Mr. Bolat Duisenov, Chairman of Coteccons’ Board of Directors, at the 2025 Annual General Meeting held on the morning of October 20, 2025.

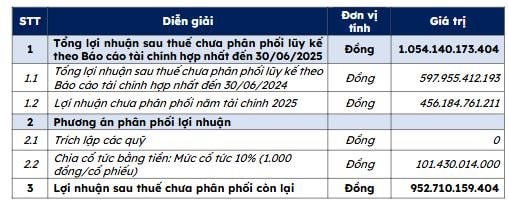

According to the shareholder consultation materials for Coteccons’ 2025 Annual General Meeting, the company’s cumulative undistributed after-tax profit as of June 30, 2025, stands at VND 1,054.1 billion. This includes a cumulative after-tax profit of VND 597.9 billion as of June 30, 2024, and an after-tax profit of VND 456.1 billion for the 2025 fiscal year.

Profit Distribution Plan: Coteccons proposes a cash dividend payout of 10% (VND 1,000 per share) to shareholders. If approved, the company will allocate VND 101.4 billion for dividend distribution. Post-dividend, the undistributed after-tax profit will be VND 952.7 billion.

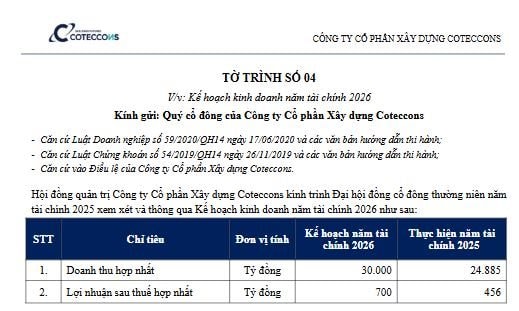

During the ongoing Annual General Meeting, Coteccons also presented its 2026 business plan, targeting consolidated revenue of VND 30,000 billion and consolidated after-tax profit of VND 700 billion.

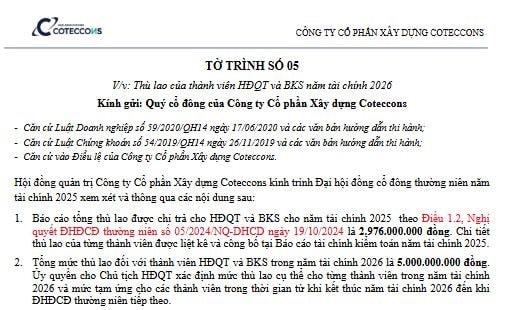

Board of Directors and Supervisory Board Remuneration: Coteccons proposes a total remuneration of VND 2.976 billion for the Board of Directors and Supervisory Board for the 2025 fiscal year. For the 2026 fiscal year, the proposed remuneration is VND 5 billion.

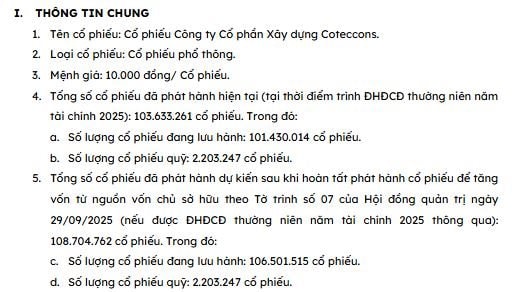

Additionally, at the 2025 Annual General Meeting, Coteccons proposed a share issuance plan for existing shareholders at a ratio of 20:1 (shareholders holding 20 shares will receive 1 new share). If approved, the total number of shares will increase from 103,633,261 (including 2,203,247 treasury shares) to 108,704,762 shares, with the number of treasury shares remaining unchanged. The capital for this issuance will be sourced from the Development Investment Fund in Coteccons’ 2025 audited separate financial statements. A total of 5,325,076 shares are expected to be issued.

The 2025 Annual General Meeting will also propose the sale of treasury shares to employees (ESOP), totaling 1,154,347 shares at a price of VND 10,000 per share, expected to raise VND 11.543 billion. These ESOP shares will be subject to a one-year transfer restriction.

Eligible recipients include members of the Board of Directors, members of the Executive Board, key management personnel, and other employees of the company and its subsidiaries.

In other developments, Coteccons recently announced plans to streamline its management structure. Mr. Tran Van Thuc, Chairman of the Supervisory Board, and Mr. Doan Phan Trung Kien, Member of the Supervisory Board, have resigned from their positions.

The company’s announcement stated: “The Board of Directors and Supervisory Board of Coteccons acknowledge and appreciate the contributions of both gentlemen during their tenure.”

Furthermore, Coteccons has approved a plan to issue public bonds with a maximum value of VND 1,400 billion.

According to the Board of Directors’ resolution, these are non-convertible bonds, without warrants or collateral, with a 3-year term and an expected interest rate of 9% per annum.

Coteccons plans to issue 14 million bonds, with a face value of VND 100,000 per bond. The offering will take place after the company receives the Registration Certificate from the State Securities Commission, with the specific issuance date determined by the Chairman of the Board of Directors.

Coteccons (CTD) Plans to Raise VND 1.4 Trillion Through “Triple-Zero” Bonds

Coteccons (CTD) is set to issue up to VND 1.4 trillion in bonds with a 3-year term and an annual interest rate of approximately 9%. Notably, these bonds are of the “triple no” type: non-convertible, without warrants, and unsecured.

Coteccons Secures Role as Main Contractor for Sun Group’s $560 Million Opera House Project

The Hanoi Opera House is anticipated to be completed by 2027, marking a significant cultural milestone for the city.