I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 14, 2025

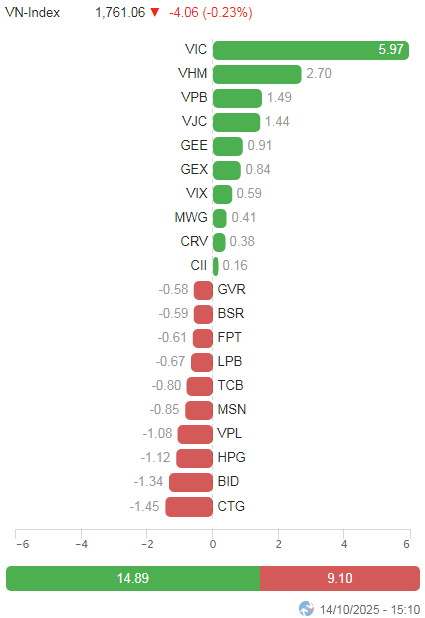

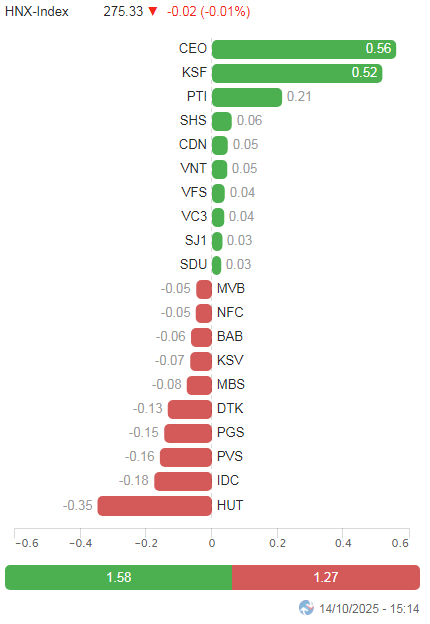

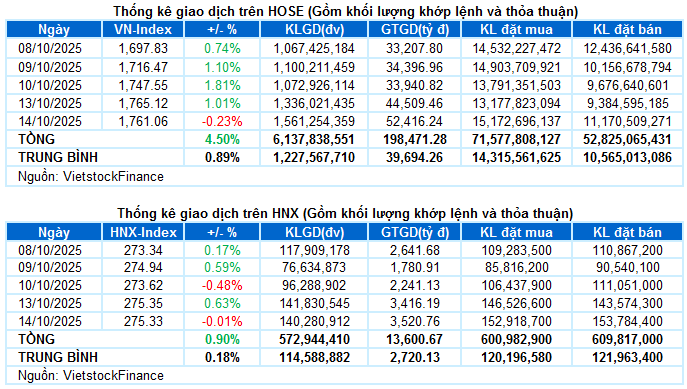

– Major indices reversed course, closing lower on October 14. Specifically, the VN-Index dropped by 0.23%, settling at 1,761.06 points, while the HNX-Index hovered near the reference level, closing at 275.33 points.

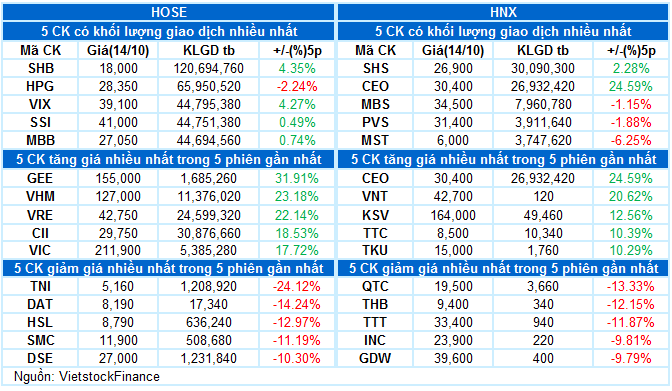

– Trading volume on the HOSE increased by 21.1%, reaching nearly 1.5 billion units. The HNX recorded approximately 140 million matched units, a 7.1% increase compared to the previous session.

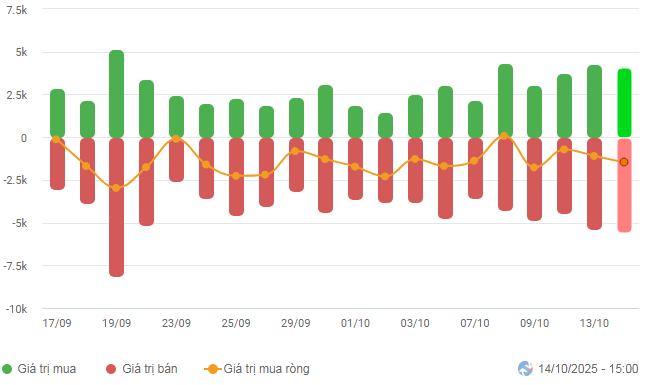

– Foreign investors continued to net sell, with a value of nearly VND 1.5 trillion on the HOSE and VND 67 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

