Hanoi’s apartment market has seen relentless price hikes since the beginning of the year, yielding profits of up to billions of dong for many investors in just a short period.

Mr. Nguyen Hung (Tu Liem District, Hanoi) shared that earlier this year, his family invested in a 43 sqm one-bedroom old apartment in Tay Mo Ward for 3.2 billion dong. Currently, he is renting it out for 10 million dong per month. Recently, he has received multiple offers to buy it back at 4.3 billion dong.

“After consulting, I noticed that apartments in the area have also seen significant price increases. Some owners have even cashed in billions in profits in less than a year,” he added.

Similarly, Mr. Nguyen Phong (Thanh Liet Ward, Hanoi) recounted that in April this year, his family purchased a 58 sqm two-bedroom apartment for 2.3 billion dong to live in. After just over six months, many people have offered to buy his apartment for 3.4 billion dong. However, he decided not to sell.

“At the time of purchase, I thought the price was high, as similar apartments in 2023 were only around 1.5–1.6 billion dong. But since my family needed a home immediately to prepare for the arrival of our first child, I had to accept it. I never expected that in such a short time, the property’s value would soar so dramatically,” he shared.

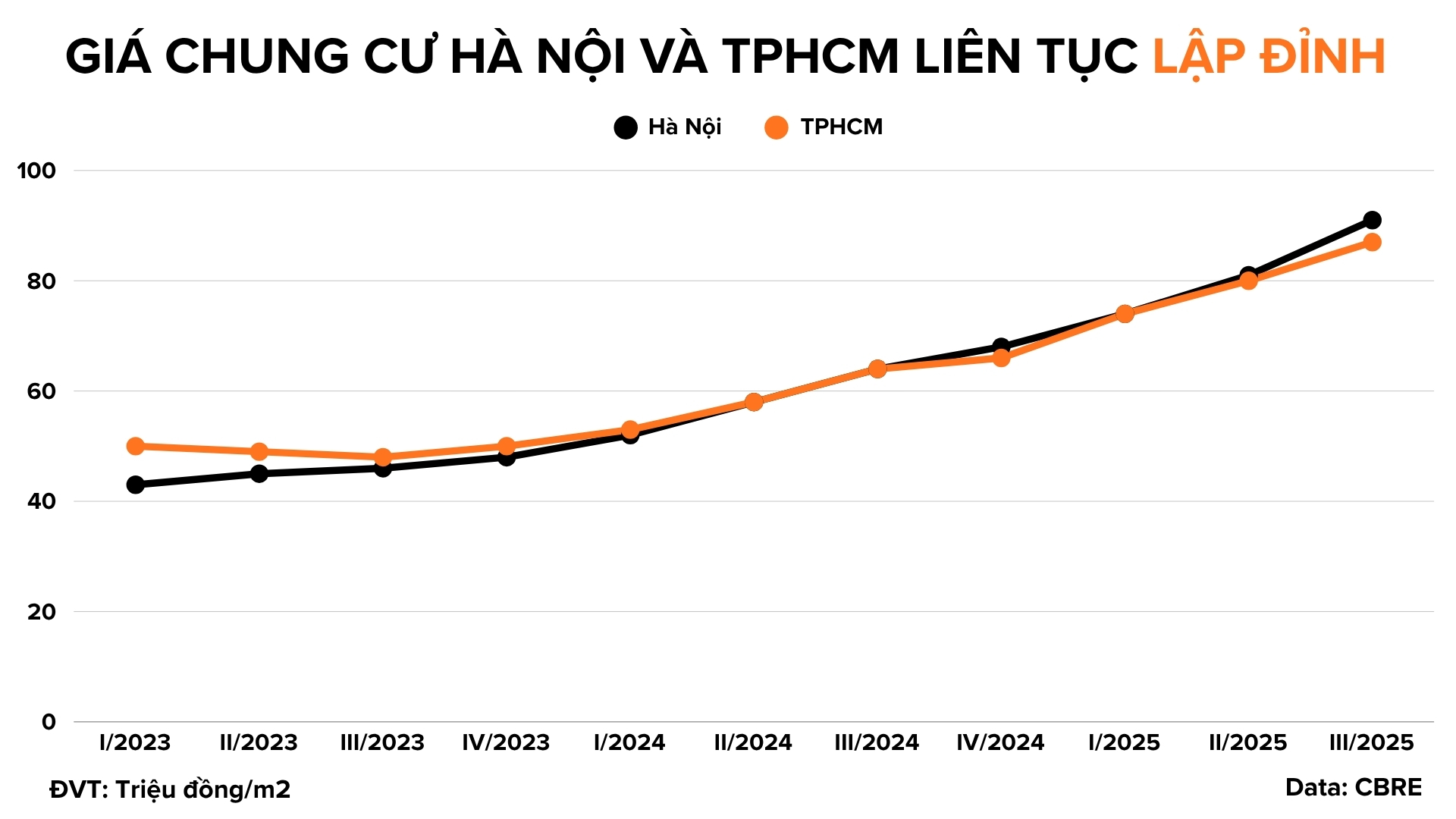

Mr. Vu Thanh Tung, owner of a real estate agency in Hanoi, also acknowledged that the continuous rise in apartment prices since the beginning of the year was unexpected. Between 2023 and 2024, the market witnessed several strong price surges, causing many apartment values to double or even triple compared to 2022.

Mr. Tung pointed out that one of the main reasons is that the supply of new apartments remains concentrated in the high-end segment, with prices exceeding 100 million dong per sqm, while market absorption rates remain very positive.

