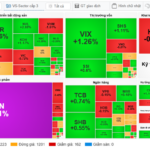

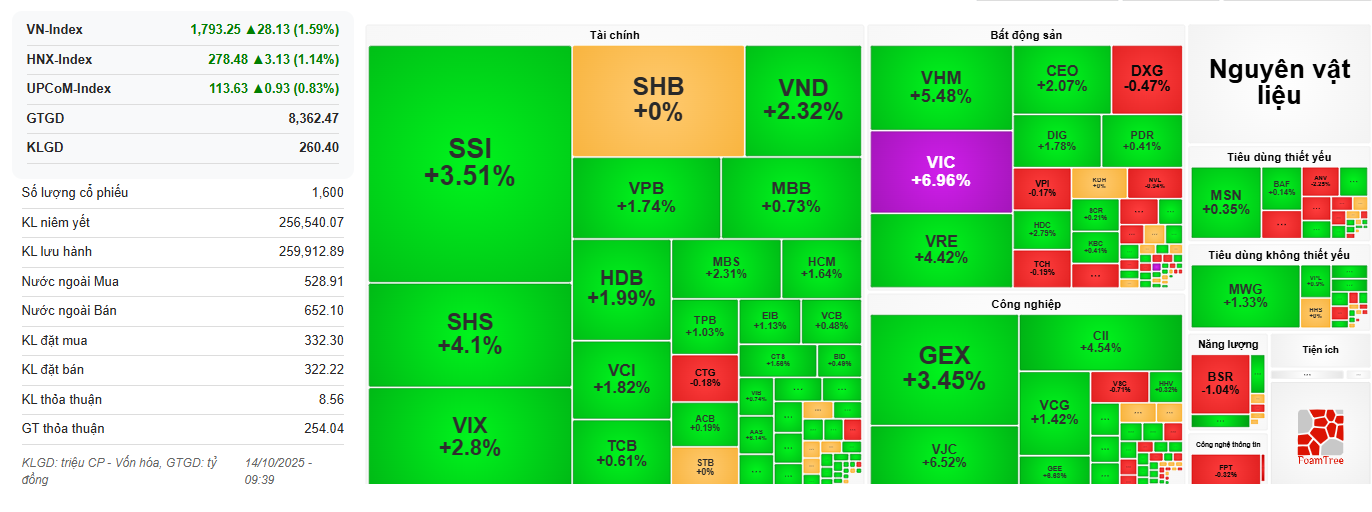

Red dominates the market, with only a few stocks in select sectors retaining their green status. Notably, in the real estate group, VIC, CEO, VHM, and HDC have risen by 2-4%. In the industrial sector, GEX, GEE, and VJC have hit their ceiling rates. Additionally, stocks like CII, GMD, and PC1 have maintained solid gains.

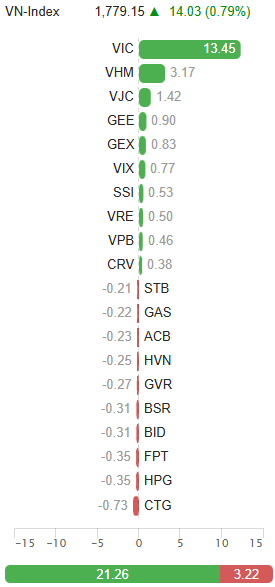

Key supports for the VN-Index include VIC, VHM, VPB, GEE, GEX, and VIX. Conversely, the banking group—CTG, BID, TCB, LPB—along with large-cap stocks like HPG, VPL, MSN, BSR, GVR, and FPT, have weighed down the index.

| Top 10 stocks impacting VN-Index on October 14, 2025 (in points) |

The VN30-Index remains in the green, showcasing the strength of VIC. This stock alone has lifted the large-cap index by nearly 9 points.

Liquidity remains robust, with trading values exceeding 56 trillion VND. Trading activity has improved compared to yesterday. Despite selling pressure, the increased liquidity indicates investors are ready to buy when prices dip.

The tourism and hospitality sector lagged today, with VPL dropping over 3%. Oil and gas stocks also declined, with BSR, PLX, PVS, PVT, PVD, and PVC falling 2-3%.

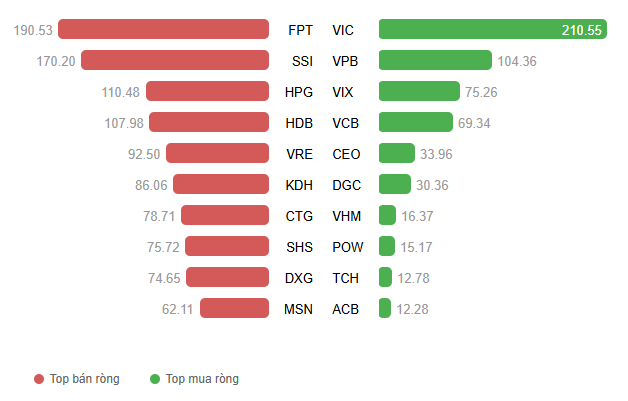

Foreign investors continued their net selling streak, with today’s net sell value nearing 1.5 trillion VND. Stocks like FPT, SSI, VRE, KDH, HPG, and HDB faced significant selling pressure. Conversely, VHM, VIC, VCB, and FRT saw strong net buying.

| Foreign investor net buying/selling trends |

14:00: Selling pressure increases, VN-Index stalls

Increased selling pressure in the afternoon session caused a market reversal. The number of declining stocks surged to over 520, outpacing the 240 gainers. The VN-Index dipped by nearly 8 points.

