Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.22 billion shares, equivalent to a value of more than 40 trillion VND; the HNX-Index reached over 99.9 million shares, equivalent to a value of more than 2.5 trillion VND.

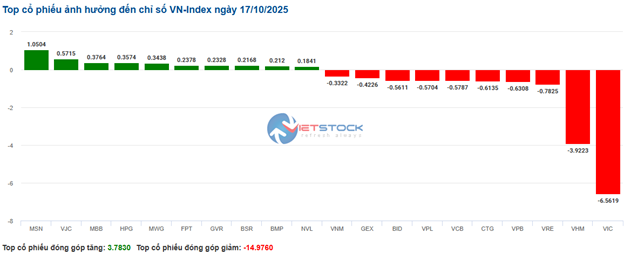

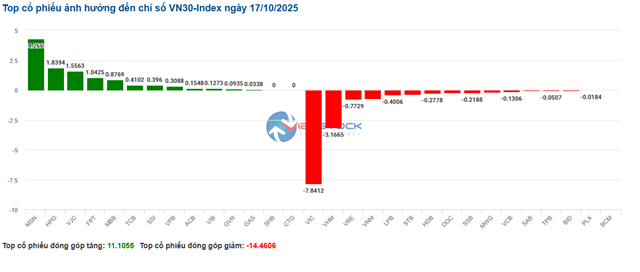

The VN-Index opened the afternoon session with continued selling pressure, causing the index to plummet despite buyers re-emerging towards the end. However, they couldn’t alter the situation, and the VN-Index closed in a rather pessimistic red. In terms of impact, VIC, VHM, VPB, and CTG were the most negatively influential stocks on the VN-Index, contributing to a decline of over 17.5 points. Conversely, GEE, BMP, VJC, and VSH maintained their green status but only added nearly 1 point to the overall index.

| Top 10 Stocks Impacting VN-Index on October 17, 2025 (in Points) |

Similarly, the HNX-Index showed a rather pessimistic trend, with negative impacts from stocks like HUT (-2.26%), MBS (-1.78%), PVS (-2.25%), and IDC (-1.9%).

| Top 10 Stocks Impacting HNX-Index on October 17, 2025 (in Points) |

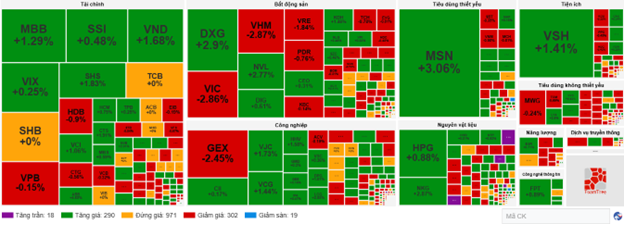

At the close, the market declined with red dominating most sectors. The real estate sector saw the sharpest decline at 3.39%, primarily due to VIC (-4.27%), VHM (-4.92%), VRE (-5.53%), and KBC (-2.7%). The finance and information technology sectors followed with declines of 1.79% and 1.78%, respectively. Conversely, the communication services sector was the only one in the green, rising 0.32%, led by VGI (+0.62%), SGT (+2.13%), ADG (+2.4%), and MFS (+3.54%).

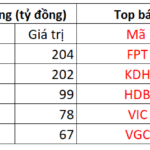

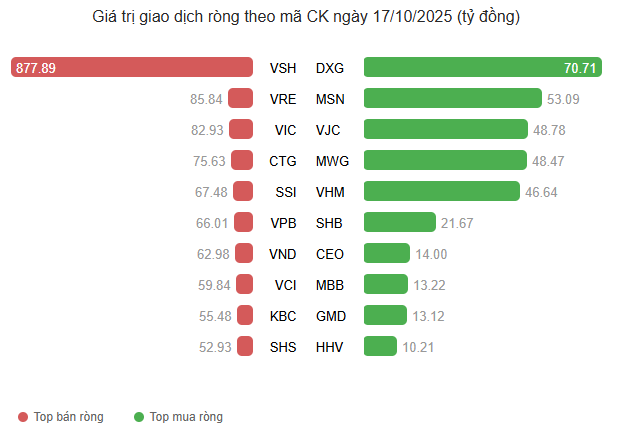

In terms of foreign trading, foreign investors turned net sellers with over 1,913 billion VND on the HOSE, focusing on VSH (927.32 billion), VRE (184.72 billion), SSI (170.19 billion), and VCI (166.18 billion). On the HNX, they net sold over 145 billion VND, concentrated in SHS (117.16 billion), IDC (66.94 billion), NTP (12.3 billion), and MBS (5.7 billion).

| Foreign Net Buying/Selling Trends |

Morning Session: Pressure from Blue Chips Pulls VN-Index Below 1,755 Points

Market sentiment is tilting towards selling as pressure from blue chips shows no signs of easing, while buying momentum in the rising group appears to stall. The VN-Index closed the morning session at 1,753.32 points, down 0.77%. Meanwhile, the HNX-Index maintained a slight green with a 0.23% increase, reaching 277.71 points. Market breadth recorded 318 gainers (21 at the ceiling) and 376 losers (23 at the floor).

