ABS Research reports that the global economy continued to polarize in September. While U.S. manufacturing expanded for the second consecutive month, growth remained sluggish in China, the EU, and the UK, with manufacturing indices continuing to contract. Inflation rates rose in major economies, except for China. President Trump’s tariffs will continue to impact U.S. inflation but with limited effect, as companies had already imported goods before the tariffs took effect and absorbed some of the costs.

The Fed’s 0.25% rate cut in September 2025 helped lower U.S. Treasury yields and the DXY index. This cooled the VND/USD exchange rate in September but drove global gold prices higher.

Domestically, economic indicators remained positive. Vietnam’s Q3 2025 GDP growth reached 8.23%, the second-highest increase (after Q3 2022’s 14.38%) in 15 years. Growth was driven by the manufacturing sector, public investment, record foreign investment, and double-digit export growth, despite U.S. tariffs implemented in early August. Credit expansion further supported the services and manufacturing sectors.

On October 8, 2025, FTSE Russell announced that Vietnam’s stock market had met all criteria for a Secondary Emerging Market classification under the FTSE Equity Country Classification Framework. The upgrade from Frontier to Secondary Emerging Market, effective September 2026, marks a significant milestone in Vietnam’s 25-year stock market development, attracting billions in international investment.

Negatively, the U.S. rejected 12 Vietnamese seafood sectors and imposed a 25% tariff on wooden furniture (effective October 14, 2025), with potential increases to 30–50% in 2026, impacting Vietnam’s timber industry. However, Vietnam is actively negotiating with the U.S. to secure more favorable trade agreements.

With high U.S. tariffs on China and India, coupled with political unrest and border conflicts in Southeast Asia, Vietnam remains an attractive FDI destination due to its stability and minimal tariff disparities. The gap between credit and deposits is widening, pressuring bank liquidity. Deposits primarily come from organizations, while individual deposits slow as assets like stocks and real estate offer higher returns. Deposit rates may rise to attract savers, potentially increasing overall interest rates. Foreign reserves as of May 2025 remained unchanged from 2024, below the IMF’s recommended three months of import coverage.

Exchange rate pressures persist into late 2025 and 2026 due to foreign net selling, increased import demand for U.S. goods, and profit repatriation by foreign investors.

Valuation-wise, the VN-Index P/E for the latest four quarters rose from 14.77x on September 8, 2025, to 15.42x on October 8, 2025, nearing the 3-year 2x standard deviation of 15.66x. Large-cap stocks in VN30 trade at 14.51x, above their 3-year 2x standard deviation of 13.93x. However, VN30 P/E remains lower than mid-caps in VNMID (18.61x) but higher than small-caps in VNSML (12.41x).

Source: ABS

|

In the optimistic scenario, ABS Research forecasts a short-term uptrend, with the medium-term uptrend continuing across monthly levels. The bullish reversal is confirmed as prices hold support and break above the 1,700-point resistance. ABS Research expects the market to target 1,740–1,780, then 1,813–1,820. Recommended mid-term stocks remain in uptrends; consider taking profits near short-term moving averages. Safely lock in gains near 1,740 points.

Support levels are at 1,586–1,600 and 1,486–1,530 points.

In a less optimistic scenario, prices may range between 1,600–1,700 with declining volume. Persistent institutional selling could weaken momentum, leading to a test of deeper support at 1,500 (1,486–1,530). A close below short-term moving averages signals a correction. Investors should reduce positions and re-enter after a confirmed rebound above 1,500.

ABS Research advises taking mid-term profits on upswings. New buyers should trade short-term trends. Focus on strong sectors like banking, securities, real estate, infrastructure, and food. Monitor reactions at 1,740 and manage risk at 1,630.

– 13:50 15/10/2025

Vietnam’s 2025 Stock Market Newcomers: Doubling Prices, Laggards, and Billion-Dollar Giants on the Horizon

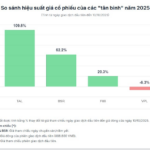

In 2025, IPO activity rebounded, fueled by market upgrades and new policies. Newly listed companies showed mixed performance, while a wave of large-scale enterprises await their market debut.

VN-Index Hits New High Post-Upgrade: Why Are Many Investors Still Losing?

Last week, following the stock market upgrade, the VN-Index surged by over 100 points, yet many investors were left in tears.