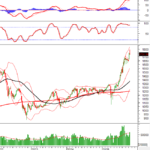

The stock market experienced a two-day rally at the beginning of the week, reaching a short-term peak around 1,800 points. However, the main index faced significant selling pressure in the final session, dropping nearly 40 points. Stocks from the Vingroup family and the banking sector were the primary contributors to the market’s decline. VN-Index closed the week of October 13-17 down over 16 points (-0.94%) at 1,731.19 points.

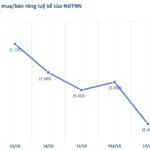

In terms of foreign trading, cumulative net selling by foreign investors over the five sessions reached nearly 5.2 trillion VND across the market.

Most experts predict that the correction in the final session is merely a “pit stop” before the next wave of growth, with an immediate target of 1,800 points.

Continuing to “Adjust to Rise”

According to Mr. Dinh Viet Bach – Securities Analyst at Pinetree, the VN-Index experienced a volatile week as third-quarter earnings reports from companies began to surface.

Early in the week, the market was shaken by escalating U.S.-China trade tensions, marked by new tariffs. Despite this, the first session saw a surge as strong capital inflows boosted key stocks, particularly those in the “Vin family” and other VN30 constituents, pushing the VN-Index to new highs.

However, from the third session onward, as Vin stocks began a sharp correction, ending a prolonged rally, the VN-Index faced significant downward pressure. The final session was particularly negative, with widespread declines, and the “Vin family” alone dragging the index down by over 15 points.

Despite this, capital shifted toward real estate stocks, which maintained a relatively positive performance even as the VN-Index dropped by more than 30 points at times. The index closed the week at 1,731 points with a red inverted hammer candle, close to the 10-day MA, and recorded higher liquidity than the previous week.

Looking ahead, Mr. Bach forecasts that the market is likely to “adjust to rise”. With two distribution sessions and a red inverted hammer weekly candle, the probability of a correction next week is high. The first support level could be around 1,700 points—the most optimistic short-term scenario.

If the VN-Index breaks below this level, it may retreat to the next support at the 10-week MA, around 1,670 points. This is because recent capital has concentrated on Vin stocks and some VN30 constituents. As these stocks correct, the market loses its primary drivers and needs time for other groups to accumulate before resuming an upward trend.

Capital is likely to continue shifting toward the real estate sector, which is expected to lead the market in the coming period. Meanwhile, banking and securities sectors are predicted to show stronger divergence as third-quarter financial reports influence stock prices.

A Necessary “Pause” After a Prolonged Rally

According to Mr. Nguyen Trong Dinh Tam – Deputy Director of Analysis at ASEAN Securities, the VN-Index’s sharp volatility on October 17 can be attributed to (1) psychological effects from inspection news at certain listed companies, (2) increased profit-taking near historical highs, and (3) a pull-back after the index surpassed the critical 1,700 technical threshold. A pull-back tests a recently breached or conquered technical level.

Liquidity on HOSE during the October 17 session exceeded 1.22 billion units, higher than the previous session but significantly lower than the record levels seen in July and August.

Mr. Tam notes that the slight increase in liquidity during the final session primarily reflects short-term profit-taking by some investors, who are now adopting a wait-and-see approach rather than signaling a market exit.

Additionally, alongside selling pressure, there are buyers actively investing as stock prices dip.

To determine if significant capital has exited the market, technical confirmations are needed, such as (1) consecutive distribution sessions with notably high volumes (e.g., nearing August’s record levels) or (2) leading stock groups weakening or becoming undefined.

Mr. Tam views this as a necessary correction and shakeout for the VN-Index after months of continuous gains without a substantial pause to absorb supply pressure. In September, the index moved sideways rather than experiencing clear corrections.

Furthermore, the index’s behavior reflects a pull-back after surpassing the critical 1,700 +/- technical level.

Looking ahead, Mr. Tam believes the VN-Index will gain momentum for its next rally in late 2025 and early 2026, supported by continued macro easing policies, attractive valuations, Vietnam’s market upgrade attracting new capital, and ongoing IPO activity. The next target after the current volatility is the 1,800 +/- region.

The 1,720 Support Level Gains Importance

According to Mr. Nguyen The Minh – Director of Securities Analysis at Yuanta Vietnam, the negative performance in the final session was largely driven by external factors.

Specifically, the U.S. market fell sharply due to concerns over bad debt risks in the banking system, seen as a hurdle to economic recovery. Simultaneously, renewed U.S.-China tensions late in the week caused Asian markets to decline in the afternoon session. These developments quickly affected domestic investor sentiment, already sensitive after a heated rally.

Besides international factors, the sharp correction in Vingroup stocks was a key driver of the VN-Index’s decline. After rapid gains, many investors secured profits and were quick to “take profits” as correction risks emerged.

However, Mr. Minh believes current market valuations are not excessively high, and no significant technical resistance levels have emerged to trigger strong selling pressure. The session’s movements were largely technical, combined with psychological impacts from derivative expirations, which typically bring short-term volatility.

According to Mr. Minh, the final session’s correction is not a “trend break” signal but likely a technical adjustment within a medium-term uptrend. Excluding Vingroup’s influence, actual selling pressure was not excessive.

Technically, the 1,720 level is a critical short-term support for the VN-Index. If the index holds above this level, the medium-term uptrend remains intact. However, if this support is breached, investors should prioritize defensive positions.

In the current context, Mr. Minh advises investors with strong positions to maintain high equity exposure but limit new investments to observe upcoming correction sessions. If the market holds support, it will present opportunities to reasonably increase exposure.

Not all stocks have risen during this period, so selecting the right sectors and stocks remains crucial. Stocks with strong fundamentals and attracting capital are better positioned to withstand current corrections. For portfolios with these characteristics, a 1–2% decline does not pose significant risk.

The Female Powerhouses Steering Vingroup Empire Alongside Billionaire Pham Nhat Vuong

Meet the formidable women leaders whose vision, talent, and unwavering determination have been instrumental in building and expanding Vingroup’s ecosystem alongside billionaire Phạm Nhật Vượng. Their exceptional leadership and strategic acumen have shaped the conglomerate’s success, leaving an indelible mark on Vietnam’s business landscape.

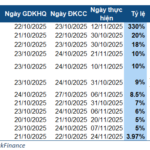

Week of October 20-24: VIC Subsidiary’s Nearly 5.5 Trillion VND Dividend Payment Takes Center Stage

During the week of October 20-24, only 12 companies announced dividend payouts in cash, a significant decline compared to previous weeks. Notably, the highest dividend yield reached an impressive 330%, equivalent to 33,000 VND per share.

Vietstock Weekly (Oct 20-24, 2025): Consolidating at the Peak

The VN-Index reversed its upward trend, closing lower as a Long Upper Shadow candlestick pattern emerged, accompanied by trading volume surpassing the 20-week average. This suggests intense profit-taking pressure as the index approached new historical highs. While the MACD has maintained a buy signal since May 2025, the weakening momentum of the Stochastic Oscillator in overbought territory indicates potential short-term volatility ahead.