On October 18th, the global silver price closed at over $51.9 USD per ounce, marking a significant decline of $2.25 USD per ounce, or 4.16%, compared to the opening price of $54.15 USD per ounce on October 17th. The trading range for October 17th was between $50.61 USD and $54.48 USD per ounce.

Crowds queuing to buy silver on the morning of October 18th

In the domestic market, as of October 18th, Ancarat silver was trading at 1,986 million VND per tael for buying and 2,046 million VND per tael for selling. One-kilogram silver bars were priced at 52,310 million VND for buying and 53,810 million VND for selling.

Phú Quý silver was traded at 1,985 million VND per tael for buying and 2,046 million VND per tael for selling. For one-kilogram Phú Quý silver bars, the buying price was 52,933 million VND, and the selling price was 54,559 million VND per kg.

Despite the sharp drop in silver prices, crowds of people were still queuing to buy silver. At Ancarat’s store in Hanoi, long lines formed early in the morning, with each person limited to purchasing a maximum of 5 kg.

One-kilogram silver bars are currently in high demand

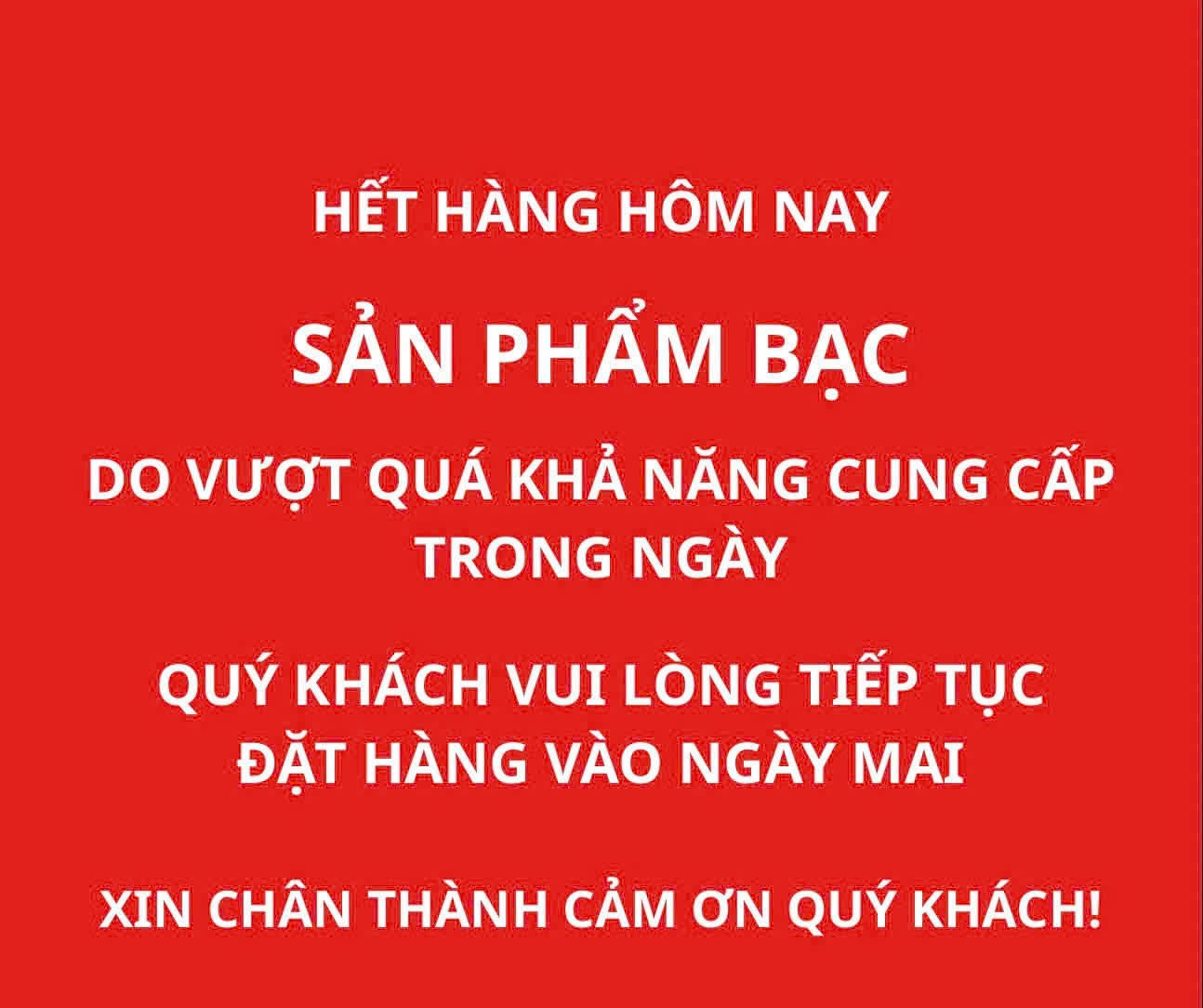

Meanwhile, Phú Quý’s store briefly opened before announcing that it had temporarily run out of stock.

Analysts attribute the sharp decline in silver prices during the October 17th trading session to profit-taking by investors and the influence of yesterday’s significant drop in gold prices.

The sharp drop in silver prices has led many to queue up for stockpiling

Experts at Heraeus warn that technical indicators such as the RSI and the deviation from the 200-day moving average suggest the market is extremely overextended. A price correction is entirely possible.

Additionally, due to the silver market’s smaller size and higher volatility compared to gold, investors should prepare for abrupt and highly volatile trading sessions.

Ancarat staff issuing queue numbers to customers

However, in the long term, silver is expected to maintain its upward trend, supported by investor demand for safe-haven assets amid financial market volatility and supply shortages, coupled with growing industrial demand.

Phú Quý announces sold-out silver on the morning of October 18th

Gold Surges Past $152 Million per Tael: Two-Day Purchase Limit Sparks Silver Rush

On the morning of October 17th, gold prices surged dramatically, surpassing 152 million VND per tael. Despite stores temporarily halting sales due to stock depletion, eager buyers continued to queue up early, undeterred by the shortage.

Silver Prices Surge Past 2 Million VND per Tael

Silver prices surged today, both domestically and globally, marking a significant upward trend in the precious metals market.