On the morning of October 17th, during the 50th session, the Standing Committee of the National Assembly (SCNA) reviewed and adopted a Resolution on adjusting the family circumstance deduction for personal income tax.

Nearly 41% Increase in Family Circumstance Deduction

At the session, 100% of the attending SCNA members approved the Resolution on adjusting the family circumstance deduction for personal income tax. The Resolution stipulates that the deduction for taxpayers is 15.5 million VND per month (186 million VND per year), and the deduction for each dependent is 6.2 million VND per month. This Resolution takes effect from the date of signing, and the new family circumstance deduction will be applied in the 2026 tax year, with settlement in the first quarter of 2027.

Earlier, presenting the Government’s Report at the session, Deputy Minister of Finance Nguyen Duc Chi stated that according to calculations, by the end of 2025, the consumer price index (CPI) will have fluctuated by over 20% compared to the last adjustment of the family circumstance deduction in 2020, which was 21.24%. This provides a legal basis for adjusting the family circumstance deduction.

The Government proposed two options for adjusting the family circumstance deduction. The first option increases the deduction for taxpayers from 11 million VND per month to approximately 13.3 million VND per month, and the deduction for each dependent from 4.4 million VND per month to 5.3 million VND per month. The second option raises the deduction for taxpayers to 15.5 million VND per month and for dependents to 6.2 million VND per month.

After synthesizing feedback, the Government incorporated the second option into the draft Resolution for SCNA’s consideration and approval. With this option, an individual taxpayer (with no dependents) earning 17 million VND per month would not be subject to personal income tax after deducting insurance and the taxpayer’s allowance. Income exceeding 17,285 million VND per month would be taxed at a starting rate of 5%.

For a taxpayer with one dependent, after deducting insurance, the taxpayer’s allowance, and the dependent’s allowance, income exceeding 24,22 million VND per month would be taxed at a starting rate of 5%.

Concluding the discussion, Vice Chairman of the National Assembly Nguyen Duc Hai announced that after consideration, the SCNA agreed to adjust the family circumstance deduction for personal income tax according to the Government’s second proposed option.

Deputy Minister of Finance Nguyen Duc Chi presents the draft Resolution on adjusting the family circumstance deduction for personal income tax. Photo: PHẠM THẮNG

Ensuring a Living Standard

The new family circumstance deduction, effective from 2026, has been positively received by taxpayers.

Ms. Le Thi Diep, a salaried employee in Ho Chi Minh City with an average income of around 16 million VND per month, shared that for many years, with the previous deduction of 11 million VND per month for taxpayers and 4.4 million VND per month for each dependent, she still had to pay personal income tax. Ms. Diep explained: “After researching, I learned that the Ministry of Finance has calculated that with the new deduction, individuals earning 15 million VND per month from wages will not have to pay personal income tax. If the income is 20 million VND per month, the tax payable is only about 120,000 VND per month. For individuals with two dependents and an income of nearly 30 million VND per month, they would also not have to pay personal income tax.”

Mr. Nguyen Van Duoc, Head of the Policy Board of the Ho Chi Minh City Tax Consultancy and Agency Association, noted that the new family circumstance deduction will apply from 2026. In 2025, the current deduction of 11 million VND per month for taxpayers and 4.4 million VND per month for each dependent will still apply. Mr. Duoc commented that the current deduction has become outdated in practice, especially after the COVID-19 pandemic, when many people’s incomes were affected while the prices of goods and services rose. Therefore, the new deduction (15.5 million VND per month for the taxpayer and 6.2 million VND per month for each dependent) is more suitable and realistic. This helps reduce the tax burden for individuals with incomes below 20 million VND per month after deductions, supports labor regeneration, ensures a minimum living standard, encourages creativity, and enhances productivity. It also provides a basis for amending and supplementing the Law on Personal Income Tax.

Also at the session, the SCNA adopted a Resolution on environmental protection tax rates for gasoline, diesel, and lubricants in 2026. From January 1, 2026, to the end of 2026, the environmental protection tax for gasoline (excluding ethanol) will be 2,000 VND per liter; for diesel, mazut, and lubricants, 1,000 VND per liter; for grease, 1,000 VND per kg; and for kerosene, 600 VND per liter.

Why FDI Waves Reversed, Costing Northern Vietnam’s Largest Industrial Hub Its Crown

After four months of provincial mergers, Vietnam’s economic landscape is beginning to reveal a fresh palette of opportunities. The consolidation and expansion of development spaces have not only facilitated infrastructure connectivity and resource sharing among localities but have also rapidly amplified the ripple effect in attracting foreign direct investment (FDI).

Vietnam’s Mining Sector Burdened by Higher Taxes, Fees Than US, Australia, Raising Business Concerns

Mining enterprises in Vietnam currently face a staggering nine different types of taxes. According to tax experts, the country’s mining sector bears a total tax and fee burden of approximately 25% of revenue, significantly surpassing the 5-10% average seen in countries like Australia, the United States, and Malaysia.

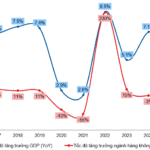

Soaring High with VJC: Unlocking the Skies (Part 1)

Vietjet Aviation Joint Stock Company (HOSE: VJC) has solidified its position as a leading player in Vietnam’s aviation industry, boasting remarkable growth rates, a substantial market share, and a well-defined international expansion strategy. This impressive performance has garnered significant attention from investors in the market.