According to surveys, most new projects launched in Hanoi belong to the high-end segment. Specifically, in Dai Mo Ward, selling prices range from 80 to 120 million dong per sqm. Another project on Le Quang Dao Street is listed at around 130 million dong per sqm, excluding VAT and maintenance fees.

In Viet Hung Ward, a project is expected to exceed 120 million dong per sqm. In Cau Giay District, another project is launched at 150 million dong per sqm, while in Xuan Dinh Ward, a new project is also opening at 100 million dong per sqm.

In Ho Chi Minh City, apartments priced at 100 million dong per sqm and above account for 80–90% of the market. Notable projects like Eaton Park by Gamuda Land, Masteri Grand View (Global City Urban Area) by Masterise Homes, The Privé by Dat Xanh Group, Diamond Sky by Van Phuc Group, and sub-zones like The Beverly and Lumiere Boulevard (Vinhomes Grand Park Urban Area) are all priced between 100–150 million dong per sqm.

CBRE’s Q3 report indicates that the total apartment supply in Hanoi in the first nine months reached nearly 21,100 units, up 10% year-on-year. Notably, this quarter set a new record for supply from projects with selling prices exceeding 120 million dong per sqm (excluding VAT, maintenance fees, and discounts).

Ms. Nguyen Hoai An, Senior Director of CBRE Vietnam in Hanoi, stated, “The emergence of many new projects in prime locations has significantly boosted transaction activity this quarter. Total apartment transactions in Q3 in Hanoi reached over 11,100 units, the highest quarterly figure recorded in Hanoi since 2018.”

Despite high prices, many still view apartments as the most promising segment in the next six months. A survey by Batdongsan.com.vn shows that 36% of respondents believe apartments have the best potential, followed by private houses (29%) and land plots (24%).

Ms. Nguyen Hoai An believes that the upward trend in Hanoi’s apartment prices will continue until year-end, with an estimated increase of about 20% year-on-year. This remains an impressive growth rate, though slightly lower than the increase in secondary market prices in 2024.

Mr. Le Dinh Chung, a member of the Advisory and Market Research Group of the Vietnam Real Estate Brokerage Association (VARS), noted that in the past three months, new projects, despite higher prices, have been well-absorbed by the market, with some even selling out on the first day. This is driven by both real demand and increased investment amid cheap capital and inflationary pressures, pushing investors toward safe-haven assets.

He analyzed that the high prices of newly launched properties have pulled up secondary market prices. Secondary transactions have become more vibrant as primary products are expensive and mostly future assets, leading buyers to shift to secondary products. However, relative scarcity persists as most current owners have no intention to sell, and investors are holding onto properties awaiting better prices.

According to him, apartment prices will continue to rise as cheap capital keeps flowing into the economy, boosting investment demand while supply remains limited. With scarce land and rising construction costs, developers maintain a high-end development strategy to ensure profits, especially as this segment remains well-absorbed by financially capable buyers with long-term asset expectations.

However, the expert advises that investing at this time requires caution and a clear strategy. Short-term “flippers” will struggle to achieve high profits in the current phase. Instead, they should shift to long-term holdings of three years or more, optimizing profits through rentals during this period.

In the long term, investors can still achieve good profit margins due to rapid urbanization and population growth in major Vietnamese cities. This creates significant housing demand, driving apartment prices upward. He suggests investors consider projects in satellite cities or suburban areas with clear planning, ongoing infrastructure investment, and lower prices than core areas.

Mr. Pham Duc Toan, CEO of EZ Property, believes that in the current context, many are seeking investment channels to combat inflation. With stocks already high and gold difficult to buy (limited to 1 tael per person per day), real estate, especially apartments, remains a preferred option. This segment offers both capital appreciation potential and rental income.

However, Mr. Toan predicts that while apartment prices are unlikely to drop, their growth rate will slow. He emphasizes that investors should focus on major cities like Hanoi, Ho Chi Minh City, and Da Nang to ensure liquidity.

He advises investors to avoid excessive leverage at this time to prevent cash flow risks if the market stalls. Buyers should adopt a long-term mindset for optimal results. Short-term investors should not expect high profits, as the market has already experienced a strong price surge and needs time to recalibrate.

Additionally, he recommends buyers focus on project legality, developer reputation, and local infrastructure advantages to ensure investment safety.

Echoing this, Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, suggests investors choose reasonably priced products. He notes that the timing of purchase is less important than having a solid financial foundation. Buyers should have at least 30–40% of the property value in cash and ensure stable cash flow for the next 3–5 years to avoid unnecessary financial pressures.

Tam Nguyen

Benhill Residence: Accelerating Progress, Ready for Handover by Year-End

For many young families, owning their first home is a milestone filled with meaning. At Benhill Apartments, this journey is becoming a reality, as the project prepares to hand over keys to its first residents by the end of this year.

Skyrocketing Real Estate Prices: When a Motorcycle Can Only Buy You… “A Beautiful Window Frame”

Dr. Vo Tri Thanh highlights that Vietnamese real estate prices have significantly outpaced their true value and the purchasing power of citizens, posing a risk of distorting investment structures. Meanwhile, Savills experts attribute the root cause to limited supply and escalating development costs, creating a market imbalance that further distances homebuyers from their dream of stable housing.

Northern Investment Capital Flows Shift Significantly Southward as Year-End Approaches

According to Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, the expanded areas surrounding Ho Chi Minh City, such as former Binh Duong and Long An, are witnessing a robust supply of properties. Here, the average primary prices are approximately 30% for low-rise housing and 50% for condominiums compared to the older districts of HCMC.