Vingroup stocks (VIC, VHM, VRE, and VPL) are among the top 10 most negatively impactful stocks, collectively reducing the VN-Index by nearly 12 points. Additionally, “king stocks” like VPB, CTG, VCB, and BID further decreased the index by over 2 points. Positive highlights such as MSN, VJC, MBB, and HPG are narrowing their gains compared to this morning’s highs.

Source: VietstockFinance

|

Market polarization remains evident as most sector indices fluctuate within narrow ranges, except for the real estate sector, which declined by over 2%, weighed down by VIC (-3.57%), VHM (-3.52%), VRE (-3.57%), PDR (-1.52%), TCH (-1.18%), and KBC (-1.08%).

Yesterday’s net buying reversal by foreign investors wasn’t sustained this morning. Selling pressure returned, notably with a massive trade in VSH. This stock alone saw net selling of 878 billion VND, largely from block trades at 40,000 VND per share. Excluding this anomaly, foreign investors still net sold nearly 800 billion VND across all three exchanges this morning. Besides VSH, VRE and VIC also saw significant net selling, with values exceeding 80 billion VND, while DXG led the net buying side with 70 billion VND.

Source: VietstockFinance

|

10:30 AM: Market Continues to Polarize Amid Lack of Support

The market is showing more optimism compared to the opening but still lacks support, indicating investor caution. As of 10:30 AM, the VN-Index continued to decline by 7.9 points, trading around 1,758 points. The HNX-Index rose by 1.55 points, trading around 278 points.

Polarization is evident within the VN30 group, with red dominating. Specifically, VIC reduced the index by 7.84 points, VHM by 3.16 points, VRE by 0.77 points, and VNM by 0.71 points. Conversely, MSN, HPG, VJC, and FPT supported the index recovery, contributing over 8.7 points of increase.

Source: VietstockFinance

|

The raw materials sector is leading the market recovery with a 1.06% increase. Notable performers include steel stocks like HPG (+0.88%), NKG (+3.15%), and HSG (+0.81%). Additionally, chemical stocks such as GVR (+1.47%), DCM (+0.14%), and DDV (+1.52%) also supported the market.

The essential consumer goods sector also showed strength, led by stocks like MSN (+3.74%), DBC (+1.11%), and VHC (+0.92%).

While polarization persists in the financial sector, the number of rising stocks holds the advantage. Notable performers include MBB (+1.29%), SSI (+0.6%), VND (+1.47%), and SHS (+1.83%).

Conversely, the real estate sector continues to weigh on the market, with polarization evident. Notably, VIC, VHM, and VRE remain in the red, primarily restraining the overall market’s upward momentum.

Compared to the opening, the number of unchanged stocks remains high at over 970, with sellers slightly dominating: 302 decliners versus 290 advancers.

9:30 AM: Real Estate Sector Turns Negative Early, VN-Index Enters Tug-of-War

As of 9:30 AM on October 17, major indices moved in opposite directions. The VN-Index fluctuated around 1,763 points, while the HNX-Index traded around 278 points.

Green dominated most sectors, except for real estate, which recorded declines. Leading real estate stocks like VIC (-1.41%), VRE (-0.58%), and VHM (-0.82%) declined early in the session.

Large-cap stocks such as VIC, VHM, VCB, and STB weighed on the market, collectively reducing it by over 4 points. Conversely, MSN, GEE, and HPG led the gainers but only contributed less than 1.9 points. Additionally, several blue-chip stocks maintained good early gains, including MSN (+3.4%), SSI (+0.73%), MBB (+0.18%), HPG (+1.24%), and FPT (+1.34%).

Utility stocks unexpectedly saw notable trading activity early in the session, with power sector stocks turning green. Notable gainers included VSH (+0.94%), NT2 (+0.22%), and POW (+0.35%).

– 09:39 17/10/2025

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.

Massive Deal Shakes Up the Stock Market

Masan’s MSN stock took center stage today (October 16th) with a dramatic surge, hitting its daily limit right at the opening bell. A massive block trade of over 44 million shares, valued at approximately $127 million, further fueled the excitement. This, coupled with the positive performance of other large-cap stocks, propelled the VN-Index upwards.