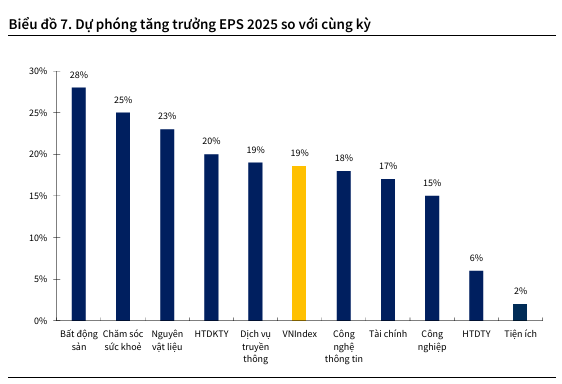

According to KBSV Research, the forecast region is set at 1,814 points, representing an estimated 18.6% increase compared to the same period last year in the average EPS of listed companies on the HOSE market. This growth rate surpasses the previous forecast of 15%, reflecting a more optimistic outlook on the impact of the government’s economic stimulus policies, while tariff concerns have proven less severe than initially feared.

Source: 4Q2025 Market Outlook Report by KBSV Research

|

Simultaneously, the target P/E ratio stands at 16.7 times (calculated using Bloomberg’s methodology), equivalent to the average P/E over the past five years and slightly above the current 16.3 times.

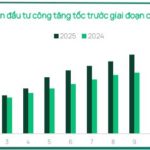

KBSV Research believes this valuation is reasonable for Vietnam’s market, given the supportive factors in play. These include a sustained low-interest-rate environment, robust economic growth aiding business expansion, increased money supply (M2) corresponding to high credit growth, accelerated public investment disbursement, and market upgrades.

Source: 4Q2025 Market Outlook Report by KBSV Research

|

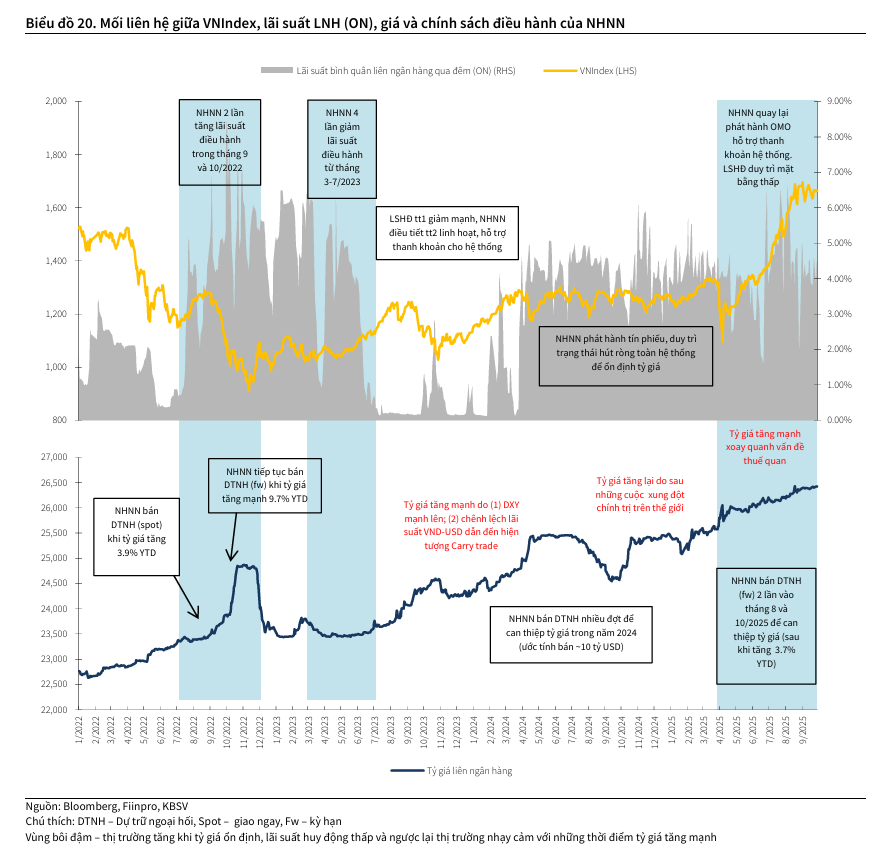

Meanwhile, two notable risks for the market in the fourth quarter are exchange rates and “carry-over” taxes.

In the baseline scenario, the most intense phase of exchange rate pressure has passed. While rate pressures may resurface at times when the Dollar Index rises again, they are expected to gradually ease toward year-end.

On the other hand, the risk of “carry-over” taxes has been deferred to 2026 instead of late this year. However, should this risk re-emerge in the fourth quarter, with a 40% tax applied to Vietnamese goods not meeting high localization rates (60-70%), the impact on the macroeconomy and stock market would be more severe.

KBSV outlines three investment themes: market upgrades benefiting the securities sector; public investment driving infrastructure, construction materials, and electrical installation groups; and legal clarifications opening opportunities for real estate and construction sectors. These themes serve as critical drivers supporting the overall stock market trend and particularly benefiting directly impacted sectors.

– 18:00 18/10/2025

Foreign Block Net Sells Over 2,000 Billion as VN-Index Plunges Nearly 36 Points: Which Stocks Were Hit Hardest?

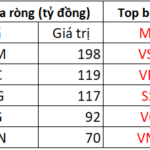

In the afternoon trading session, VHM stocks emerged as the most heavily net-bought securities across the entire market, with a total value of approximately 198 billion VND.