The organization collects a daily fee of 0.03% on overdue or evaded mandatory social insurance and unemployment insurance contributions. Photo: VGP

The Government has issued Decree No. 274/2025/NĐ-CP dated October 16, 2025, detailing certain provisions of the Social Insurance Law regarding overdue or evaded mandatory social insurance and unemployment insurance contributions, as well as complaints and denunciations related to social insurance.

The Decree consists of 4 chapters and 16 articles, with notable provisions addressing overdue or evaded mandatory social insurance and unemployment insurance contributions.

Cases Not Considered as Evasion of Mandatory Social Insurance and Unemployment Insurance Contributions

The Decree specifies cases under Clause 1, Article 39 of the Social Insurance Law that are not considered evasion of mandatory social insurance and unemployment insurance contributions when one of the following reasons is declared by competent authorities regarding natural disasters, emergencies, civil defense, and disease prevention:

1. Storms, floods, inundation, earthquakes, major fires, prolonged droughts, and other natural disasters directly and severely impacting production and business activities.

2. Dangerous epidemics declared by competent state agencies, significantly affecting production, business activities, and the financial capabilities of agencies, organizations, and employers.

3. Emergency situations as defined by law, causing sudden and unexpected impacts on the operations of agencies, organizations, and employers.

4. Other force majeure events as stipulated in civil law.

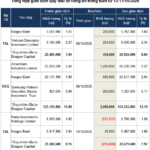

Amount and Duration of Overdue Mandatory Social Insurance and Unemployment Insurance Contributions

The Decree outlines the amount and duration of overdue mandatory social insurance and unemployment insurance contributions as per Clause 1, Article 40 of the Social Insurance Law.

Specifically, the amount of overdue mandatory social insurance and unemployment insurance contributions:

a) Overdue as per Clause 1, Article 38 of the Social Insurance Law: The overdue mandatory social insurance amount is the employer’s responsibility as defined in Clause 4, Article 13 of the Social Insurance Law, which remains unpaid after the latest deadline for mandatory social insurance contributions as specified in Clause 4, Article 34 of the Social Insurance Law. The overdue unemployment insurance amount is the employer’s responsibility, which remains unpaid after the latest deadline for unemployment insurance contributions as stipulated by unemployment insurance laws.

b) Overdue as per Clauses 2 and 3, Article 38 of the Social Insurance Law: The overdue mandatory social insurance amount is the employer’s responsibility as defined in Clause 4, Article 13 of the Social Insurance Law, which must be paid for employees not registered for social insurance within 60 days after the deadline specified in Clause 1, Article 28 of the Social Insurance Law. The overdue unemployment insurance amount is the employer’s responsibility, which must be paid for employees not registered for unemployment insurance within 60 days after the deadline for unemployment insurance participation as stipulated by unemployment insurance laws.

c) Cases under Points a and b, Clause 1, Article 39 of the Social Insurance Law not considered evasion under this Decree: The overdue mandatory social insurance amount is the employer’s responsibility as defined in Clause 4, Article 13 of the Social Insurance Law, which must be paid for employees during the period they were not enrolled in social insurance. The overdue unemployment insurance amount is the employer’s responsibility, which must be paid for employees as stipulated by unemployment insurance laws during the period they were not enrolled in unemployment insurance.

d) Cases under Points c, d, đ, e, and g, Clause 1, Article 39 of the Social Insurance Law not considered evasion under this Decree: The overdue mandatory social insurance and unemployment insurance amounts are determined as per Point a above.

Regarding the duration of overdue mandatory social insurance and unemployment insurance contributions: The duration is calculated from the day following the deadline for social insurance registration and the latest deadline for social insurance contributions as specified in Clauses 1 and 2, Article 28, and Clause 4, Article 34 of the Social Insurance Law, or after the latest deadline for unemployment insurance contributions as stipulated by unemployment insurance laws.

The Decree takes effect from November 30, 2025.

Struggling Businesses Granted Temporary Relief from Pension and Survivor Fund Contributions

Businesses facing challenges due to crises, natural disasters, or economic downturns may request a temporary suspension of contributions to pension and retirement funds.

Navigating Multiple Jobs: How to Optimize Social Insurance Contributions Without Losing Out

When employees sign fixed-term labor contracts of one month or more, they are required to contribute a portion of their salary to social insurance (BHXH) through their employer. But what happens if an individual works simultaneously for multiple companies? How should their BHXH contributions be managed in such cases?

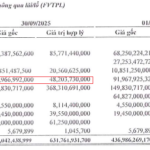

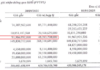

The New Regulations on Financial Mechanisms for Social Insurance, Unemployment Insurance, and Health Insurance

The government has issued Decree No. 233/2025/ND-CP, which outlines the financial mechanisms for social insurance, unemployment insurance, and health insurance. This decree also provides insights into the organizational and operational costs associated with these insurance programs.