On October 17, the Government Inspectorate of Vietnam announced the inspection results regarding compliance with policies and laws in the issuance of private corporate bonds and the use of funds from these activities across 67 issuing organizations from 2015 to 2023. The report highlights the involvement of major corporations, including commercial banks (MBBank, ACB, VPBank, VIB) and groups such as Masan Group, T&T Group, and Novaland Group.

The Government Inspectorate announces inspection conclusions for 67 corporations and banks

Among these, Novaland Group has drawn significant attention as one of the largest corporate bond issuers in the market. According to the Inspectorate’s findings, from January 1, 2015, to June 30, 2023, Novaland and its subsidiaries successfully issued 131 corporate bond codes with terms ranging from 1 to 5 years, totaling VND 67.1 trillion.

As of June 30, 2023, 59 corporate bond codes remained outstanding across 18 issuing organizations, totaling VND 34.835 trillion. Two organizations had overdue principal and interest payments, while four had overdue interest payments, amounting to VND 5.528 trillion in total.

In response to the inspection, Novaland stated that after a robust restructuring in 2024–2025, most bond packages have been settled. As of September 30, 2025, the remaining private bond debt is VND 19.559 trillion, with VND 15.319 trillion (nearly 44% of the initial debt) already repaid.

Novaland emphasized its commitment to resolving outstanding bond debt, prioritizing bondholder interests. “We have implemented suitable solutions, demonstrating our ability and determination to avoid investor and societal harm,” a Novaland representative stated.

For the 24 bond packages recommended for police investigation, Novaland has settled 15, totaling VND 7 trillion (57.7% of the initial debt). One VND 250 billion bond was restructured, seven remain on schedule, and one VND 833 billion bond is being addressed through negotiations with bondholders.

Regarding delays in information disclosure, Novaland attributed them to “objective and force majeure factors,” particularly the prolonged COVID-19 social distancing period. However, the company affirmed it has since updated and completed all disclosures transparently and in compliance with regulations.

Novaland confirmed that bond proceeds were used as approved and allocated to the intended capital recipients. The company has submitted an official explanation to the Inspectorate, detailing remaining debt and repayment plans, and urged authorities to acknowledge its financial recovery efforts.

“Novaland pledges transparent cooperation with regulators to clarify inspection findings and fulfill remaining obligations, ensuring investor protection,” the company emphasized.

Masan Group also responded, stating all bonds issued by the group and its subsidiaries have been fully repaid with interest, on or ahead of schedule. “We have no payment violations; all bonds are settled, fulfilling financial obligations to investors,” Masan Group asserted.

The group also noted no administrative penalties due to statute limitations and provided legally sound explanations for capital usage, adhering to disclosure regulations.

ACB addressed two bond issuances in 2018 and 2019, intended for medium- to long-term lending. Discrepancies in short-term loans were identified during inspections. ACB completed a review, submitted corrections on September 24, 2025, and reaffirmed its commitment to financial transparency and stability.

The Inspectorate’s conclusions aim to strengthen corporate bond issuance discipline, a sector that grew rapidly from 2019 to 2021, leading to risks and violations. Inspecting 67 major entities underscores regulatory efforts to enhance market transparency and restore investor confidence.

BCM Plans to Raise VND 2,000 Billion Through Bond Issuance in Q4

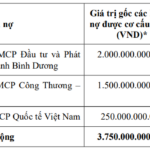

Following a successful issuance of VND 2.5 trillion in bonds in August, Becamex Group is set to launch an additional VND 2.0 trillion in private bonds in the final quarter of this year. This strategic move aims to restructure existing debt and fuel further expansion of its industrial park investments.