Thanh Cong Textile, Garment, Investment, and Trading Joint Stock Company (Thanh Cong Textile, HOSE: TCM) has recently announced its business performance for September 2025 and the first nine months of the year.

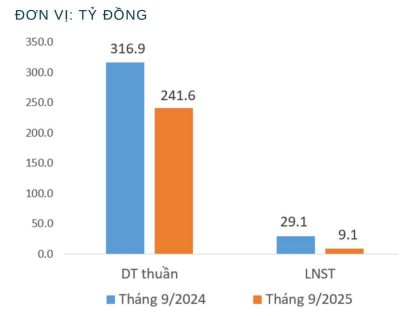

In September 2025, the parent company’s revenue reached VND 242 billion, achieving 76% of the same period last year. After-tax profit for September 2025 was VND 9.1 billion, reaching 31% compared to the same period in 2024.

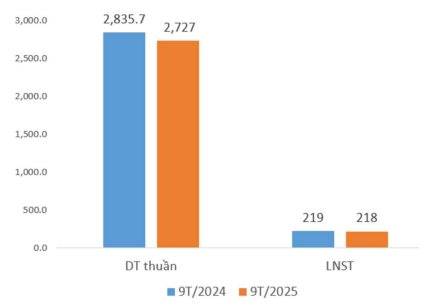

Accumulated revenue for the first nine months of 2025 reached VND 2,727 billion, a 4% decrease compared to the same period last year, and is estimated to achieve 60% of the 2025 annual revenue plan.

Accumulated after-tax profit for the first nine months of 2025 reached VND 218 billion, almost equivalent to the same period in 2024, and is estimated to achieve approximately 78% of the 2025 annual plan.

The company attributed the decline in revenue and profit in September 2025 to the off-season for fashion textiles at the end of Q3, coupled with remaining inventory due to customers requesting early shipments in previous months to avoid new countervailing duties from the US market.

Profit fell short of the plan due to reduced orders, underutilized factory capacity, lower production volumes, increased production costs, and decreased profit compared to the same period.

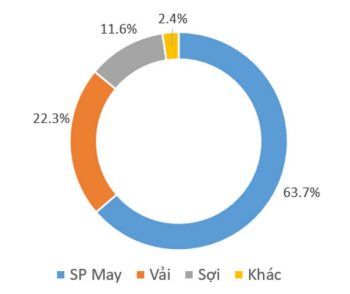

In September 2025, the company’s textile revenue came from three main segments: garments (63.7%), fabrics (22.3%), and yarns (11.6%).

Fabric segment revenue increased compared to the same period due to Vietnamese textile companies purchasing domestic fabrics to boost exports to EU and CPTPP markets, taking advantage of preferential tariffs after facing challenges in the US market due to increased tariffs. Additionally, purchasing domestic fabrics helps mitigate transshipment tax risks when exporting to the US.

Currently, the company has received approximately 76% of the planned orders for Q4/2025. With improved consumer demand in export markets towards the end of the year, Q4 is a critical period for preparing for holiday and Tet seasons in Vietnam’s textile export markets. Additionally, the US has announced countervailing duties on most major exporting countries to the US market, leading to more stable import plans for the final months of the year.

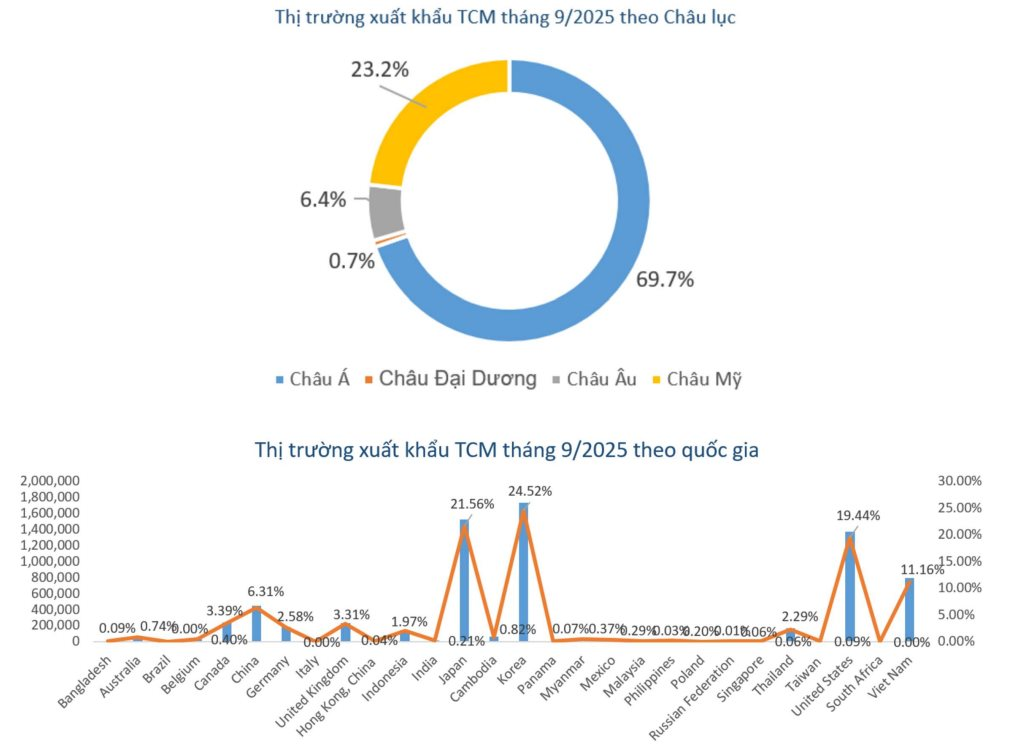

With a 20% countervailing duty on Vietnamese textile exports to the US, Vietnamese products are considered more competitive compared to peers like China and India. Thanh Cong Textile, along with other Vietnamese textile companies, is expanding its export markets to the EU, CPTPP, and RCEP to leverage benefits from free trade agreements.

“TCM Posts Nearly Double Profits for July, Anticipating a Surge in Year-End Orders”

The Ho Chi Minh City Stock Exchange-listed Thanh Cong Textile Garment Investment and Trading Joint Stock Company (HOSE: TCM) has reported robust financial results for July 2025, anticipating a vibrant fourth quarter as the festive and holiday season approaches.