National Securities has registered to purchase an additional 10 million shares of SAM, increasing its ownership stake from 1.68% to 4.31%, equivalent to nearly 16.4 million shares post-transaction. The acquisition is expected to take place between October 21 and November 19.

Based on SAM‘s closing price of 7,010 VND per share on October 17, the total transaction value is estimated at approximately 70 billion VND if the full registered amount is purchased. Currently, SAM shares are in a correction phase, declining over 15% in the past month, though they remain up 8% year-over-year, with average trading volume exceeding 700,000 shares per session.

Previously, the stock experienced a significant rally from 6,000 VND per share in early April to over 10,500 VND per share by late August 2025, marking a 75% increase in less than five months and reaching its highest level since September 2022. Over the past three years, the stock has predominantly traded below par value.

| Price Movement of SAM Shares Over the Past Year |

During SAM‘s price surge in July 2025, National Securities acquired over 5.9 million shares through a negotiated deal, increasing its ownership to 1.56% of the capital, with a total value of approximately 38 billion VND.

The relationship between the two entities is evident as Mr. Trần Việt Anh, Chairman of SAM‘s Board of Directors, is a major shareholder of NSI, holding over 10% of its capital. Additionally, Mr. Bùi Quang Bách serves as a Board Member of NSI and an Independent Board Member of SAM.

SAM Investment Temporarily in the Red by Nearly 48%

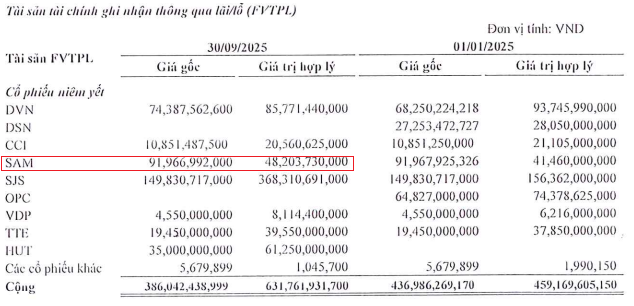

According to NSI‘s recently released Q3 2025 financial report, the initial investment in SAM was nearly 92 billion VND, but its fair value is only over 48 billion VND, resulting in a temporary loss of nearly 48%. This investment accounts for approximately 24% of the FVTPL financial assets portfolio, which has a total initial value of over 386 billion VND.

Within this portfolio, SJS is National Securities’ largest investment, with an initial value of nearly 150 billion VND and a fair value exceeding 368 billion VND, equivalent to a temporary gain of nearly 2.5 times.

FVTPL Financial Assets Portfolio of NSI as of September 2025

|

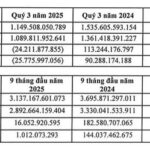

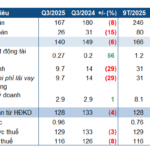

NSI‘s Q3 2025 financial results reported a net profit of 13.3 billion VND, a 71% increase year-over-year, primarily driven by a 28% rise in operating revenue to 70.4 billion VND and more than double the financial revenue compared to the same period last year, while costs increased at a slower rate than revenue. For the first nine months of the year, NSI achieved a net profit of over 53.6 billion VND, more than double the same period last year and surpassing the annual profit plan by 133%.

– 16:47 17/10/2025

180 Million Shares of Dat Xanh Ecosystem Enterprise Approved for Trading Registration

On October 14th, the Hanoi Stock Exchange (HNX) approved the listing of 180 million shares of Regal Group Joint Stock Company, trading under the ticker symbol RGG.

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.

Bình Minh Plastics (BMP) Reports Record Profits Under Thai Ownership, with Nearly 70% of Total Assets in Cash

In the first nine months of 2025, Binh Minh Plastic reported a net revenue of VND 4,224 billion, marking a 19% increase compared to the same period in 2024. The company’s after-tax profit reached VND 967 billion, reflecting a notable 27% growth year-on-year.