By the end of the morning session, the VN-Index rose by 4.33 points to 1,762.28, experiencing continuous fluctuations within a narrow range. Meanwhile, the HNX-Index increased by 0.92 points to 277.04, and the UPCoM-Index climbed by 0.34 points to 112.66.

|

Market experiences continuous fluctuations

Source: VietstockFinance

|

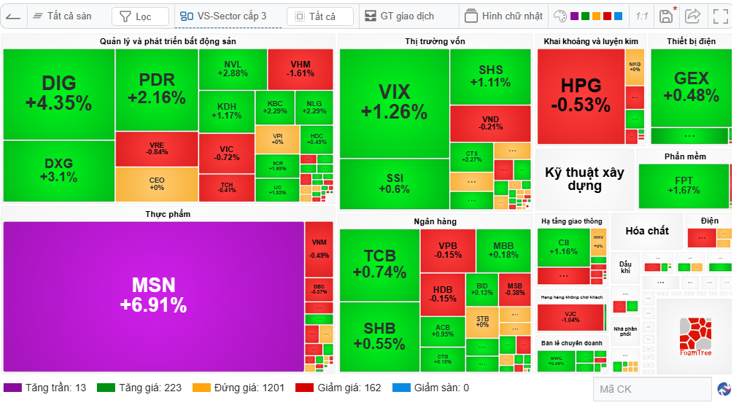

Among industry groups, 12 sectors saw gains in the morning session, led by hardware and equipment, which surged by 6.12%. This was driven by VEC hitting its ceiling, DLG rising by 1.15%, and POT climbing by 6.6%.

Two other sectors recorded gains of over 1%: industrial goods, which increased by 1.6% with notable performances from GEE hitting its ceiling and BMP rising by 4.88%; and food, beverages, and tobacco, which grew by 1.43%. Within this sector, MSN hit its ceiling early, while MCH rose by 1.08%.

Among the other gaining sectors, real estate stood out with a 0.71% increase, led by VIC (up 1.1%), VRE (up 2.74%), KBC (up 2.86%), and CRV (up 6.96%). Financial services, primarily securities, saw a modest 0.16% gain, with many stocks experiencing slight increases.

However, the securities sector also witnessed significant polarization, with SSI, MBS, FTS, DSC, and TVS all declining. In real estate, VHM fell by 1.21%, and BCM dropped by 0.78%, dampening the sector’s overall gains.

On the declining side, 11 sectors recorded losses, balancing the number of gaining sectors. Telecommunications services and consumer services led the declines, falling by 1.34% and 1%, respectively. Other notable sectors, such as banking and insurance, saw modest decreases of 0.23% and 0.49%, respectively.

Within the banking sector, polarization was evident, with VPB, CTG, LPB, STB, and SHB declining, while VCB, TCB, MBB, HDB, and EIB advanced.

|

Market records a balance between gaining and declining sectors

Source: VietstockFinance

|

From a stock perspective, the market recorded 300 gainers (13 of which hit their ceilings) and 300 unchanged stocks (3 of which hit their floors), creating a rare balance. Additionally, 999 stocks remained unchanged.

Given the polarization in the morning session, the market lacked a strong catalyst to establish a clear trend.

In this context, the overall market liquidity of nearly 19.6 trillion VND was not particularly high. However, this is understandable given the derivatives expiration session.

Foreign investors significantly reduced their trading volume compared to recent periods. Specifically, they purchased nearly 1.8 trillion VND and sold over 2.2 trillion VND, resulting in a net sell-off of more than 467 billion VND.

