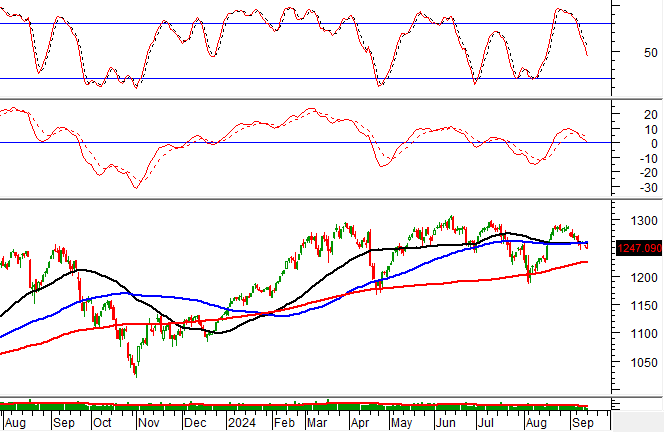

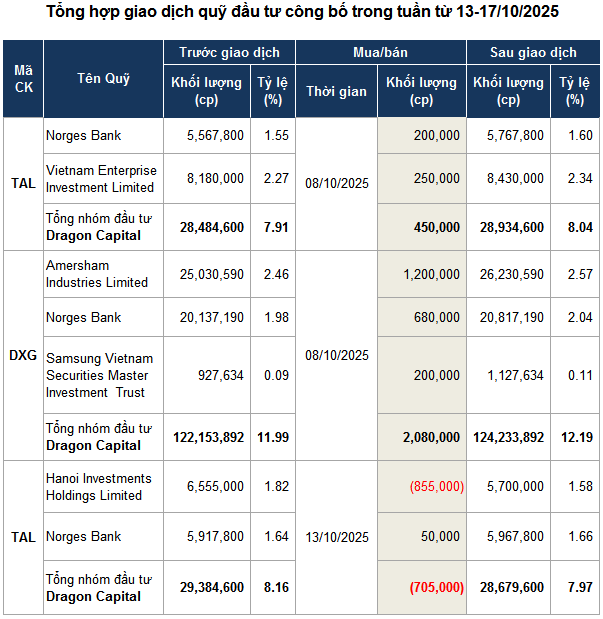

Specifically, during the session on October 8th, Dragon Capital purchased 450,000 shares of TAL (Taseco Land Joint Stock Company), increasing its ownership from 7.9% to over 8%, equivalent to 28.9 million shares.

However, just four sessions later, on October 13th, the foreign fund group swiftly sold 705,000 TAL shares, reducing its ownership below 8% to approximately 28.7 million shares.

Based on the closing prices during the buying and selling period (which remained relatively stable), it is estimated that Dragon Capital netted around 12 billion VND from this transaction.

| Price movement of TAL stock from the beginning of 2024 to the session on October 17, 2025 |

Notably, the sell-off occurred just before TAL experienced a significant price surge. The stock rose by 3.51% on October 14th—the highest increase in October—and continued to rise slightly in the following two sessions on October 15th and 16th. By the end of the week on October 17th, TAL reached 50,000 VND per share, its highest level in over a year.

Previously, in September 2025, Dragon Capital invested 620 billion VND to purchase 20 million TAL shares in the company’s private placement.

| Price movement of DXG stock from the beginning of 2020 to the session on October 17, 2025 |

In addition to TAL, the foreign fund also increased its holdings in DXG (Dat Xanh Group Joint Stock Company). On October 8th, Dragon Capital acquired 2.08 million DXG shares, raising its ownership from 11.99% to 12.19%, equivalent to over 124 million shares. At the closing price of 20,650 VND per share, the transaction value was approximately 43 billion VND.

As of the session on October 17th, DXG’s price had risen to 22,600 VND per share, marking a 9% increase since Dragon Capital’s purchase.

This move is seen as a notable reversal, as Dragon Capital had consistently net-sold over 33 million DXG shares in the previous two months, reducing its ownership from over 15% to below 12% amid DXG’s stock price approaching a three-year high.

Source: VietstockFinance

|

– 07:28 19/10/2025

Dragon Capital CEO: VN-Index at 1,700 Points is Not the Final Destination

Fueled by the dual catalysts of FTSE Russell’s upgrade and the Fed’s interest rate cut, Vietnam’s stock market is poised for a new era of growth. Dragon Capital CEO Le Anh Tuan believes the VN-Index’s 1,700-point milestone is merely a stepping stone to greater heights.