I. VIETNAMESE STOCK MARKET OVERVIEW FOR THE WEEK OF OCTOBER 13-17, 2025

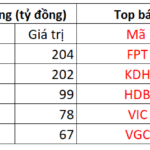

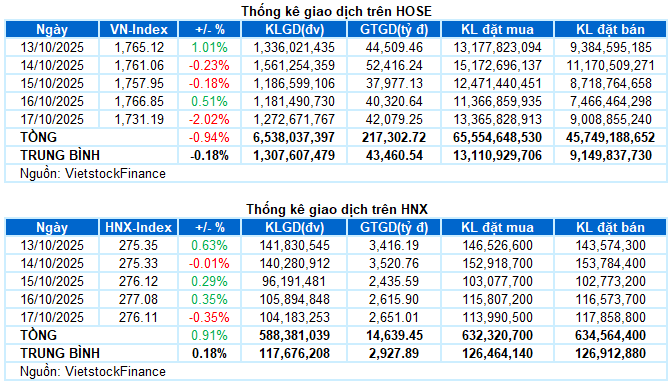

Trading Activity: Major indices closed lower in the final session of the week on October 17. The VN-Index plummeted by 35.66 points (-2.02%), settling at 1,731.19 points. The HNX-Index also shed nearly 1 point (-0.35%), ending at 276.11 points. For the week, the VN-Index lost 16.36 points (-0.94%), while the HNX-Index gained 2.49 points (+0.91%) compared to the previous week.

Vietnam’s stock market concluded a volatile week marked by significant fluctuations. After an early surge nearing the 1,800-point milestone, the VN-Index struggled to sustain momentum as selling pressure intensified at higher levels. The market entered a tug-of-war phase around the 1,760-point mark in subsequent sessions, characterized by pronounced polarization. Efforts to propel leading stocks beyond previous peaks exposed vulnerabilities as these frontrunners weakened. Escalating selling pressure in the final session pushed the VN-Index into negative territory, closing the week at 1,731.19 points.

In terms of impact, the duo VIC and VHM were primary contributors to the VN-Index’s steep decline, collectively erasing over 13 points in the final session. Additionally, VPB, CTG, and TCB exacerbated the pressure, each costing the index approximately 2 points. Conversely, positive contributions from bullish stocks were limited, with the top 10 supportive stocks adding a mere 1.5 points to the VN-Index.

Most sectors ended the week in the red, with half recording declines exceeding 1%. Real estate, a recent standout performer, led the downturn with a loss of over 3%, driven by heavy selling in VIC (-4.27%), VHM (-4.92%), VRE (-5.53%), TCH (-3.92%), PDR (-1.14%), KBC (-2.7%), VPI (-3.09%), and HDC (-2.38%). Notable exceptions included NTL, which hit the upper limit, and NVL (+2.15%), DXG (+0.67%), NHA (+2.88%), and VCR (+9.63%).

Financial and information technology sectors also declined by nearly 2%, with widespread losses. Key decliners included VPB (-3.77%), CTG (-2.97%), VCB (-1.59%), TCB (-1.45%), LPB (-3.51%), HDB (-2.69%), ACB (-2.09%), EIB (-3.01%), VIX (-2.91%), FPT (-1.89%), and CMG (-1.84%).

In contrast, the communication services sector was the sole gainer, buoyed by positive trading in VGI (+0.62%), MFS (+3.54%), and SGT (+2.13%). Other individual bright spots included BMP and VSH, both hitting their upper limits, along with NKG (+1.72%), DDV (+6.38%), NTP (+2.3%), ANV (+4.41%), GEE (+2.59%), and CII (+1.17%).

