The draft decree guiding the implementation of the amended Labor Law is under review by the Ministry of Justice, introducing significant adjustments in contribution rates, fund management, and labor rights protection. These changes aim to establish a more flexible, transparent, and modern unemployment insurance (UI) system.

Stable Contributions, Flexible Fund Management

Under the draft, both employees and employers will continue contributing 1% of monthly wages to the UI fund, while the government may provide up to 1% support from the central budget.

This approach, meticulously calculated by the Ministry of Home Affairs and the Ministry of Finance, ensures fund balance for 3-5 years without direct budget intervention.

Compared to previously proposed rates of 0.8%-0.9%, the 1% rate maintains fund stability and allows the government to adjust support flexibly based on economic and labor market conditions.

0% Contribution for Hiring Persons with Disabilities

For the first time, the draft introduces a 0% UI contribution rate for employers hiring persons with disabilities, applicable for up to 12 months.

This policy is hailed as a humane and practical step, promoting employment opportunities for persons with disabilities without additional administrative procedures. Employers simply register with the Social Insurance Agency (SIA) following existing procedures.

Key updates in the draft decree guiding the amended Labor Law on unemployment insurance

New Provisions on Preservation, Reimbursement, and Digital Data Updates

The draft decree also introduces mechanisms for preserving and reimbursing UI contribution periods, linking data on electronic social insurance books with the national employment database.

This enables employees to track contributions and benefits online, reduces file loss and information errors, and facilitates quicker processing of cancellations, reimbursements, or preservation extensions by management agencies.

According to the Ministry of Home Affairs, current regulations lack clear guidance on temporary leave, vocational training, or benefit suspension, causing practical challenges. Enhancing preservation mechanisms ensures continuous rights for employees re-entering the job market.

Standardized Fund Management and Digital Procedures

Another significant update mandates the Vietnam Social Insurance Agency to transfer all UI fund management expenses, including those for the Ministry of Defense and Ministry of Public Security, accurately, timely, and for intended purposes.

Expense settlement and oversight will be centralized within the Vietnam Social Insurance system to standardize processes, avoid cost duplication, and enhance transparency.

Simultaneously, unemployment benefit procedures are streamlined and fully digitized. Employees can submit applications, track progress, and receive results online via electronic social insurance books, replacing previous manual, multi-step submissions.

According to the Ministry of Home Affairs, these amendments aim to create a modern unemployment insurance system centered around employees, while supporting businesses in fulfilling obligations and contributing to a sustainable labor market.

“National Housing Fund Suggestion: Renting Homes, Not Trading or Selling”

The National Housing Fund is a revolutionary initiative, stemming from Resolution No. 201/2025/QH15, which pilots special mechanisms and policies for social housing development. This fund is unique in its nature, operating as a rental-only model, where units are ‘entered but never leave’. Instead of buying and selling, the fund solely focuses on providing a stable and accessible rental service, funded by the government and legal contributions from various sources. This innovative approach aims to create a sustainable and inclusive housing solution for those in need.

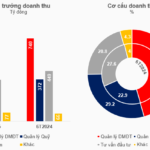

“Profits Choked by Expenses as Revenue Grows for Asset Management Firms”

The Vietnamese stock market is a bustling arena, with 43 active fund management companies trading and driving the economy. Despite a promising 9% growth in revenue, primarily fueled by dynamic trust activities, the industry faced a challenging period with a decline in net interest margins, resulting in a 3% contraction due to various factors.