reserve Governor Christopher Waller recently expressed support for another rate cut, while markets anticipate two cuts at the October and December meetings.

Since the start of the year, gold prices have surged over 64%, driven by geopolitical tensions, de-dollarization trends, central bank purchases, and strong inflows into gold ETFs.

Michael Haigh, Global Head of Commodities Research at Société Générale, noted: “Persistent ETF inflows are pushing gold prices higher than expected.”

HSBC has raised its 2025 average gold price forecast by $100 to $3,455 per ounce and predicts gold could reach $5,000 per ounce by 2026 if global risks continue to escalate.

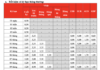

Domestically, as of the evening of October 17th, gold prices remained elevated. Bao Tin Minh Chau’s gold rings were priced at 156–159 million VND per tael, Bao Tin Manh Hai at 155.5–156 million VND per tael, and PNJ at 150.6–152.1 million VND per tael. Other major brands like SJC and DOJI saw slight adjustments, trading between 150–153 million VND per tael.

For gold bars, Bao Tin Minh Chau listed prices at 152.5–153 million VND per tael, while PNJ, SJC, and DOJI maintained levels of 151.5–153 million VND per tael.

Gold ETFs to Be Listed on Stock Exchanges as Government Expands Gold Investment Options

The State Securities Commission (SSC) is actively exploring the introduction of gold-based derivative products, specifically gold ETFs, to Vietnam’s stock market.

Gold Prices Surge Past 160 Million VND/Tael: Investors Lock in Profits, Shift Focus to Coastal Real Estate for Emerging Opportunities

As domestic gold prices surge past 160 million VND per tael, Vietnam’s asset market is witnessing a pronounced shift in capital flows, moving away from traditional safe-haven channels toward tangible assets with higher profit potential. Coastal land plots are poised to emerge as the most attractive investment destination in Q4/2025 and Q1/2026.

Gold Surges Past $152 Million per Tael: Two-Day Purchase Limit Sparks Silver Rush

On the morning of October 17th, gold prices surged dramatically, surpassing 152 million VND per tael. Despite stores temporarily halting sales due to stock depletion, eager buyers continued to queue up early, undeterred by the shortage.