By the close of the session on October 16, major indices were in the green, with the VN-Index climbing 8.9 points to 1,766.85, the HNX-Index rising 0.96 points to 277.08, and the UPCoM-Index edging up 0.05 points to 112.37.

On the VN-Index, while the morning session traded within a range of 1,757 to 1,763, the afternoon session expanded to 1,753 to 1,768. Liquidity exceeded 40.3 trillion VND, slightly higher than the previous day.

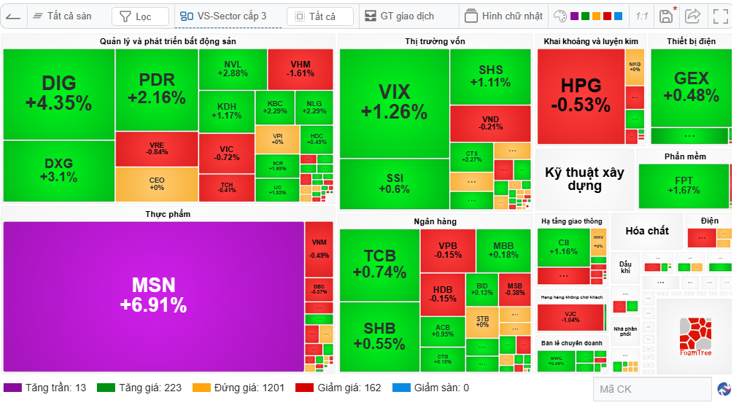

Across the market, 381 stocks gained, including 19 that hit the ceiling, while 330 stocks declined, with 8 hitting the floor; 888 stocks remained unchanged.

Among the gainers, MSN (Masan Group) stood out with a purple hue, dominating a significant portion of the market’s trading value. The stock even had a buy surplus of nearly 7.6 million shares at the close.

Another highlight was the 44.1 million shares traded in block deals, 2.6 times the volume of matched orders. With a total value of nearly 3.5 trillion VND, the average block deal price was around 78,730 VND per share. Foreign investors accounted for the majority of these block deals, buying 40.3 million shares (nearly 3.2 trillion VND) and selling 42.5 million shares (nearly 3.4 trillion VND).

Previously, in late October 2024, the market witnessed a significant foreign transaction in MSN, with SK executing a trade of 76 million shares.

Beyond MSN, other notable ceiling-hitting stocks included real estate players like DXG, DIG, and NLG. Stocks such as VIC, VRE, PDR, NVL, KBC, and TCH also saw strong gains. VHM was the most notable decliner, directly costing the VN-Index 1.84 points.

Polarization was evident in other major sectors like banking and securities.

In banking, while TCB, HDB, VCB, and TPB saw slight gains, SHB, VPB, CTG, and others declined. In securities, SHS, VND, and HCM rose, while VIX, SSI, VCI, and MBS fell.

Today’s standout performers also included GEX, up 3.97%, and GEE, which hit the ceiling, along with PNJ and VJC, which closed near the ceiling.

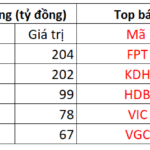

Foreign investors’ actions drew attention as they net bought nearly 416 billion VND, led by NLG (299 billion VND) and DXG (245 billion VND). Trading volume was the highest in 19 sessions, with nearly 7.5 trillion VND bought and 7.1 trillion VND sold.

In the derivatives market, VN30F1M closed at 2,012.7 on its expiry date, creating a negative basis of 9.6 points compared to the VN30-Index.

Morning Session: Green Dominates, MSN Early “Purple Ceiling”

The market opened with widespread green, and by 9:30 AM, 223 stocks were up, with several hitting the ceiling early, notably MSN from Masan Group. However, declines in key stocks, particularly from the Vingroup family, prevented a more robust market rise.

By 9:30 AM, the VN-Index was up 1.92 points to 1,759.87; the HNX-Index rose 0.98 points to 277.1; and the UPCoM-Index gained 0.23 points to 112.55. Total market liquidity was nearly 4.4 trillion VND, with nearly 129 million shares traded.

Green quickly spread to 223 stocks, with 13 hitting the ceiling early, led by MSN. Across sectors, real estate (DIG, PDR, DXG, KBC, NVL, SCR…), securities (VIX, CTS, VCI, SSI, SHS…), banking (SHB, TCB, HDB, MBB, ACB…), and key stocks like MSN, FPT, and MWG all showed positive momentum.

Conversely, 162 stocks were in the red, fewer than the gainers but with significant market impact, notably Vingroup’s VIC, VHM, VRE; steel giant HPG; and banks like VPB, HDB, and MSB.

|

MSN stands out on the market map with a purple hue

Source: VietstockFinance

|

A notable aspect of the October 16 session was the expiry of derivatives—an event often accompanied by heightened unpredictability.

On Wall Street overnight, the S&P 500 rose, supported by strong earnings reports from Bank of America and Morgan Stanley. Persistent concerns over U.S.-China trade talks and a potential government shutdown weighed on investor sentiment, but optimism from a better-than-expected start to earnings season provided some relief.

The Dow Jones was largely unchanged, dipping 17.15 points (0.04%) to 46,253.31, after rising as much as 422.88 points. The Nasdaq Composite gained 0.7% to 22,670.08, having climbed as much as 1.4%.

– 15:40 16/10/2025

Market Pulse 17/10: Financial & Real Estate Sectors Bathed in Red

At the close of trading, the VN-Index dropped 35.66 points (-2.02%), settling at 1,731.19 points, while the HNX-Index fell 0.97 points (-0.35%), closing at 276.11 points. Market breadth favored decliners, with 474 stocks falling and 283 advancing. Similarly, the VN30 basket saw red dominate, as 26 stocks declined, 3 rose, and 1 remained unchanged.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.

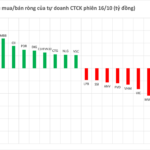

Bank Stock Hit by Heavy Sell-Off from Brokerage Firms in October 16 Trading Session

Proprietary trading firms reversed their stance, offloading a net value of VND 81 billion on the Ho Chi Minh City Stock Exchange (HOSE).

Massive Deal Shakes Up the Stock Market

Masan’s MSN stock took center stage today (October 16th) with a dramatic surge, hitting its daily limit right at the opening bell. A massive block trade of over 44 million shares, valued at approximately $127 million, further fueled the excitement. This, coupled with the positive performance of other large-cap stocks, propelled the VN-Index upwards.