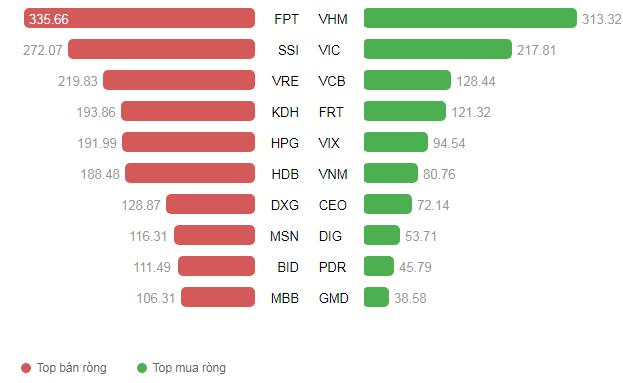

Net Trading Value by Stock Code. Unit: Billion VND

– The euphoria from blue-chip stocks continued to fuel a positive start for the VN-Index on October 14, opening with a gap up of nearly 18 points. The index quickly approached the 1,800-point mark within the first half-hour of trading. However, the upward momentum gradually stalled. Despite being led by large-cap stocks in the finance, real estate, and industrial sectors, the market exhibited clear signs of divergence. The number of declining stocks remained dominant, as seen in recent sessions, indicating that liquidity had not yet fully dispersed. In the afternoon session, widespread weakness undermined the efforts to sustain the rally. The VN-Index gradually narrowed its gains and reversed course, closing at 1,761.06 points, down over 4 points from the previous session and more than 33 points below the day’s high.

– In terms of influence, VIC remained a key pillar of the market today, contributing nearly 6 points to the VN-Index. Additionally, VHM, VPB, and VJC collectively added 5.63 points. Conversely, CTG, BID, HPG, and VPL exerted significant pressure, causing the index to lose 5 points.

Top Influencing Stocks on the Index. Unit: Points

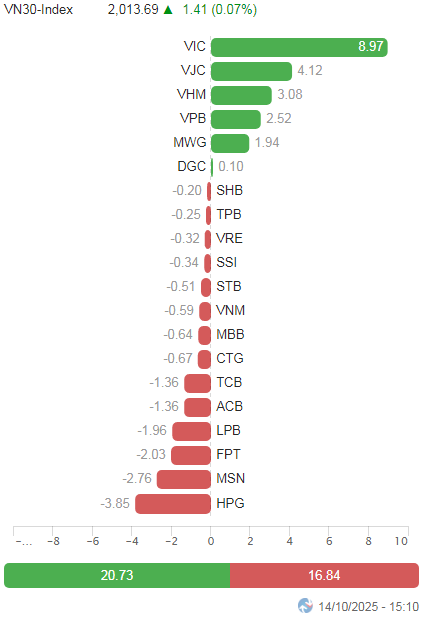

– The VN30-Index inched up by 0.07%, closing at 2,013.69 points. Despite maintaining a green hue, the basket’s breadth was heavily skewed towards selling, with 22 decliners, 6 gainers, and 2 unchanged stocks. Among these, MSN led the decline with a 2.9% drop, followed by GVR, HPG, CTG, and BID, each adjusting over 2%. Conversely, VJC continued its upward trajectory with a second consecutive ceiling session, while VIC, VPB, and VHM also rose by 2-3%, helping to sustain the index.

Red dominated most sectors. The energy sector lagged, losing 2%, with widespread adjustments, notably BSR (-2.95%), PLX (-1.32%), PVS (-1.57%), PVD (-1.42%), PVT (-2.23%), and MVB (-3.45%).

Communication services and information technology sectors also declined over 1.5%, with selling pressure on leading stocks such as VGI (-1.18%), FOX (-4.69%), VNZ (-1%), CTR (-1.44%), YEG (-3.25%); FPT (-1.7%), CMG (-1.27%), and ELC (-2.74%).

Conversely, real estate was one of the few bright spots, bucking the trend, driven by a few stocks like VIC (+3.16%), VHM (+2.25%), SSH (+6.34%), KSF (+2.87%), TAL (+3.51%), SNZ (+1.47%), and CEO (+4.83%). Meanwhile, many others plummeted, including BCM (-1.97%), KDH (-2%), KBC (-3.27%), NVL (-3.13%), DXG (-3.98%), TCH (-4.45%), and NLG (-2.82%).

The industrial index also maintained its green hue, with notable highlights from VJC, GEX, and GEE hitting their ceilings, along with GMD (+1.34%), CII (+3.84%), and PC1 (+1.23%).