10:30 AM: Vingroup and banks exert pressure

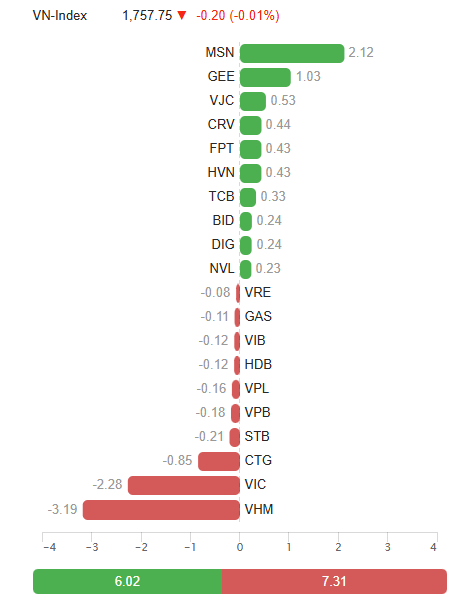

The market experienced strong volatility in the latter part of the morning session. By 10:30 AM, the VN-Index reversed, falling by 0.33 points to 1,757.62. The primary pressure came from the decline of the Vingroup sector and increasing polarization within the banking sector.

Among the other major indices, the HNX-Index rose by 1.05 points to 277.17, and the UPCoM-Index increased by 0.33 points to 112.65, both performing better than the VN-Index by maintaining their gains.

Looking at the market map, the number of declining stocks increased to 243, including 3 that hit their floors. Meanwhile, 1,045 stocks remained unchanged, and 311 stocks advanced, with 12 hitting their ceilings.

By market capitalization, the Large Cap group, despite having several positively performing stocks, rose only by 0.05% due to pressure from the Vingroup sector and increasing polarization within the banking sector. Other capitalization groups also recorded modest gains: Mid Cap rose by 0.44%, Small Cap by 0.12%, and Micro Cap by 0.61%.

Among the top 10 stocks negatively impacting the VN-Index, VHM led with a loss of 3.19 points, followed by VIC (2.28 points), CTG (0.85 points), and STB (0.21 points).

|

Vingroup and banking sectors exert significant pressure

Source: VietstockFinance

|

9:30 AM: Green spreads, MSN hits ceiling early

The market opened with widespread gains. By 9:30 AM, 223 stocks were in the green, with several hitting their ceilings early, notably MSN from Masan Group. However, declines in many blue-chip stocks, particularly in the Vingroup sector, prevented the market from recording significant gains.

By 9:30 AM, the VN-Index rose by 1.92 points to 1,759.87; the HNX-Index increased by 0.98 points to 277.1; and the UPCoM-Index climbed by 0.23 points to 112.55. In terms of liquidity, the market recorded a trading value of nearly 4.4 trillion VND, with approximately 129 million shares changing hands.

The green quickly spread to 223 stocks, with 13 hitting their ceilings early, led by MSN. Looking at the market map, positive movements were seen across various sectors: real estate (DIG, PDR, DXG, KBC, NVL, SCR…), securities (VIX, CTS, VCI, SSI, SHS…), banking (SHB, TCB, HDB, MBB, ACB…), and key stocks like MSN, FPT, and MWG.

Conversely, 162 stocks were in the red. Although fewer in number, they had a significant impact on the market, notably the Vingroup trio of VIC, VHM, and VRE; steel giant HPG; and several banks like VPB, HDB, and MSB.

|

MSN stands out on the market map with a purple ceiling

Source: VietstockFinance

|

A notable aspect of the October 16 trading session is the expiration of derivative securities—an event often accompanied by more unpredictable fluctuations than usual.

On Wall Street overnight, the S&P 500 rose, supported by breakthrough earnings reports from Bank of America and Morgan Stanley. Ongoing concerns about U.S.-China trade negotiations and the government shutdown weighed on investor sentiment, but these were somewhat alleviated by the excitement over the better-than-expected start to the earnings season.

Meanwhile, the Dow Jones remained largely unchanged, falling by 17.15 points (0.04%) to 46,253.31, after rising as much as 422.88 points at one point. The Nasdaq Composite gained 0.7%, reaching 22,670.08, having climbed as much as 1.4% earlier.

– 12:10 PM, October 16, 2025

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.

Market Pulse 17/10: Financial & Real Estate Sectors Bathed in Red

At the close of trading, the VN-Index dropped 35.66 points (-2.02%), settling at 1,731.19 points, while the HNX-Index fell 0.97 points (-0.35%), closing at 276.11 points. Market breadth favored decliners, with 474 stocks falling and 283 advancing. Similarly, the VN30 basket saw red dominate, as 26 stocks declined, 3 rose, and 1 remained unchanged.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.