However, support from key stocks like VIC, VHM, SSI, and VPB persists, with gains of 2-4%. GEX, GEE, and VJC, hitting their ceilings, are positively influencing the index.

Morning Session: VN-Index closes at 1,786, resilient despite pressure

The VN-Index ended the morning session at 1,786.09, up 20.97 points. Both the HNX-Index and UPCoM-Index also rose slightly to 277.21 and 113.16, respectively. The upward trend is promising, potentially reaching 1,800, though green remains elusive for most.

Despite maintaining gains, slight pressure emerged post-9:30, narrowing the increase. The market quickly bottomed out by 10:00, paving the way for a strong rebound.

|

VN-Index gains with some fluctuations

Source: VietstockFinance

|

Market breadth shows limited progress in advancing stocks, with 266 gainers, while decliners rose to 380. A total of 943 stocks remained unchanged. In this context, key stocks are driving the gains.

By market cap, Large Caps rose 1.41%, while Mid and Small Caps fell 0.39% and 0.22%, respectively.

Red stocks proliferated, particularly in banking (VTG, BID, STB, SHB, ACB, OCB), food (VNM, MSN), infrastructure (ACV, HVN), oil and gas (BSR, PLX, PVT), and key stocks like HPG, FPT, GAS, and VGI. Despite the market’s rise, pressures persist and are intensifying.

Key stocks are supporting the market, including Vingroup (VIC, VHM, VRE), banks (VCB, TCB, VPB), securities (SSI, VIX, VND, SHS), and aviation (VJC, HVN).

HVN, a major aviation stock, seems unaffected by a recent data breach in its online customer care platform. The company has officially addressed the issue.

Liquidity improved from yesterday, reaching nearly 28.9 trillion VND, with over 886 million shares traded.

Foreign investors maintained net selling, totaling over 1 trillion VND. Stocks like FPT, SSI, HPG, and HDB faced significant selling, while VIC and VPB mitigated some pressure.

|

Top foreign net bought/sold stocks in the morning session of October 14

Source: VietstockFinance

|

10:30: Market rally slows, key stocks provide support

After an enthusiastic start, the market’s momentum slowed. Market breadth shows fewer gainers than decliners and unchanged stocks.

By 10:30, the VN-Index rose 14.03 points to 1,779.15, the HNX-Index gained 1.7 points to 277.05, and the UPCoM-Index added 0.37 points to 113.07. However, only 258 stocks advanced, compared to 347 decliners and 995 unchanged.

By market cap, Large Caps impressed with a 1.01% gain, while Mid and Small Caps fell 0.34% and 0.25%, respectively.

The Vingroup trio led gains, with VHM up 2.66%, VRE up 2.21%, and VIC nearing its ceiling, contributing 3.17, 0.5, and 13.45 points to the VN-Index. Real estate topped sector gains at 3.28%.

Gelex’s GEX and GEE also hit their ceilings, adding 0.83 and 0.9 points to the index. In aviation, VJC’s ceiling gain provided strong support.

Banking and securities stocks traded actively, with SSI, VIX, and VPB boosting the index.

Green was scarce, with declines in real estate (DXG, TCH, KBC, KDH, NVL), banking (SHB, CTG, TPB, ACB, VCB, STB), mining (HPG, NKG), food (MSN, HAG, ANV, BAF), and software (FPT).

|

Key stocks supporting the market

Source: VietstockFinance

|

9:30: Market surges at open, VN-Index nears 1,800

The market opened with enthusiasm on October 14. The VN-Index soared nearly 30 points in the first 40 minutes, reaching 1,793.

Market dynamics at the open on October 14, 2025. Source: VietstockFinance

|

VIC led gains, boosting the VN-Index by nearly 12 points. The top 10 contributors added 20 points, with VIC as the primary driver. By 9:35, VIC hit its ceiling, reaching nearly 220,000 VND/share.

Other Vingroup stocks like VHM and VRE also rose over 5%.

Green dominated, with nearly 330 gainers and 170 decliners. Finance, real estate, and industrials led the rally.

Securities stocks surged on strong buying. SSI, VIX, VND, SHS, MBS, and ORS all rose sharply.

– 15:50 14/10/2025

Vietstock Daily October 15, 2025: Momentum Slows

The VN-Index reversed its course, closing lower and snapping a four-session winning streak. With the Stochastic Oscillator potentially signaling a sell-off from overbought territory, the previously breached September 2025 peak (around 1,700–1,711 points) is poised to act as critical support should the correction extend in upcoming sessions.

Market Pulse 16/10: Persistent Tug-of-War as Gainers and Losers Balance Out

The VN-Index fluctuated within a narrow range of 1,757 to 1,763 points during the morning session, reflecting a highly polarized market landscape.

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.

Vingroup Aims to Build Vietnam’s Most Advanced Sea-Crossing Highway, Top in Southeast Asia: Transforming Ho Chi Minh City into the “Dragon” of the Region?

The trans-sea route is poised to become a new symbol of prosperity and development for Ho Chi Minh City.