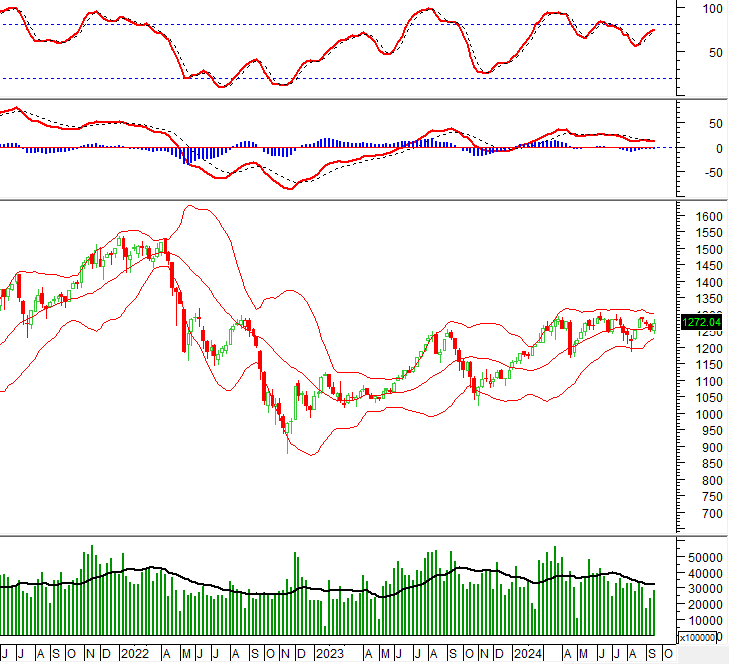

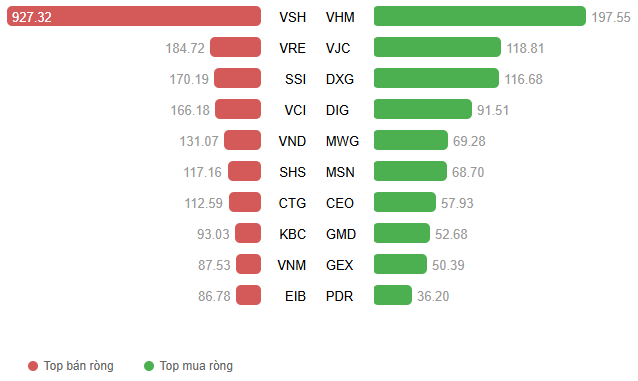

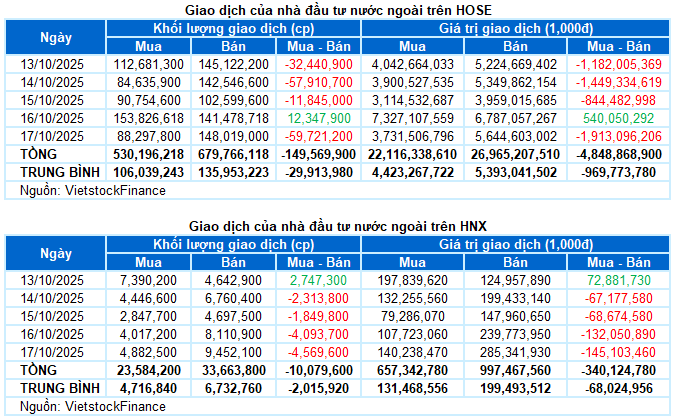

Foreign investors continued their net selling streak, offloading nearly VND 5.2 trillion across both exchanges during the week. Specifically, they net sold over VND 4.8 trillion on the HOSE and VND 340 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

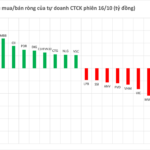

Net Trading Value by Stock Code. Unit: Billion VND

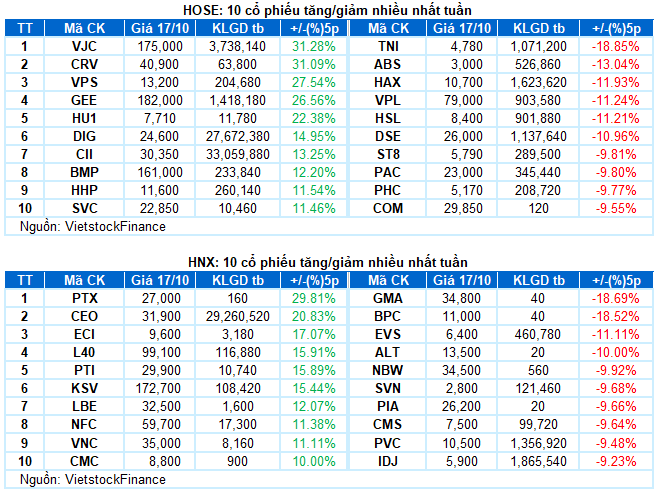

Top Performing Stock of the Week: VJC

VJC Surged 31.28%: VJC concluded a stellar week with five consecutive sessions of gains, accompanied by trading volumes consistently above the 20-session average, reflecting investor optimism. The stock price closely tracked the Upper Band of the Bollinger Bands, while the MACD indicator widened its gap above the Signal line following a buy signal, reinforcing the short-term bullish outlook.

Worst Performing Stock of the Week: HAX

HAX Dropped 11.93%: HAX extended its losing streak into the sixth consecutive week. The stock price fell below the Lower Band of the Bollinger Bands and is retesting the October 2023 lows (around 10,000-11,000). Additionally, the Stochastic Oscillator deepened into oversold territory, signaling a bleak short-term outlook.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:06 17/10/2025

Massive Deal Shakes Up the Stock Market

Masan’s MSN stock took center stage today (October 16th) with a dramatic surge, hitting its daily limit right at the opening bell. A massive block trade of over 44 million shares, valued at approximately $127 million, further fueled the excitement. This, coupled with the positive performance of other large-cap stocks, propelled the VN-Index upwards.