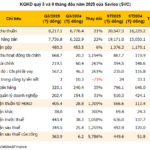

According to the newly released Q3/2025 financial report, Vietcap Securities Corporation (stock code VCI, HoSE) recorded an operating revenue of VND 1,443 billion, a 48% increase year-over-year.

The largest contributor to revenue was the profit from the sale of FVTPL financial assets, amounting to VND 672 billion, up 25% year-over-year. Meanwhile, the brokerage segment saw the strongest growth, reaching VND 373 billion, a 104% increase year-over-year.

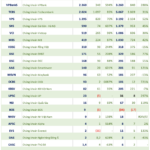

In Q3, Vietcap ranked 4th among the Top 10 companies with the largest brokerage market share on HoSE, capturing 6.43%, though slightly down from 6.81% in the first half of 2025.

Another key contributor to business performance was the profit from loans and receivables, which brought in VND 314 billion, a 52% increase year-over-year.

During the period, operating expenses rose by 46% to nearly VND 686 billion. As a result, Vietcap Securities reported pre-tax profit of VND 519 billion, up nearly 96% compared to Q3/2024. Net profit also increased similarly to VND 420 billion, the highest in the last 15 quarters.

For the first nine months of the year, VCI achieved an operating revenue of VND 3,454 billion, up 28%; pre-tax profit reached VND 1,086 billion, and net profit reached VND 899 billion, both up 30% year-over-year.

In 2025, Vietcap Securities set a pre-tax profit target of VND 1,420 billion, a 30% increase from the previous year. Thus, the company has completed 76% of its annual profit goal.

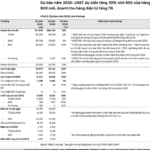

As of September 30, 2025, VCI’s total assets stood at VND 29,718 billion, an increase of over VND 3,100 billion from the beginning of the year.

Of this, margin loan and advance payment debt reached VND 13,945 billion, up more than VND 2,700 billion year-to-date, accounting for 47% of total assets.

The AFS financial asset portfolio is currently valued at VND 11,457 billion, over VND 1,600 billion higher than its cost.

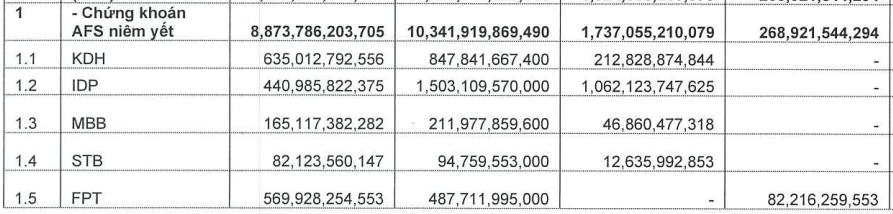

Within this, the listed equity portfolio has a cost of VND 8,874 billion, currently showing a total unrealized profit of over VND 1,400 billion. KDH shares hold the largest proportion at VND 635 billion, down about VND 250 billion from the beginning of the year, with an unrealized profit of VND 213 billion.

Source: VCI

The largest profit in the portfolio comes from IDP shares, with a cost of VND 441 billion and an unrealized profit of over VND 1,000 billion. FPT shares, with a cost of VND 570 billion, increased by about VND 70 billion from the beginning of the year but are currently showing an unrealized loss of over VND 82 billion.

During the period, VCI invested an additional VND 150 billion in MBB shares, bringing the cost to VND 165 billion, with an unrealized profit of VND 47 billion.

In addition to listed equities, Vietcap Securities’ AFS portfolio includes VND 1,458 billion in bonds, VND 4,874 billion in other listed securities, and VND 927 billion in unlisted securities.

Regarding capital sources, the company recorded short-term borrowings of VND 15,867 billion, up more than VND 3,200 billion from the beginning of the year. Domestic bank loans account for over VND 10,500 billion.

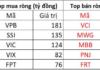

Savico’s Q3 Profits Surge 5,800%, Stock Hits Consecutive Upper Limits

Savico (HOSE: SVC) reported record-breaking Q3/2025 profits, surpassing all previous years by a significant margin. This remarkable achievement was driven by a one-time financial gain of VND 537 billion from the divestment of a real estate project.

October 17th Update: Securities Firms Report Earnings, with One Company Posting a Staggering 6,000% Growth

Several leading securities companies have unveiled their Q3 and 9-month 2025 business performance reports, offering valuable insights into their financial standing and operational achievements.