On October 17, 2025, in Son La, a delegation from the State Bank of Vietnam (SBV), led by Deputy Governor Pham Thanh Ha, conducted a working session with the banking system in Zone 3.

Implementing the directives of the Politburo, the Secretariat, the Government, and the Prime Minister, the SBV has successfully streamlined its organizational structure. As of March 1, 2025, the SBV established 15 regional branches by reorganizing 63 provincial and city branches. The SBV Zone 3 branch, formed through the merger of four provincial branches (Hoa Binh, Son La, Dien Bien, and Lai Chau), began operations on March 1, 2025, under Decision No. 303/QD-NHNN dated February 24, 2025. Amended by Decision No. 2303/QD-NHNN on June 16, 2025, the branch has managed three provinces—Son La, Dien Bien, and Lai Chau—since July 1, 2025.

Located in the Northwest region, Zone 3 serves as the western gateway of the nation, bordering Laos and China. This area boasts significant potential and favorable conditions for agriculture, forestry, hydropower, ecotourism, and valuable mineral resources.

According to the SBV Zone 3 report as of September 30, 2025, the region hosts 23 credit institutions, 33 first-tier branches, 9 people’s credit funds, 27 second-tier branches, 108 transaction offices, 435 transaction points, 158 ATMs/CDMs, and 320 POS terminals. Total mobilized capital reached VND 79,585 billion, a 9.69% increase from 2024. Outstanding loans totaled VND 92,607 billion, with a focus on production and business sectors, particularly priority areas and growth drivers aligned with government policies.

Deputy Governor Pham Thanh Ha noted that after seven months of operation, SBV Zone 3’s activities have remained smooth and uninterrupted, with no significant impact from the merger. Banking services and monetary policy implementation in the region have been stable and efficient.

Deputy Governor Pham Thanh Ha emphasized that SBV Zone 3’s operations have been seamless and efficient since its establishment.

For the final months of 2025, Deputy Governor Ha urged Zone 3 banks to focus on key tasks: closely monitor economic, social, and monetary trends to develop effective strategies; address challenges promptly in collaboration with local authorities; ensure safe credit growth, prioritizing production, business, and government-designated sectors; support typhoon-affected individuals and businesses; and enhance access to bank credit for residents and enterprises.

During their visit to Zone 3, Deputy Governor Ha and the delegation also participated in a social welfare program on October 17, 2025, benefiting Bac Yen and Pac Nga communes in Son La province.

The banking sector has actively collaborated with Son La authorities on social welfare initiatives, including new rural development, healthcare, education, and disaster relief. Since 2020, the sector has contributed over VND 211 billion to Son La’s social welfare efforts, such as constructing schools in Nam Pam and Hang Chu communes and providing aid to disadvantaged households.

On October 17, 2025, the delegation donated VND 300 million worth of educational equipment (15 computers and 12 TVs) to Bac Yen commune and VND 278 million (16 computers and 10 TVs) to Pac Nga commune. Additionally, 30 gifts were distributed to students in Bac Yen commune.

Why Don’t Vietcombank and Techcombank Produce Their Own Gold Bars? The Case for Outsourcing Production

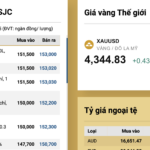

Gold prices surge as SJC gold bars hit VND 153 million, prompting Vietcombank and Techcombank to seek gold bar manufacturing partnerships.