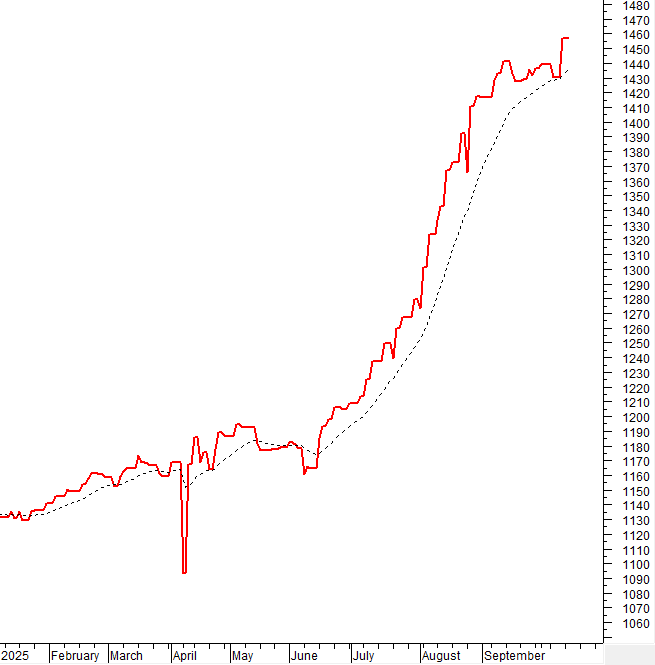

The VN-Index reversed course, closing lower at the end of the session, ending a four-session winning streak. Given the Stochastic Oscillator’s potential sell signal in the overbought zone, the previously breached September 2025 peak (equivalent to the 1,700-1,711 point range) will serve as critical support for the index if the correction continues in upcoming sessions.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator May Signal a Sell

The VN-Index reversed course, closing lower at the end of the session, ending a four-session winning streak.

Given the Stochastic Oscillator’s potential sell signal in the overbought zone, the previously breached September 2025 peak (equivalent to the 1,700-1,711 point range) will serve as critical support for the index if the correction continues in upcoming sessions.

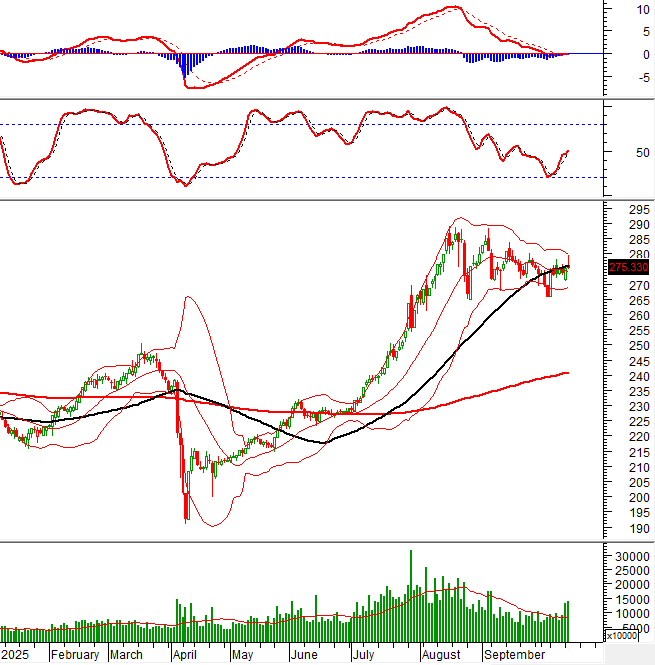

HNX-Index – Long Upper Shadow Candle Formation

The HNX-Index narrowed its gains towards the end of the session, forming a Long Upper Shadow candle, while failing to surpass the 50-day SMA.

However, the MACD indicator has given a buy signal by crossing above the Signal line. If this condition persists and crosses above the zero threshold in upcoming sessions, the index’s short-term outlook will brighten.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Investor Flow: Foreign investors continued to net sell in the October 14, 2025 session. If foreign investors maintain this action in upcoming sessions, the outlook may become more pessimistic.

III. MARKET STATISTICS FOR OCTOBER 14, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:24 October 14, 2025

Market Pulse 16/10: VN-Index Expands Range in Afternoon Session, MSN Secures Massive Deal

In a continuation of the morning session, the market experienced heightened volatility during the afternoon, with significant fluctuations across various sectors. The divergence was particularly evident in major industry groups, showcasing a vibrant spectrum of performance. Notably, MSN stood out with a substantial block trade executed by foreign investors, further intensifying the market’s dynamic movements.

Market Pulse 17/10: Financial & Real Estate Sectors Bathed in Red

At the close of trading, the VN-Index dropped 35.66 points (-2.02%), settling at 1,731.19 points, while the HNX-Index fell 0.97 points (-0.35%), closing at 276.11 points. Market breadth favored decliners, with 474 stocks falling and 283 advancing. Similarly, the VN30 basket saw red dominate, as 26 stocks declined, 3 rose, and 1 remained unchanged.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.