Despite global economic uncertainties, Vietnam’s market is poised for a new growth cycle, fueled by robust fundamentals. However, after a period of strong growth, strategic asset allocation and flexible investment strategies tailored to life stages are crucial.

Growth Drivers and Stock Selection

Trịnh Duy Viết, Director of Securities Strategy at Kafi, attributes the market’s momentum to high economic growth, political stability, institutional reforms, and strong corporate earnings. Vietnam’s 2025 GDP is projected to exceed 8%, with public investment disbursement up by over 20%, alongside retail and FDI growth. Low public debt and substantial forex reserves provide room for government support policies.

Currently, the market’s P/E ratio stands at 15-16 times. “Stocks are priced higher than before, but investors remain optimistic about growth potential,” notes Viết. Promising sectors include construction materials, real estate tied to public investment, and retail.

Lương Duy Phước, Kafi’s Head of Analysis, emphasizes that market upgrades don’t guarantee uniform stock performance, making selective investing critical. Nguyễn Minh Đức of S&I Rating advises investors to focus on financial transparency, credit ratings, and corporate governance.

Trần Kim Đăng, Director of Kafi Derivatives, suggests exploring derivatives and warrants alongside equities to optimize returns and manage risks.

Investing Across Life Stages

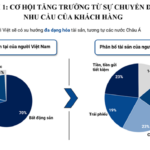

Hồ Quốc Thảo, Kafi’s Capital & Financial Business Director, highlights that many Vietnamese seek high returns but lack suitable strategies. Experts stress the need for age-specific portfolio structures.

Ages 20-40 are ideal for accumulation, leveraging real estate and allocating 10-20% to equities or warrants. From 40-60, investors should accelerate wealth growth while diversifying into low-volatility products. Post-60, focus shifts to preservation via bonds or funds for stable income. Ngô Vũ Minh Châu of VIB notes that risk tolerance evolves with life stages.

Gold vs. Stocks: Diversification Perspectives

Debate arises over asset allocation, particularly gold’s role. Thảo suggests a 20% allocation to high-risk assets like gold or crypto, based on market outlook. Conversely, another expert advocates concentration, citing domestic gold market risks such as price discrepancies and high spreads.

Foreign Capital Flows and Market Upgrades

Addressing foreign outflows, Viết explains that funds prioritize safe-haven markets during global uncertainty. Post-upgrade, Vietnam’s market is expected to attract sustainable foreign capital.

Corporate Bond Market: Reshaping Post-Turbulence

Nguyễn Minh Đức notes the corporate bond market is recalibrating post-volatility. Despite 9M2025 issuance totaling 425 trillion VND, net issuance remains low due to maturities and buybacks, indicating a gradual recovery.

The forum offered diverse insights into growth prospects, risks, and market challenges, enriching investor perspectives.

Upcoming Quarter: VND 48.08 Trillion in Bond Maturities, with Major Players Poised to Raise Thousands of Billions of Dong

In September, the corporate bond market witnessed a significant decline in new issuance volumes, amid mounting pressure from maturing debts and year-end payment obligations.

Anticipating Portfolio Restructuring Trends Post-Market Upgrade

In today’s volatile market landscape, effective investing is no longer about chasing maximum returns but rather optimizing portfolios to align with specific financial goals. When investors clearly define key factors such as expected capital, investment horizon, and risk tolerance, every decision—from asset allocation to rebalancing and instrument selection—becomes more grounded and verifiable.

Top Korean Retail Giant Discovers Vietnam’s ‘Goldmine,’ Plans to Open 2-3 Mega Malls Amid Sluggish Domestic Sales

Lotte’s strategy targets the premium consumer segment by leveraging Korean-style marketing, capitalizing on the growing allure of Korean culture and cuisine to tap into the market’s robust purchasing power.